Scottish economic insights: October 2024

Provides further analysis and insights on the economic themes presented in the monthly Scottish economic bulletin.

Part of

Forward Look and Conclusion

The economy has faced a succession of shocks in recent years from the pandemic and cost of living crisis which have had significant direct and indirect impacts on the economy. These shocks, and their subsequent base effects on economic data, have largely worked through the economy and current economic forecasts now indicate a more stable growth outlook than in recent years.

At a global level, the OECD forecast world GDP growth to stabilise at 3.2% over 2024 and 2025.[28] The pattern of growth is expected to differ across key economies with growth in China and the US expected to slow slightly in 2025 from 4.9% to 4.5% and from 2.6% to 1.6% respectively. In contrast Euro Area growth is forecast to strengthen from 0.7% to 1.3% and UK growth is forecast to strengthen from 1.1% to 1.2%.

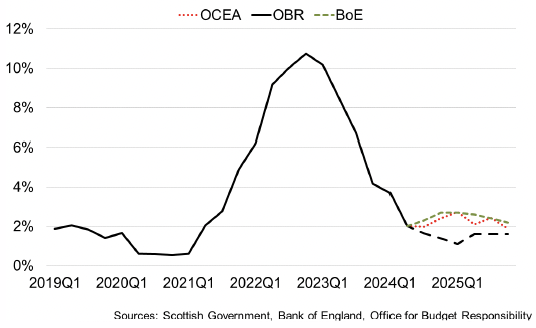

Inflation is also forecast to continue stabilising around national target rates, albeit services price inflation is expected to remain relatively sticky with central banks expected to continue loosening monetary policy.

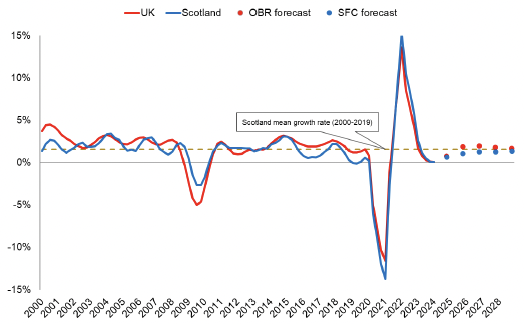

Following growth of 0.1% in 2023, the Scottish economy is forecast by the Scottish Fiscal Commission to strengthen to 0.7% in 2024 and 0.8% in 2025 as consumption increases, supported by the improvements in real earnings growth and expectations that business investment improves due to lower and more stable inflation and the prospect of loosening monetary conditions.[29] More recently the Fraser of Allander Institute forecast growth of 0.9% in 2024 rising to 1.1% in 2025 and 1.2% in 2026.[30]

The outlook for inflation is also significantly more stable than it has been over the past two years with the Bank of England forecasting inflation to rise slightly from its current rate of 2.2% to around 2.5% by the end of the year, before returning to target from 2026.[31] This is broadly in line with other projections in the medium term with base effects still working through in the short term. Overall, this is expected to have a positive impact stabilising demand and expenditure in the economy following a period of volatility.[32]

However risks to the economic outlook remain. The escalation of tensions in the Middle East, mean that global economic risks have increasingly shifted from the focus on supply chains to the risks of further upward pressure on oil prices.

In conclusion, this edition of Scottish Economic Insights has focused on three themes; recent economic conditions and labour market trends, longer term challenges in productivity, investment and competitiveness and the economic outlook. The improvement in economic conditions in 2024 compared to last year is evident across a range of economic indicators. Compared to the second half of 2023, the first half of 2024 has seen economic growth and business activity strengthen, albeit moderately; inflation has returned to near its 2% target, real earnings growth has remained robust and consumer sentiment has strengthened notably.

The improvement in outturn data is positive and underpins the forecasts for stronger growth in 2024 and 2025. Furthermore, the outlook for growth and inflation is notably more stable than experienced since the outbreak of the pandemic in 2020 and the start of the war in Russia and Ukraine in 2022 and presents a potentially more stable basis for business investment growth and consumption which could further strengthen output growth and improve prospects for improving productivity growth over the longer term.

However, despite improving real incomes, consumer sentiment remains fragile, particularly relating to expectations for the year ahead, and reflects a slight increase in downside risks to consumption in the near term. Furthermore business concerns around weakening demand and recruitment challenges present domestic challenges.

These may by exacerbated by modest global growth coupled with ongoing geopolitical tensions which continue to present headwinds to the global economic outlook. Internationally, geopolitical risks such as the attacks on shipping in the Red Sea are presenting challenges to global supply chains leading to increased costs and delivery times. The impacts remain at a business level, and have not notably fed through to the Scottish economy at an aggregate level, however the further escalation of tensions in the Middle East risks creating upward pressure on oil prices which has a broader number of channels through which it could impact on the domestic economy.

Contact

Email: economic.statistics@gov.scot

There is a problem

Thanks for your feedback