Scottish economic bulletin: November 2024

Provides a summary of the latest key economic statistics, forecast and analysis on the Scottish economy.

Business Conditions

Business activity continued to grow in Q3 2024, though indicates the pace of growth has eased from the second quarter.

Business Activity

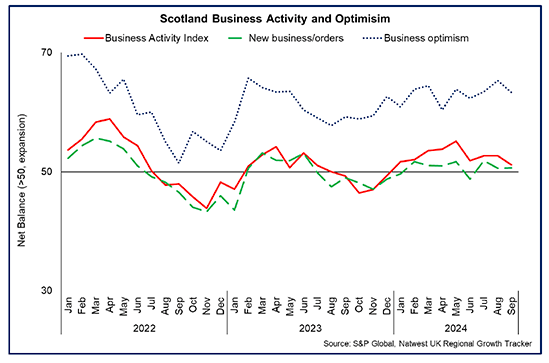

- The RBS Growth Tracker business survey indicates that business activity in Scotland’s private sector continued to grow in September (51.2), albeit at its weakest pace in 2024 so far, with the business activity indicator slowing over the third quarter.[7]

- The services sector continued to drive growth in new business, activity and employment while manufacturing firms saw a reduction in new orders.

- This is consistent with the Fraser of Allender Institute’s Scottish Business Monitor for Q3 2024, which reports that businesses in Scotland experienced a slight fall in activity over the quarter, with the Volume of Business Activity indicator falling from 4.5 points in Q2 2024 to -0.8 in the third quarter.[8]

Business Concerns

- Slowing activity is also reflected in the latest Business Insights and Conditions Survey (BICS) data on business concerns in November, with the most commonly cited concern being falling demand of goods and services (16.9%). While this is down slightly from recent months, the level of concern remains higher than in 2023.[9]

- In contrast, 11.9% of businesses flagged energy prices as a concern. While this is not as significant a factor as it was during the energy price shock in 2022 and 2023, concerns have increased in the most recent data, up from 6.3% in August.

- However, concerns around other issues have fallen over the course of 2024, with businesses decreasingly citing inflation of goods and services (8.3%) and interest rates (3.2%) as causes for concern.

Title: Main Business Concerns in 2023 and 2024

Line chart showing business are more concerned about falling demand for goods and services than about energy prices, but are also increasingly concerned about taxation.

- Business concerns vary at a sector level, with Accommodation and Food Services businesses more commonly reporting worries around energy prices (26.5%) and falling demand (23.2%), while key concerns for the Information and Communication sector are falling demand (25.2%), and competition with other UK businesses (21.5%).

- Interest rates are causing less concern among businesses, likely reflecting expectations that the Bank of England will continue to reduce interest rates, albeit gradually, over the coming year. Furthermore, the Scottish Business Monitor for Q3 2024 reported that the cost of credit has become less of a concern for businesses, with 30% of firms reporting this as their key cost driver (down from 38% last year).

- However, business concerns around taxation have picked up in recent months, with 9.4% of businesses reporting this as a concern in November, its highest rate in the timeseries. This is potentially in part due to expectations and announcements from the UK Government Budget.

Business Costs

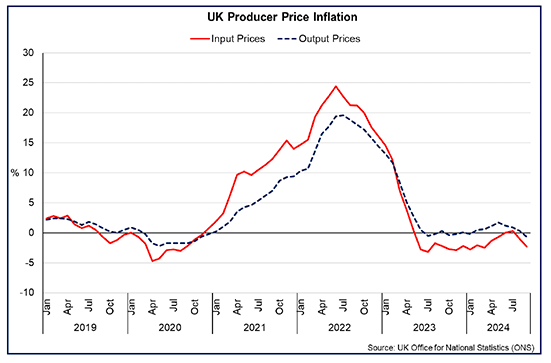

- At a headline level, producer input prices fell by 2.3% in the year to September 2024. A key driver of this fall was the fall in the input price of crude oil (-23.3%) and inputs of fuel (-11.2%) which offset an increase in domestic food input prices (1.7%).[10]

- Scottish business survey data from the RBS Growth Tracker also highlighted that input cost pressures have continued to decelerate, with the measure at a 43-month low in September (58.2). While costs are still reported to be rising, driven by increasing labour and material costs, this trend is in line with broader disinflation seen in other price measures.[11]

