Publication - Research and analysis

Scottish Economic Bulletin July 2024

Provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Labour Market

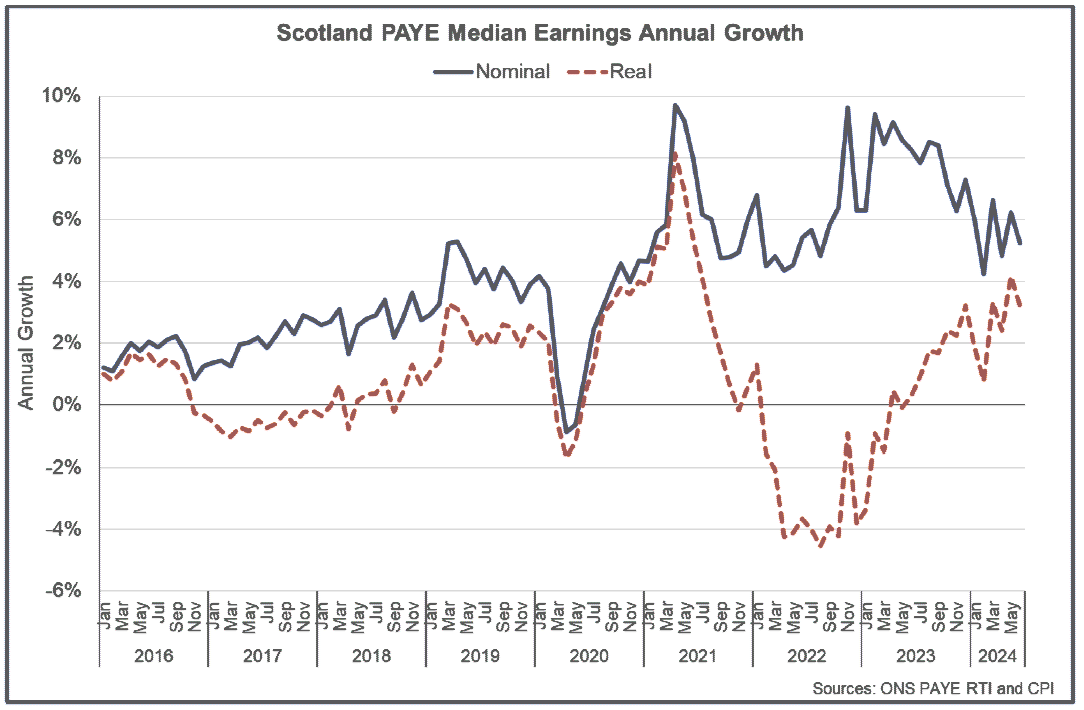

Earnings growth remains robust in nominal and real terms.

