Scottish economic insights: November 2023

Further analysis and insights on the economic themes presented in the monthly Scottish economic bulletin report.

Inflationary Pressures

A key economic challenge over the past year has been the combination of high inflation and slowing economic growth with the risks that rising interest rates could further stall economic growth and increased international uncertainty could raise the persistence of inflationary pressures.

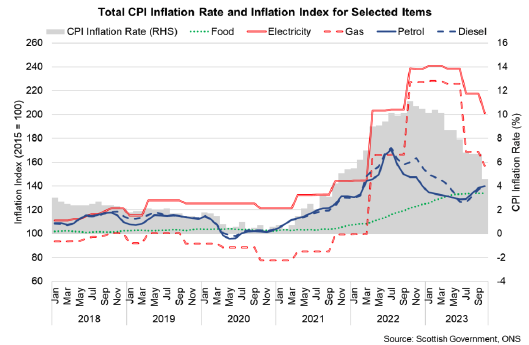

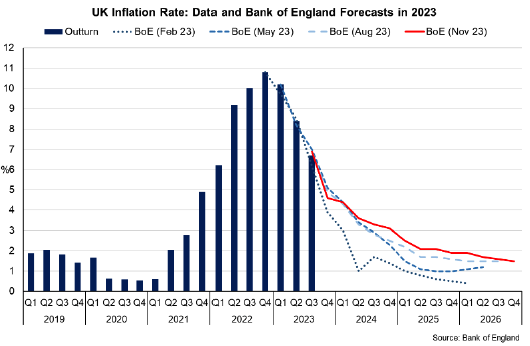

UK inflation fell to 4.6% in October, down 6.5 percentage points over the past year and is now at its lowest rate for two years having peaked at 11.1% in October 2022.[2]

The fall in inflation largely reflects the fall in consumer energy prices with electricity prices falling 15.6% over the past year and gas prices down 31%. Food prices continue to grow strongly at 10.1% however the pace of growth has slowed notably from its peak of 19.6% in March this year.

Disaggregating the Scottish GDP deflator

Consumer Prices Indices (CPI and CPIH) provide the official estimates of consumer price inflation in the UK and internationally. They estimate changes in the price level for a basket of goods and services (e.g. energy and food prices) and are critical to understanding the drivers of inflation.

The GDP deflator is an alternative and broader measure of inflation which reflects the prices of all goods and services that comprise GDP.

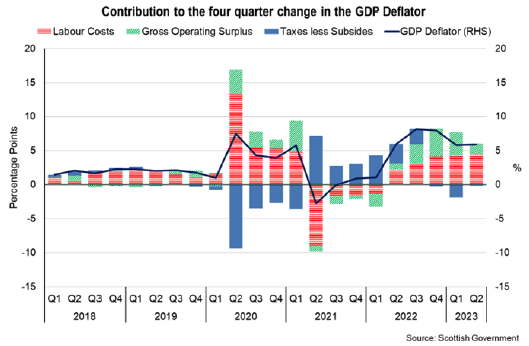

Disaggregating the GDP deflator by the income approach can provide insights on how labour costs (labour earnings), gross operating surplus (primarily corporate earnings), and production taxes less subsidies have contributed to inflation.

As with CPI and CPIH, the GDP deflator has captured the inflationary shock, peaking at 8.2% in Q3 2022, and eased back to 5.9% in Q2 2023.

As inflation started to rise at the end of 2021, this was initially driven by positive contributions from taxes less subsidies, which primarily reflected the withdrawal of pandemic related subsidies. However, this was accompanied by positive contributions from labour earnings and operating surplus over 2022 and in the first half of 2023. Between 2020 Q2 and 2022 Q3, a year after the end of the Coronavirus Job Retention Scheme, there are unusually large contributions to the GDP deflator from the subsidies which were introduced to support businesses during the COVID- 19 pandemic.

Subsidies contribute negatively to the GDP deflator, because the income they provide to factors of production is not generated through economic activity but transferred from Government. This negative contribution is most prominent in the graph in two instances – furlough payments to furloughed workers in 2020, and most recently the Energy Price Guarantee at the end of 2022 and into 2023.

When the GDP deflator peaked at 8.2% in Q3 2023, taxes less subsidies contributed 2.2 percentage points, gross operating surplus 2.7 percentage points and earnings 3.2 percentage points.

Inflation has gradually fallen since then partly driven by negative contributions from taxes less subsides in 2023 (-0.1 percentage points in Q2 2023) and lower contributions from gross operating surplus (1.5 percentage points in Q2 2023). Labour earnings have continued to strengthen and contributed 4.5 percentage points in Q2 2023, reflecting the increase in wage growth.

