Scottish economic insights: October 2024

Provides further analysis and insights on the economic themes presented in the monthly Scottish economic bulletin.

Recent Labour Market Trends

Scotland’s labour market has continued to perform strongly over the past year with indicators suggesting that the previous tightness has eased slightly while earnings growth has remained robust leading to a sustained period of real earnings growth.

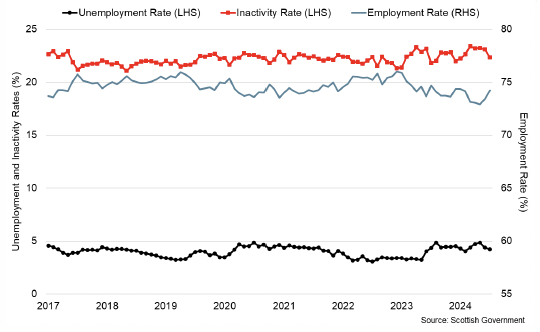

Latest Labour Force Survey data for May to July show that Scotland’s unemployment rate continues to remain relatively stable, falling 0.1 percentage points over the year to 4.2%. There has been a relatively larger change in Scotland’s employment rate which fell 0.5 percentage points over the year to 74.2% while the inactivity rate rose 0.5 percentage points to 22.3%.[15]

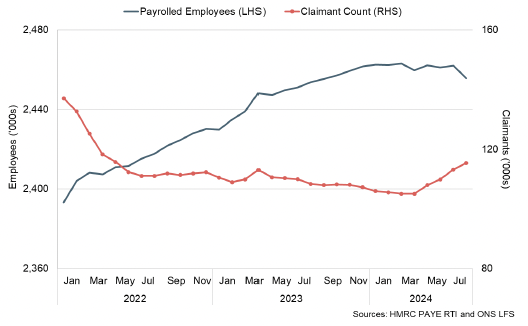

These indicators continue to remain broadly in line with longer run trends though indicate a slight loosening in conditions over the past year. This is consistent with wider labour market data for July which shows the number of payrolled employees in Scotland fell 0.3% since the start of 2024 to 2.46 million though remains 0.1% higher compared to August 2023.

Alongside this, Scotland’s claimant count unemployment rate has increased over the past year from 3.7% in August 2023 to 4% in August 2024 with 115,000 claimants.[16],[17]

The persistence of the labour market inactivity rate in recent years, both while overall labour market conditions have been tight and also as they start to ease, is reflective of a long term labour market challenge to reduce the inactivity rate and support people into the labour market. The following box sets out further insights on showing the potential impacts of increasing economic activity rates in the labour force on the Scottish economy.

Insight on the Potential Impact of Increasing Economic Activity Rates in the Labour Force on the Scottish Economy

Recently, there has been increasing focus on the number of people who are classed as “economically inactive” or those who are not in employment and have not been seeking work.

For example, the Office for Budget Responsibility (OBR), the official independent economic and fiscal forecaster for the UK Government, noted in their latest Fiscal Risks and Sustainability report that a significant rise in health-related economic inactivity in the labour force amongst working-age adults is in their view one of three key risks that have crystalised since 2020 (along with the rise in energy prices and government debt).

In their December 2023 Economic and Fiscal Outlook, the Scottish Fiscal Commission also noted that long-term sickness continues to be a large and persistent reason for economic inactivity in Scotland. Recent analysis by the Scottish Parliament Information Centre (SPICe) has also highlighted that the share of economic inactivity attributed to permanent ill health or disability in both Scotland and the rUK has risen sharply in recent years.

The rate of economic activity is important for the economy. The economic activity rate directly affects the number of people available to work, which consequently directly affects the quantity of goods and services that the economy is able to produce. As such, changes in activity can affect the size and growth rate of the economy and even relatively small changes in the economic activity rate can have a notable impact.

