Publication - Research and analysis

Scottish economic bulletin: October 2023

Provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Inflation

Inflation continues to fall however remains significantly above the 2% target.

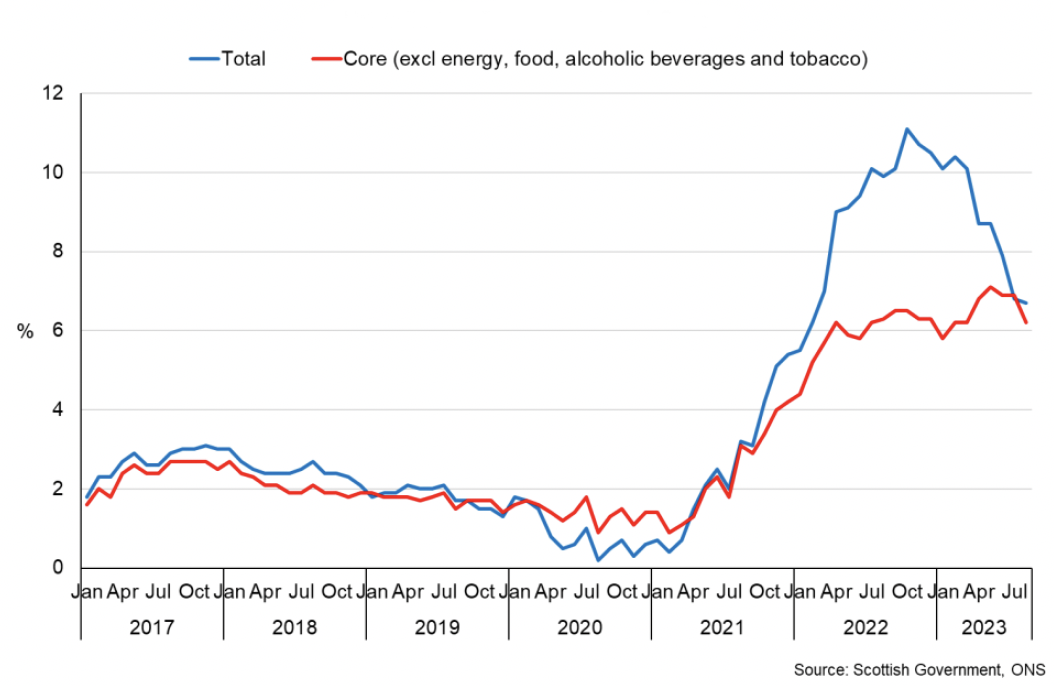

- UK inflation fell for a third successive month in August to 6.7%, continuing its downward trend from its recent peak of 11.1% in October 2022 and is at its lowest rate since February 2022.[2]

- The fall in August was modest, down from 6.8% in July, with the largest downward contributions from food and non-alcoholic beverages and restaurants and hotels, offset by upward contributions from transport (particularly motor fuels) and clothing.

- Core inflation, which excludes food, energy, alcohol and tobacco, fell to 6.2% in August, down from 6.9% in July, and while it remains elevated, indicates a slight easing in inflation pressures from recent months.

- In terms of the downward contribution from food and non-alcoholic beverages, the annual rate of inflation fell for a fifth consecutive month in August to 13.6% (down from 14.8% in July and from its recent peak of 19.1% in March), however remains notably elevated. In contrast, motor fuel prices (petrol and diesel) have been on a downward trend since the end of 2022, and are 15% and 19% lower respectively compared to last year. However, prices increased by c. 4% over the month between July and August, providing an upward contribution to the overall rate.

- Electricity and gas price annual inflation rates remained unchanged at 6.7% and 1.7% respectively, and partly reflects the shift in July from the Energy Price Guarantee to the Energy Price Cap (EPC) for July to September, which estimates the typical annual energy bill to fall c. 17% to £1,978. The EPC for October to December is expected to result in a further 7.3% fall in the typical annual energy bill to £1,834 from October.[3]

- Overall, annual consumer price inflation rates are on a downward trend, however the price index level remains 21% higher than at the start of 2021, illustrating the rapid increase in the overall price level facing consumers over this period.

- In response to latest inflation and wider economic data the Bank of England's Monetary Policy Committee (MPC) voted by 5 to 4 to maintain Bank Rate at 5.25% in September, unchanged from the previous meeting in August. This was the first pause in the current sequence of Bank Rate rises since December 2021 having risen at fourteen consecutive MPC meetings.[4]

- The Bank Rate remains at its highest rate since 2008 and is expected to remain at restrictive rates to support the fall in inflation back towards the 2% target in the medium term. Markets currently expect the Bank Rate to average slightly under 5% over the next 3-years, which is slightly lower than expectations in August and reflects the easing in inflationary pressures.

Contact

Email: OCEABusiness@gov.scot

There is a problem

Thanks for your feedback