Scottish economic bulletin: March 2024

Provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Labour Market

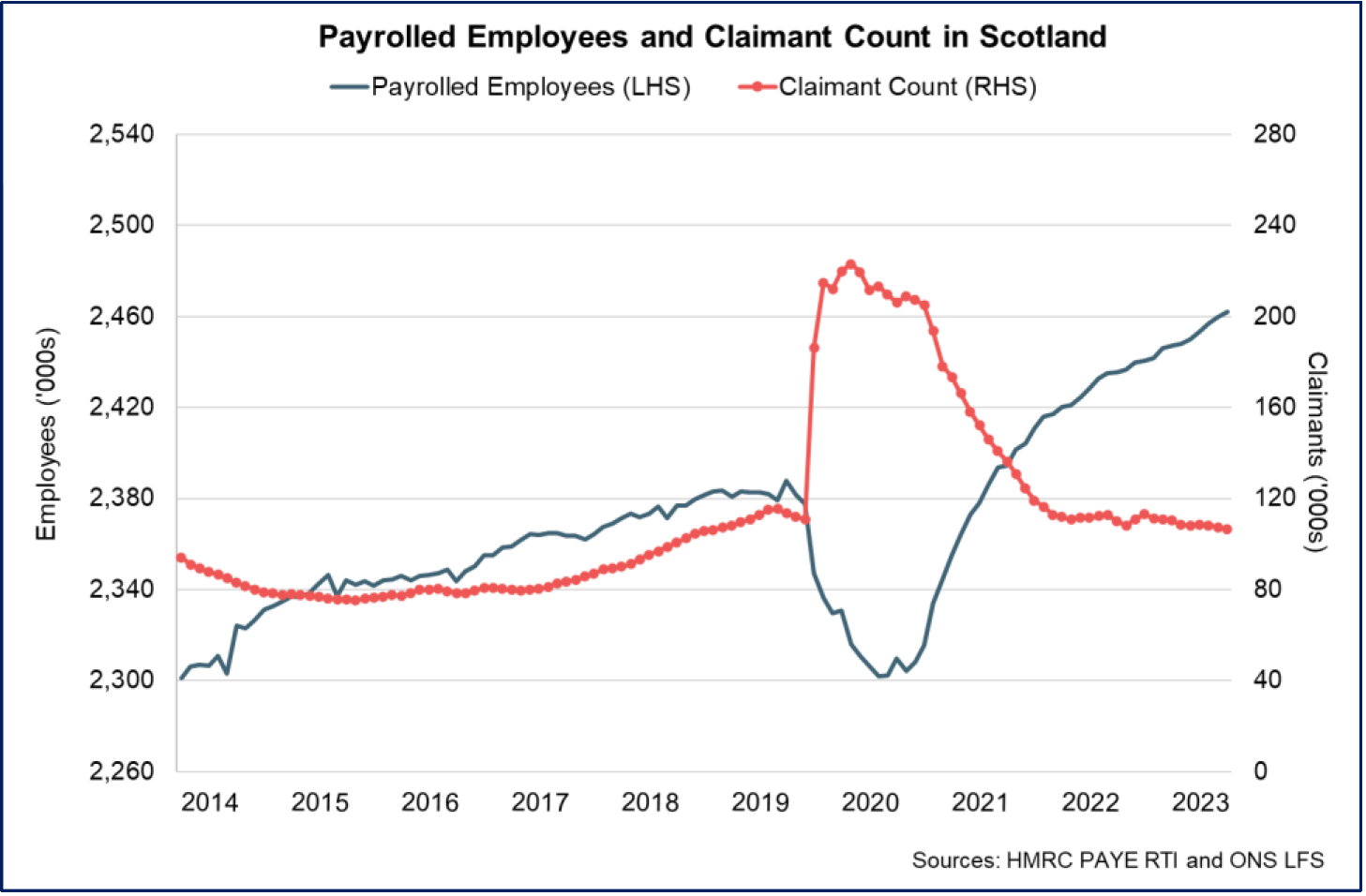

Payrolled employees continue to rise while the claimant count is at its lowest level since 2019.

Employment, Unemployment and Inactivity

- Labour market conditions have been tight since the start of 2022 and have been resilient in the face of subdued GDP growth and inflationary pressures. This has been characterised by low unemployment, strong demand for labour with elevated vacancy rates and some companies reporting staffing shortages.

- Latest data for October to December show that Scotland’s unemployment rate rose 0.1 percentage points over the quarter to 4.5%, while the employment rate rose by 0.6 percentage points to 74.4%, and inactivity rate fell by 0.8 percentage points to 22.0%.[12]

- Labour market conditions have softened slightly over the last year with the employment rate falling 1.6 percentage points while the unemployment rate has increased 1.1 percentage points, and the inactivity rate has risen 0.7 percentage points.