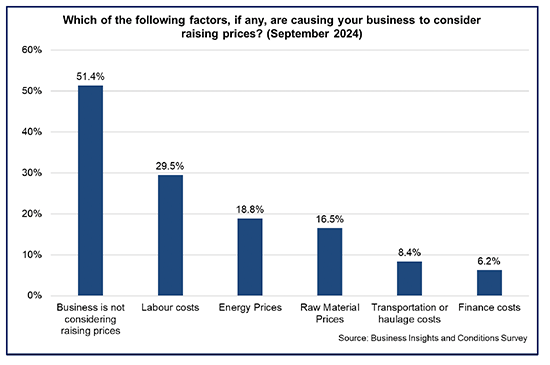

- In terms of the feed through to output prices, producer output prices fell 0.7% over the year to September, down from an 0.3% rise in the year to August, with output prices falling at their fastest rate since October 2020. More broadly, the RBS Regional Growth tracker indicated a slight increase in output price pressures in September, however, looking ahead, latest BICS data show that a majority (51.4%) of businesses do not plan to raise prices in November. Among those businesses considering price increases, labour costs (29.5%), energy prices (18.8%) and raw material prices (16.5%) are the most commonly cited factors.

Business Investment

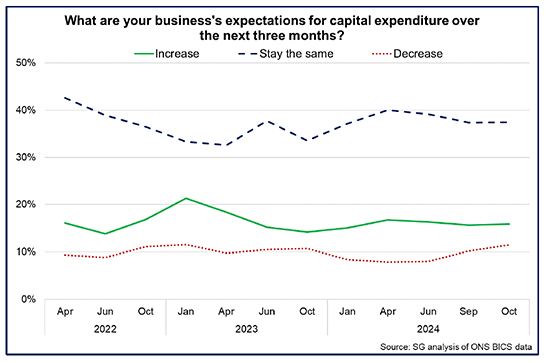

- Latest business surveys for 2024 show that indicators of new capital investment have improved from 2023 however generally remain weak overall with the combination of business concerns around demand, cost pressures and borrowing costs continuing to weigh on business investment decision making.

- The Scottish Business Monitor reported that levels of new capital investment remained negative in Q3 2024 (-5.4) though has improved in recent quarters and is it at its highest level since Q1 2023.[12] Additionally, the Scottish Chambers of Commerce Quarterly Economic Indicator for Q3 2024 suggests that investment trends are seeing positive growth across most sectors.[13]

- BICS data indicate that there has been a slight increase in the share of businesses expecting to decrease capital expenditure in the second half of 2024 (most recently 10.2%), compared to the first half of 2024, however, the majority of businesses continue to expect capital expenditure to remain the same (37.4%) or increase (15.6%) in the final quarter of the year.

- Of those businesses expecting to authorise capital expenditure, 48.1% report that it will be for replacements, with fewer respondents intending to provide new services ( 6.8%) or purchase new technology (8.4%). Business investment is also being directed to increase efficiency (18.3%) and expand capacity (15.1%).

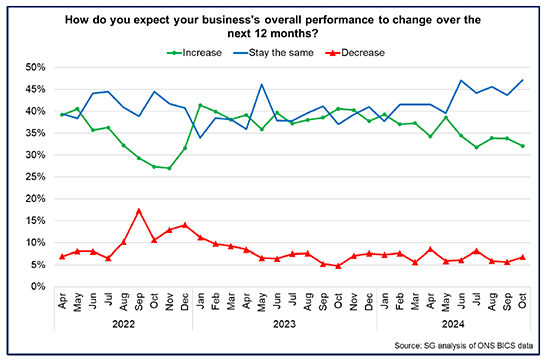

Business Optimism

- As outlined above, RBS Growth Tracker data shows that the outlook for businesses in Scotland over the next 12 months remains positive, though fell to a three-month low in September.

- BICS data for October indicates that most businesses expect their overall business performance to stay the same (47.1%) or increase (32.1%) over the coming year. In the last few months, businesses have decreasingly reported that they expect business performance to improve, with more saying they expect to remain stable over the next twelve months. However, the proportion of businesses expecting their performance to decrease in the coming year has remained low (6.8%).

Contact

Email: economic.statistics@gov.scot

There is a problem

Thanks for your feedback