Employment, Unemployment, and Inactivity

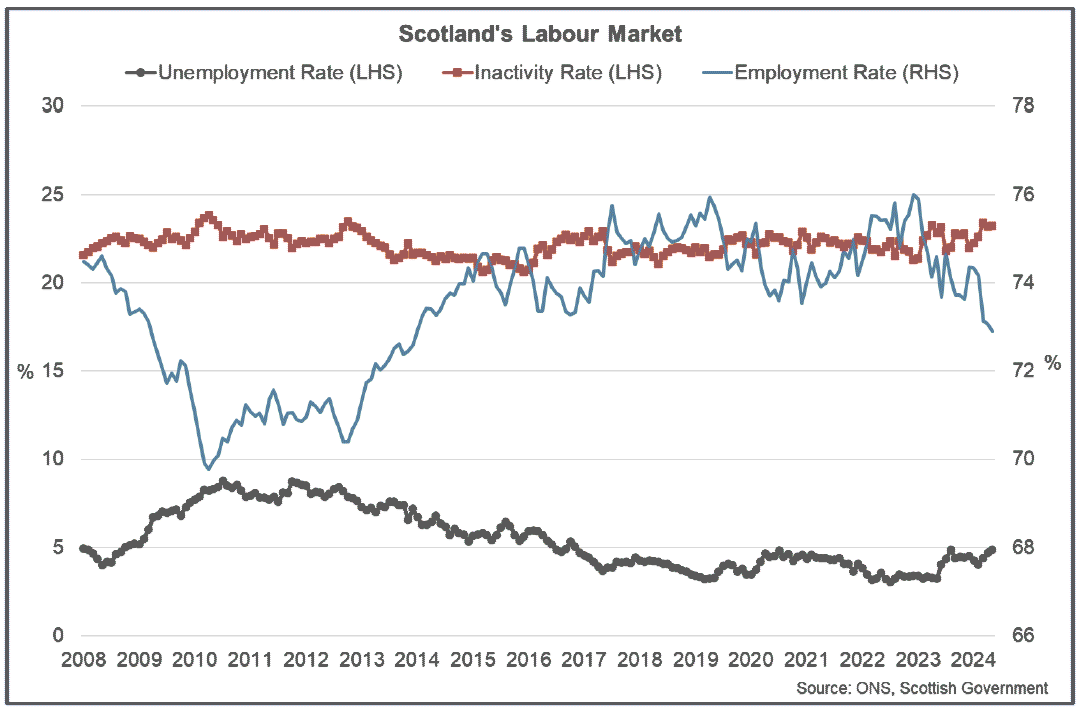

- Scotland’s labour market has continued to perform strongly in the first half of 2024, though there are indications it has loosened slightly over the past year.

- Latest Labour Force Survey data for March to May show that Scotland’s unemployment rate rose 0.8 percentage points over the quarter and 1.6 p.p over the year to 4.9% while the employment rate fell 1.3 p.p over the quarter and 1.7 p.p over the year to 72.9%. The inactivity rate has also increased over the quarter (0.6 p.p) and year (0.4 p.p) to 23.3%.[9]

