Scottish economic bulletin: November 2024

Provides a summary of the latest key economic statistics, forecast and analysis on the Scottish economy.

Consumer Activity

Consumer sentiment has weakened in recent months, but remains stronger than a year ago.

Consumer Sentiment

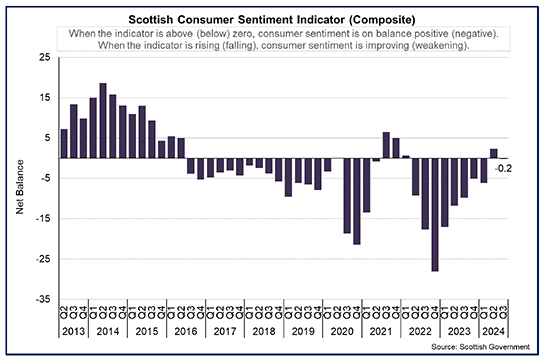

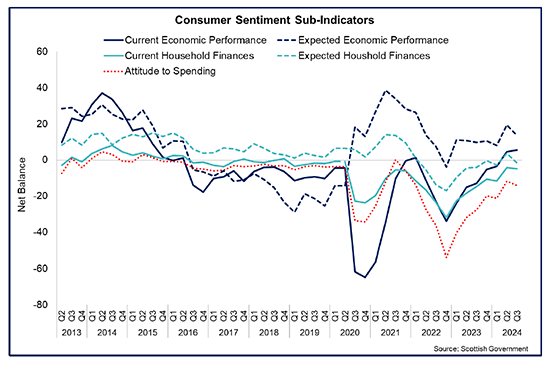

- The Scottish Consumer Sentiment Indicator reflects how households think the economy is performing, how secure they feel about their household finances and how relaxed they feel about spending money.

- Consumer sentiment has weakened from Q2 2024 to Q3 2024, with the indicator falling 2.6 points to -0.2. However, the indicator remains 9.7 points higher than the same quarter last year and is at its second highest level since Q4 2021.[19]

- The improvement in consumer sentiment relative to last year reflects that consumers have been indicating, on balance, that the economy, their household financial security and their attitude to spending has been improving. The latest fall in sentiment, however, partly indicates increased uncertainty about the outlook and is consistent with a recent pattern of weakening consumer confidence at a UK level.[20]

- The main driver of the fall in sentiment over the quarter was a fall in the expectation indicators for the coming year. Household financial security expectations fell 5.1 points to -1.5, indicating that respondents on balance expect their personal financial security to weaken over the next year. Similarly, the expected economic performance indicator fell 5.8 points to 13.7, indicating that respondents on balance expect the economic outlook to improve over the coming year, but to a lesser extent than the previous quarter.

- Sentiment relating to households’ current financial security (-4.7) and attitudes to spending (-14.1) also fell over the quarter, by 0.4 and 2.4 points respectively, and remain negative, likely reflecting the continuing cost of living challenges facing households. This data suggests consumers are increasingly pessimistic about what their personal circumstances will look like next year.

- Current economic performance was the only area of sentiment which increased over the quarter, by 0.9 points, and is likely reflective of the modest improvement in economic conditions seen in the first half of this year.

- Monthly consumer sentiment data also highlights the recent decline in sentiment over August and September, with latest data for September showing that sentiment fell 7.8 points over the month to -6.9. All five sub-indicators of sentiment fell over the month, with four out of five sitting in negative territory. Only sentiment on future economic performance remains positive, falling from 13.1 in August to 1.8 in September.

Cost of Living and Spending

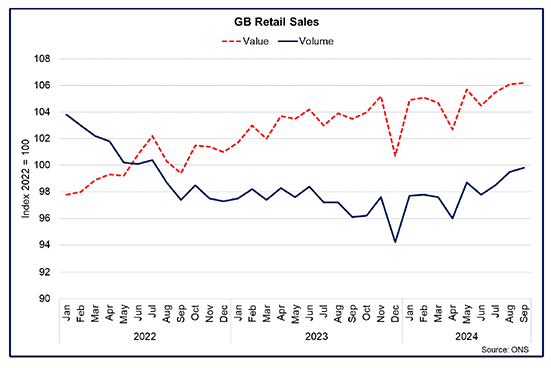

- Inflation has broadly returned to near its target rate, however the sharp rise in the cost of living over 2022 and 2023 and the increase in interest rates over that period, continue to impact households and their spending, saving and borrowing behaviour.