Overall, the disaggregation of the GDP deflator indicates that both labour earnings and, to a lesser extent, gross operating surplus have continued to contribute positively to inflationary pressures in 2023. However, the contribution of gross operating surplus in the latest quarter was relatively small at 1.5 percentage points. This is broadly comparable to the UK as a whole, with the Bank of England indicating that the contribution to inflation from Gross Operating Surplus is not from corporate profits, but from other sources of income.

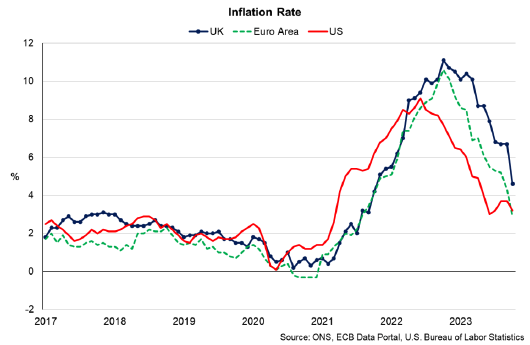

Internationally, inflation rates have also fallen sharply over the year. In the Euro Area, inflation fell to 2.9% in October, down 7.7 percentage points over the year while US inflation fell 4.1 percentage points over the past year to 3.2%. In each area, inflation is at more consistent rates with those at the end of 2021 prior to the outbreak of war in Ukraine.[3],[4]

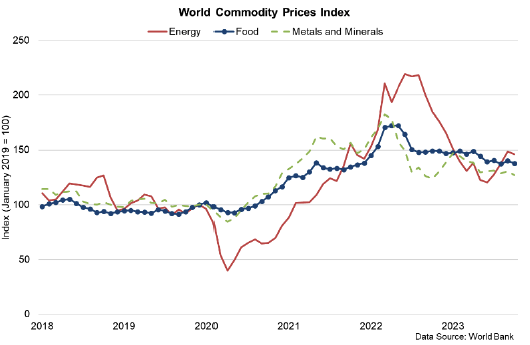

The moderation in international commodity prices and the feed through to consumer prices has played an important role in this during 2023, falling 7.7% over the past year, while metals and minerals prices have remained more stable and grew 2.4%. Energy prices have proved slightly more volatile but, despite an upward trend in recent months reflecting the rise in oil prices in the second half of the year, have fallen 20.9% over the past year.[5]

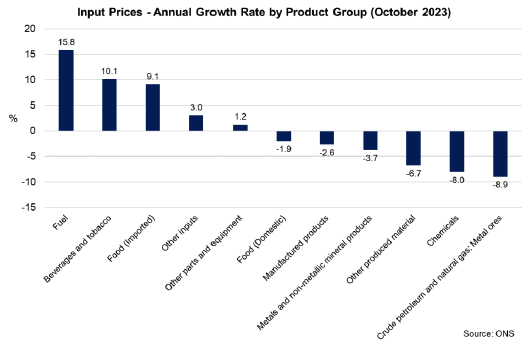

The fall in commodity prices, alongside wider improvements in supply chains, has supported the fall in producer input costs in the UK which has further fed through to the fall in consumer prices. Producer input prices fell 2.6% over the year to October 2023 and has fed through to consumer goods price inflation falling to 2.9% in October while services price inflation fell more moderately to 6.6% and is forecast to continue falling more slowly over the coming months.[6]

The fall in producer prices over the past year has been most notable in crude petroleum and natural gas prices (-8.9%) and chemicals (-8%). Input inflation rates for fuel, beverages/tobacco and imported food remain robust and highlight that while services price inflation is likely to be slower to ease than good price inflation, the international context and its impact on global inflationary pressures remains a risk to goods price inflation.

The war in Ukraine continues to present a risk to global commodity prices, with the events in Gaza and Israel presenting a new risk to oil and gas prices, and to a greater extent if the wider region and its energy supplies are impacted.

The Geopolitical Risk Index illustrates the spikes in world geopolitical risks at the start of the war in Ukraine at the start of 2022 and then again most recently in October 2023 when the in Gaza-Israel escalated.[7]

Looking ahead, inflation is forecast to continue on its downward trajectory towards the 2% target as the impacts of higher interest rates and weakening demand weigh on inflationary pressures. Market expectations are for the Bank Rate to remain around its current rate of 5.25% until Q3 2024 before declining gradually to 4.25% by the end of 2026.[8]

Compared to forecasts from earlier in the year, the fall in inflation is expected to be more gradual, particularly in the services sector, with inflation approaching the 2% target in the second half of 2025.

Contact

Email: OCEABusiness@gov.scot

There is a problem

Thanks for your feedback