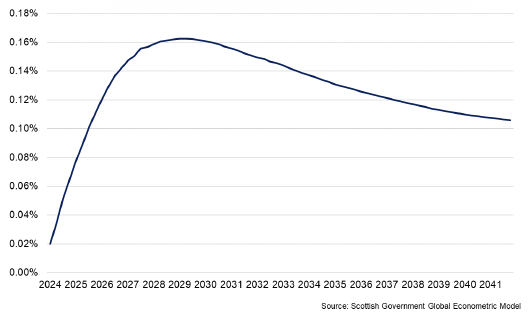

As an example, we have used the Scottish Government’s Global Econometric Model (SGGEM) to perform an illustrative scenario analysis of how a change in economic activity could impact the Scottish economy. The chart below shows the impact of a permanent increase in the economic activity rate of individuals aged 16+ in Scotland by 0.25 percentage points (relative to baseline).

As shown above, even a relatively small increase of 0.25 percentage points in the economic activity rate could boost GDP in the long-term by around 0.1%, or around £180 million a year (in 2024-25 prices).

The Scottish Government has a range of policies across employability, fair work, skills training, and childcare that aim to support individuals to progress towards, into and sustain work. The Scottish Government is committed to investing in employability services to ensure that anyone can access support to fulfil their potential in the labour market. This can help improve lives, reduce poverty and inequality, and provide a long-term boost to the Scottish economy.

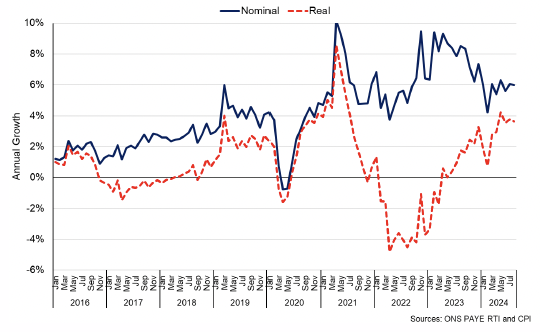

Slightly looser labour market conditions have also been reflected in the pace of earnings growth which have eased from elevated rates in 2023, however remain robust overall.

PAYE median monthly nominal pay grew 6% over the year in August and is down slightly from the average annual growth rate of 8% in 2023. However consumer prices inflation has slowed more quickly than earnings growth, resulting in real earnings growth of 3.6% in real terms in August which remains higher than the average real terms growth rate of 0.6% in 2023.

The strength of real earnings growth has been an important underlying factor in supporting consumption and growth as real disposable household income continues to gradually recover from the impacts of the inflation shock.

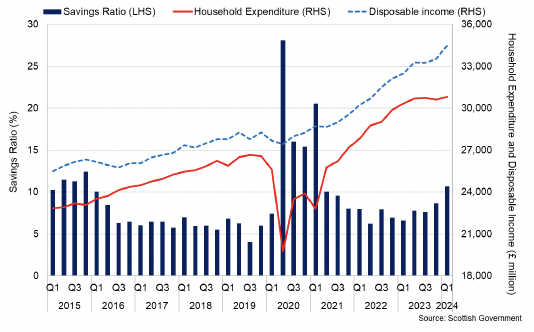

During the pandemic, households on aggregate increased their savings due to the retention of income combined with reduced expenditure. The increase in demand following the pandemic, coupled with high inflation reduced the share of household income available for saving. The savings ratio, a measure of funds that are available for adding into savings, including into pension funds, or paying off debt, peaked at 28.1% in Q2 2020 before declining to 7.3% during 2022.[18]

As inflation has decreased and real terms earnings growth has increased, latest quarterly national accounts estimates indicate that disposable income has grown at a faster rate than household expenditure (four quarter average of 6.1% and 4.1% respectively). As a result, the savings ratio increased to 10.7% in Q1 2024.

The combination of lower and more stable inflation, the recovery in real household disposable income, lower interest rates and stronger consumer sentiment presents an improved landscape for household consumption.

Contact

Email: economic.statistics@gov.scot

There is a problem

Thanks for your feedback