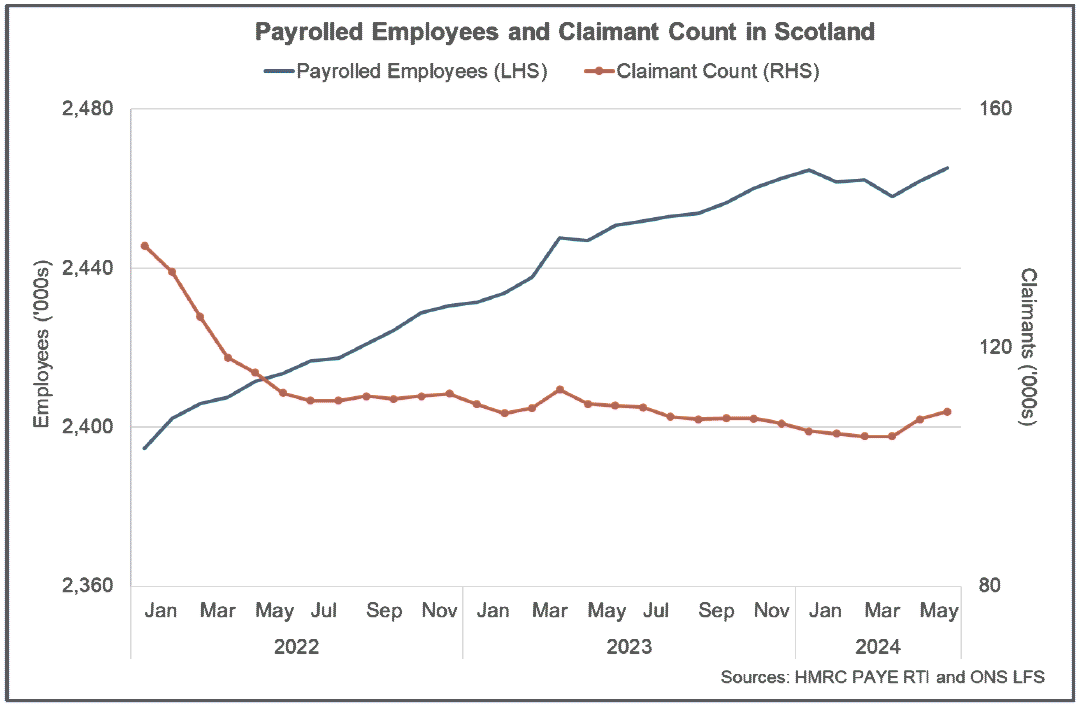

- Wider labour market data continues to illustrate underlying resilience. In June, the number of payrolled employees in Scotland increased over the month to 2.47 million, up 0.6% over the past year and is at its highest level in the timeseries. Alongside this, Scotland’s claimant count unemployment rate increased slightly in June to 3.8% (up from 3.7% in May) however the number of claimants (109,294) fell by 1,700 over the year.[10],[11]

Recruitment Activity

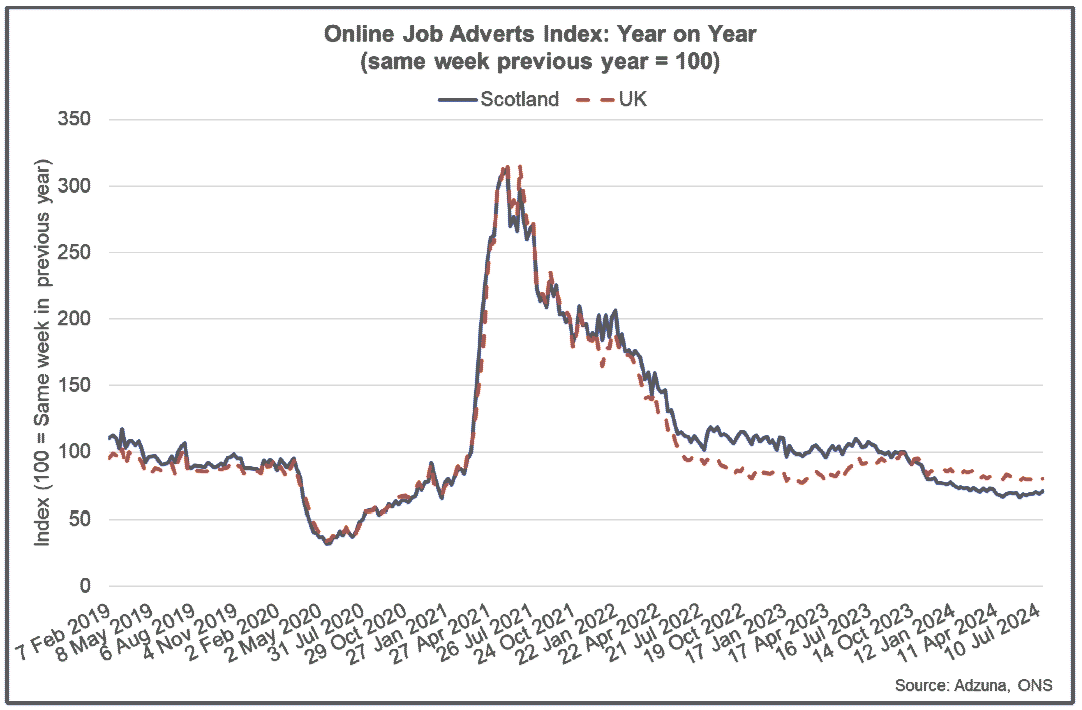

- Recruitment activity gradually stabilised in 2023 following the sharp spike during 2021 and 2022 as the economy was recovering from the pandemic.

