Scottish economic bulletin: November 2024

Provides a summary of the latest key economic statistics, forecast and analysis on the Scottish economy.

Inflation

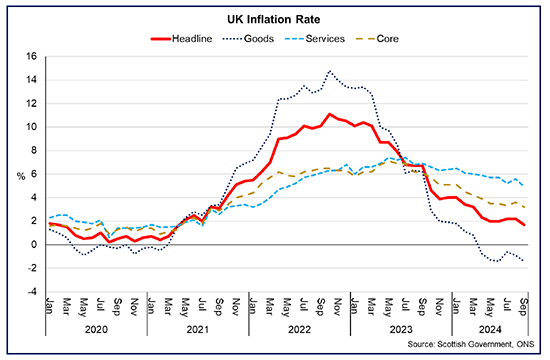

Inflation fell below its target in September to 1.7%, its lowest rate since April 2021.

- The inflation rate fell to 1.7% in September from 2.2% in August. The rate falling below its 2% target is expected to be temporary, and is forecast to rise slightly above target again in the fourth quarter and into 2025.[2]

- The core inflation rate, which excludes energy, food, alcohol, and tobacco, fell from 3.6% in August to 3.2% in September. Furthermore, there continues to be a notable difference between services and goods price inflation, with stronger persistence of services price inflation which fell from 5.6% to 4.9% compared with goods price inflation which fell from -0.9% to -1.4%.

- The outlook for headline inflation is more stable than it has been for the past two years, with the latest forecast from the OBR projecting inflation to remain near target, averaging 2.5% in 2024, rising to 2.6% in 2025 before falling back to 2.3% in 2026. The Bank of England forecast a similar trajectory for inflation in the November 2024 Monetary Policy Report (MPR), increasing to a peak of 2.8% in Q3 2025 before falling to 1.9% in the second half of 2027.[3],[4]

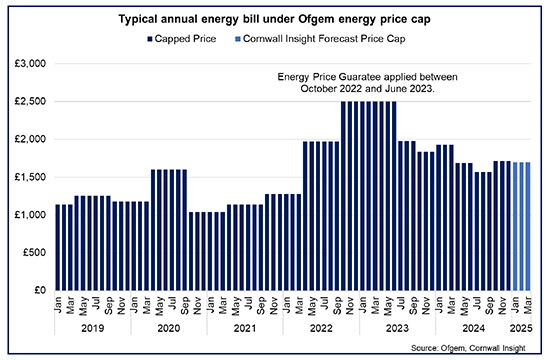

- This forecasted increase in the inflation rate is partly driven by higher electricity and gas prices. The Energy Price Cap (EPC) has increased by 9.5% for the fourth quarter of 2024, however is 6.4% lower compared to Q4 2023 and is projected to fall slightly (by 1.2% from the cap in Q4 2024) in the first quarter of 2025 (down 12% annually).[5]

- The ongoing conflict in the Middle East continues to present elevated uncertainty and risks to the outlook for energy prices and inflation forecasts. However, in response to lower and more stable inflation, the Bank of England’s Monetary Policy Committee (MPC) have reduced interest rates to 4.75% (down from their recent peak of 5.25%) and markets currently expect further gradual reduction over the coming year.[6]

Contact

Email: economic.statistics@gov.scot

There is a problem

Thanks for your feedback