- Retail sales volumes in Great Britain have gradually returned to around their 2022 level over the course of 2024 (having fallen over 2022 and 2023) with most recent data showing growth of 1.9% in volume terms in the three months to September (1.6% growth in value terms) as inflationary pressures have eased.[21]

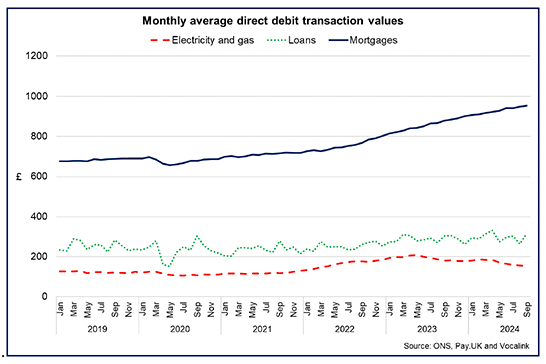

- Similarly the change in prices and borrowing costs have had a significant impact on the amount consumers are paying for their energy costs, mortgages and other loans. In September, the average direct debit transaction value for electricity and gas was £153.34, 15.1% lower than for the same time last year, partly reflecting the fall in the energy price cap over that period.[22]

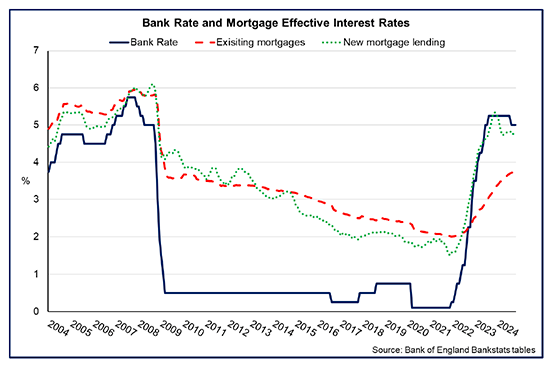

- However, the average monthly direct debit payment for mortgages was £955 in September (up 8.5% over the year) and £316 for loans (up 3.9% over the year). This in part reflects the feed through of higher interest rates to higher borrowing costs however the rate of change has stabilised as the Bank Rate remained at 5.25% from August 2023 before being reduced to 5% in August 2024. The increase in direct debit payments may further moderate in future data with November’s quarter-point interest rate cut.

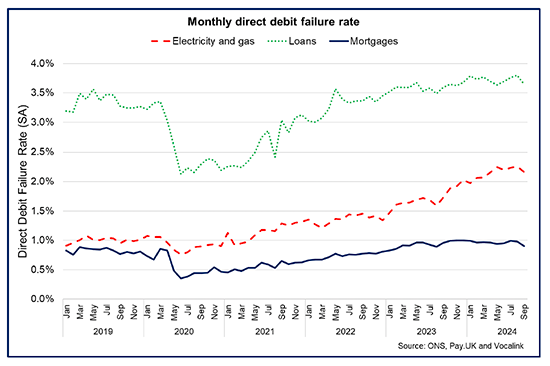

- The sharp increase in prices has been accompanied by an increase in the direct debit failure rate (the percentage of transactions that fail due to insufficient funds), reflecting the challenges facing some household budgets. For electricity and gas payments, the payment failure rate was at 2.16% in September (up from 1.73% in September 2023), while for mortgages the payment failure rate has remained relatively more stable over the year and fell to 0.90% (down from 0.96% in September 2023).

- More broadly in September, the ONS Public Opinions and Social Trends survey showed that 35% of respondents foundit very or somewhat difficult to afford energy bill payments (down from a peak of 49% in 2023) while 34% of respondents said the same for mortgage and rent payments (down from a peak of 46% in July 2023).[23]

- The more gradual and persistent impacts of higher interest rates on mortgage payment challenges compared to energy payments reflects the sharp rise in the Bank Rate between the end of 2021 and middle of 2023 and the time it takes for the impacts of interest rate changes to be felt at an aggregate level. This is because of the high share of mortgages that are on a fixed rate.

- Reflecting this, the ‘effective’ interest rate – the actual interest paid – on newly drawn mortgages fell to 4.76% in September and is lower than in the second half of 2023 (average 5.06%) in part reflecting the decrease in Bank Rate in August and broader market expectations of lower interest rates in 2024. Rates on the outstanding stock of mortgages however continued to rise to 3.74% (up from 3.14% in September 2023).[24]

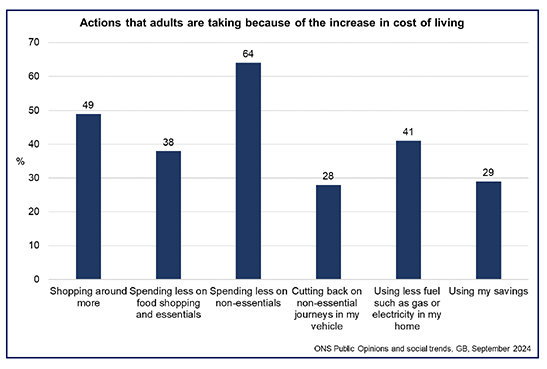

- In response to the change in cost pressures facing households, ONS Public Opinions and Social Trends survey data from September show that the most common actions people are taking in response to the increased cost of living continue to be spending less on non-essentials (64%) and shopping around more (49%).

- Furthermore, 41% reported using less fuel such as gas or electricity in their home and 38% reported spending less on food shopping and essentials. These figures have remained broadly consistent over the course of 2024, suggesting cost of living challenges continue to impact consumers despite lower inflationary pressures and strengthening real terms earnings at an aggregate level.

Contact

Email: economic.statistics@gov.scot

There is a problem

Thanks for your feedback