- However wider labour market data further emphasises the resilience in the labour market. The number of PAYE employees in Scotland continued its upward trend since the start of the 2023, rising 0.1% in January to 2.46 million, its highest level in the timeseries back to 2014.[13]

- Scotland’s claimant count rate also remained stable in January at 3.5% with the number of claimants falling 0.9% over the month to 106,500, its lowest level since May 2019.[14]

Recruitment Activity

- Business survey data also signals that the extent of tightness in the labour market has continued to cool in recent months. The RBS Report on Jobs indicated a further fall in permanent staff placements in January (45.0) while business demand for staff fell for a sixth consecutive month and at its quickest rate since the end of 2020 (41.9).[15]

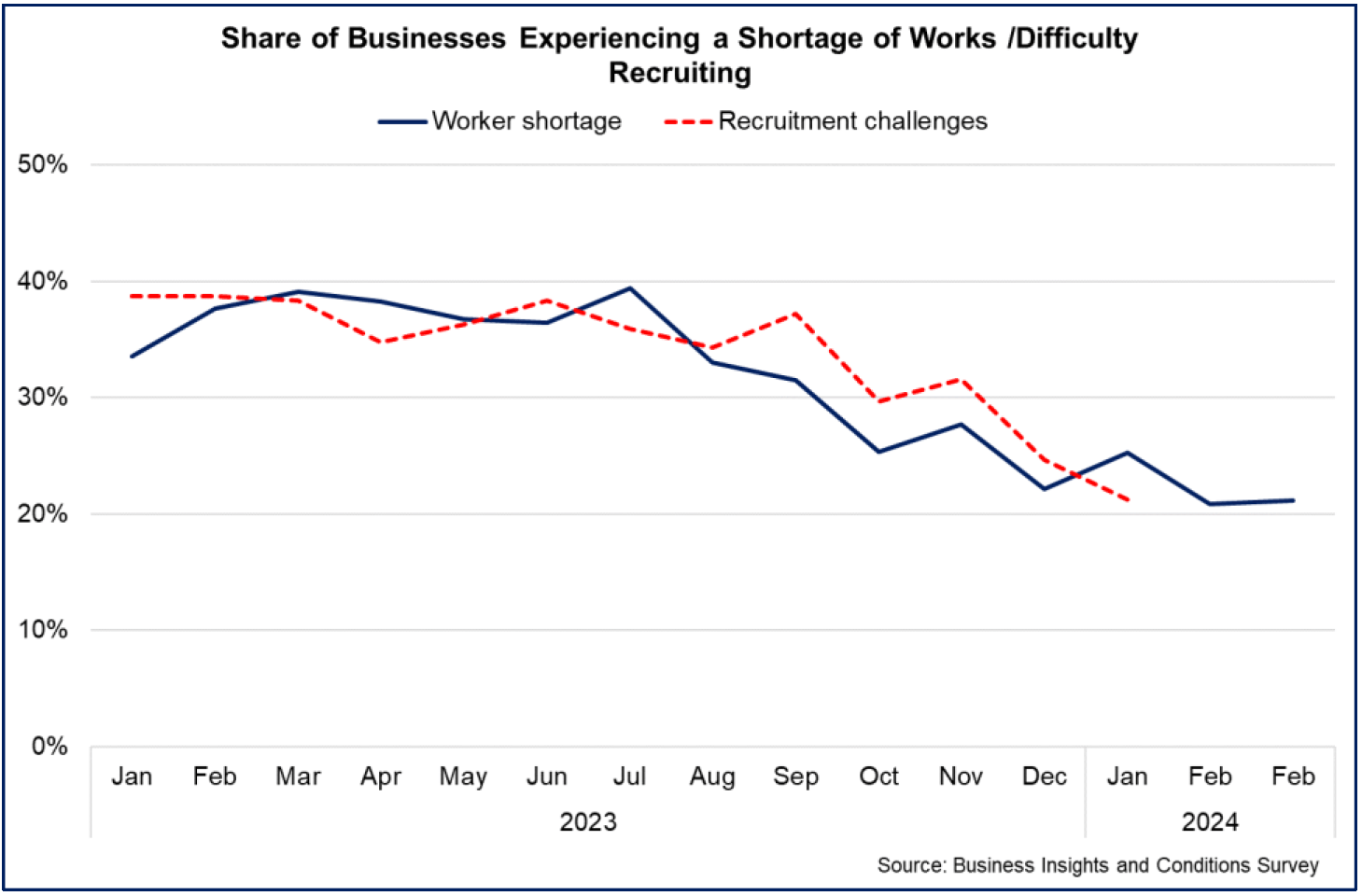

- BICS data provides further insights on labour shortages and recruitment challenges which have been gradually easing over the past year as the labour market has loosened. In February, 21% of businesses reported experiencing a shortage of workers, down from the average rate of 34% at the start of 2023, while 21% of businesses reported experiencing difficulties recruiting in January, down from 39% at the start of 2023.

- At a sector level, worker shortages in February were most reported in construction (30%), professional, scientific and technical activities (29%) and the manufacturing sector (26%). 60% of businesses reported that worker shortages led to employees working increased hours, while 40% reported being unable to meet demands and 33% reported having to recruit temporary workers.

- Recruitment difficulties were most reported in construction (27%), manufacturing (25%) and accommodation and food services sectors (24%). Latest data from January show most businesses responded that a lack of qualified applicants (63.1%) alongside a low number of applications (49.1%) were reasons why they experienced difficulties in recruiting employees while 20.1% reported not being able to afford an attractive pay package for applicants.