- In the first half of 2024 online job adverts have continued to stabilise and in July were 30% lower than their elevated level in July 2023. Online job adverts are now broadly in line (-1.6%) with their level in 2019 prior to the pandemic.[12]

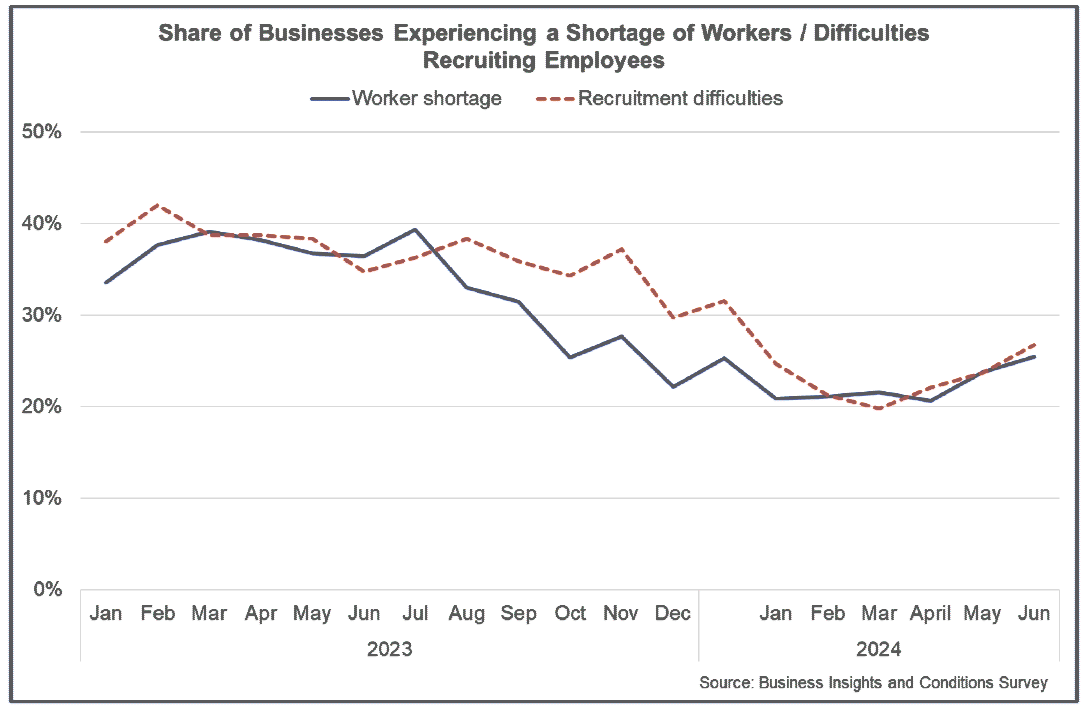

- However, many businesses that are recruiting continue to face labour shortages and report recruitment difficulties with the share rising in the second quarter of the year. In June, 25.5% of businesses in BICS reported experiencing a shortage of workers, up from 21.2% in the first quarter of the year but remains below the average during 2023 (33.4%).

- Similarly, 26.8% of businesses reported experiencing difficulties recruiting in May, rising from 21.9% during the first quarter of the year but remains below the 2023 average of 34.9%.

- At a sector level, worker shortages in June were most reported in construction (35.1), accommodation and food services (30.2%) and admin and support services (29.1%). This has resulted in 32.2% of respondents reporting that worker shortages have led to employees working increased hours, 15.7% had to recruit temporary workers while 11.9% reported being unable to meet temporary demands.

- Recruitment difficulties in May were most reported in construction (39.6%), accommodation and food services (29%) and manufacturing (28.6%). Latest data from April show most businesses responded that a lack of qualified applicants (49.8%) alongside a low number of applications (33.9%) were reasons why they experienced difficulties in recruiting employees, while 21.4% reported not being able to afford an attractive pay package for applicants.

Earnings

- Despite indications that the labour market has loosened over the past year, the pace of earnings growth has remained robust. Coupled with the fall in inflation rate, this has resulted in earnings continuing to grow steadily in real terms.

- Nominal median monthly PAYE pay in Scotland was £2,413 in June, up 5.2% over the year and is above the average annual growth rate over the past nine years (4%), having slowed from higher rates of growth of around 9% in 2023.[13]

- Adjusting for inflation, which was 2% in June, real median earnings grew 3.2% on an annual basis. This was the thirteenth consecutive month of positive annual growth following the period of falling real pay during 2022 and the start of 2023.

Contact

Email: OCEABusiness@gov.scot

There is a problem

Thanks for your feedback