Earnings

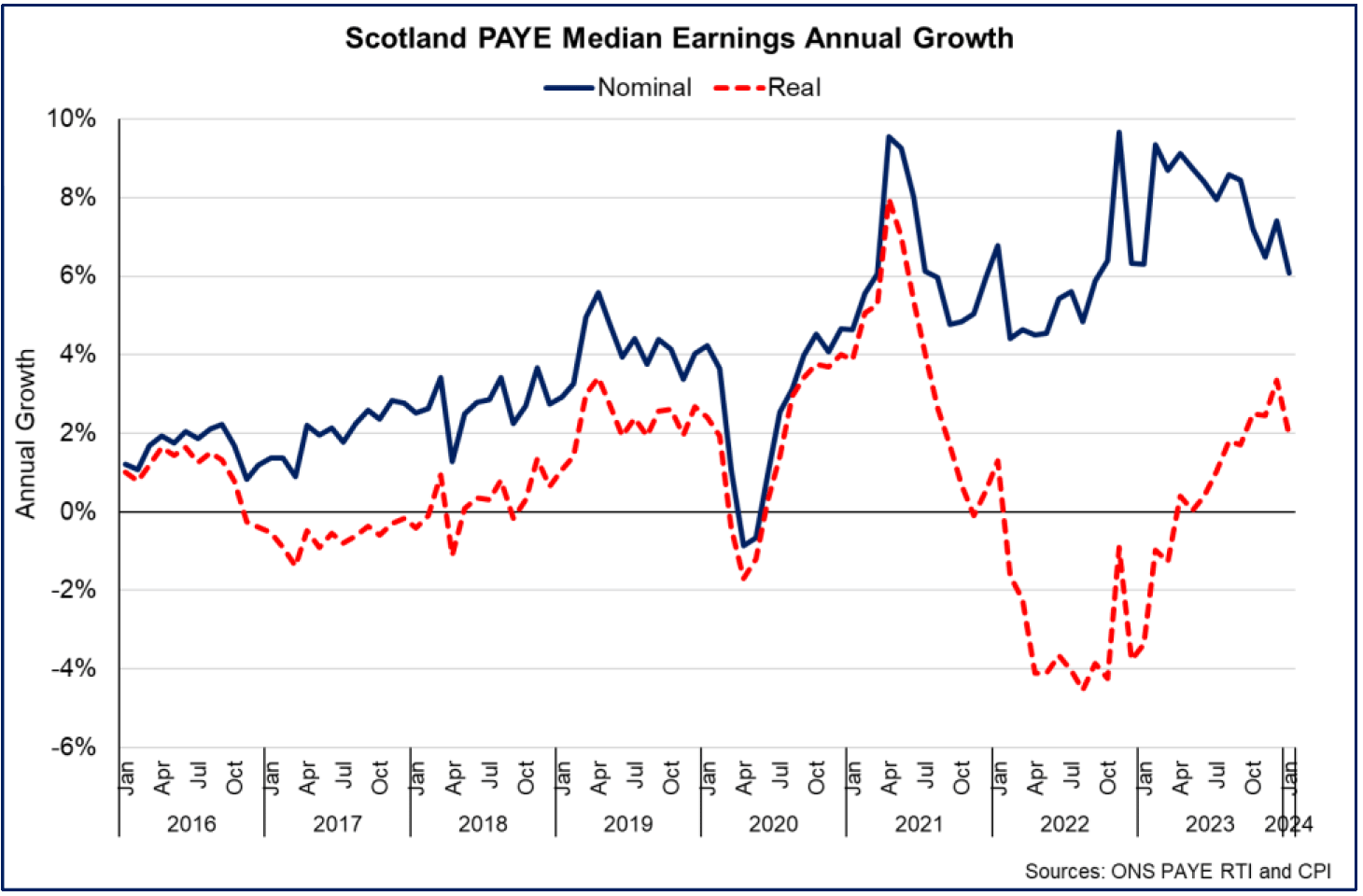

- Recruitment challenges, staffing shortages and inflationary pressures have generated upward pressure on earnings growth over the past year, however the pace of growth has been easing in recent months.

- The RBS Report on Jobs for January indicates that growth in starting salaries remained positive (net balance of 54.9), though the pace of growth has significantly softened to its lowest rate since February 2021.

- More broadly, nominal median monthly PAYE pay in Scotland was £2,359 in January, down 0.1% over the month and up 6.1% over the year. This remains above the average annual growth rate over the past eight years (4.2%), however has slowed from higher rates of growth of around 9% in 2023 and is its slowest annual rate of growth since September 2022.[16]

- Adjusting for inflation, which was 4% in January, real median earnings grew 2% on an annual basis. This was the tenth consecutive month of positive annual growth following the period of falling real pay during 2022 and the start of 2023, reflecting the increase in nominal pay growth and easing in inflationary pressures.

Contact

Email: OCEABusiness@gov.scot

There is a problem

Thanks for your feedback