Electronic purchasing card: user guide for card holders

User guide for holders of the Scottish Government electronic purchasing card (ePC).

3. Reviewing transactions

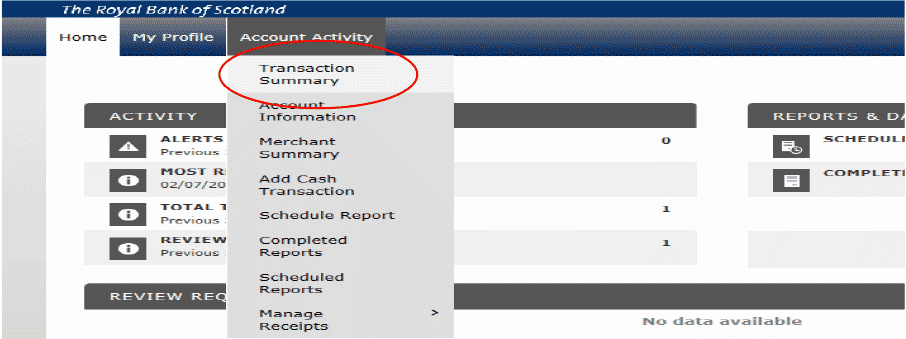

From the home page click on “Account Activity” and from the drop down menu select “Transaction Summary”

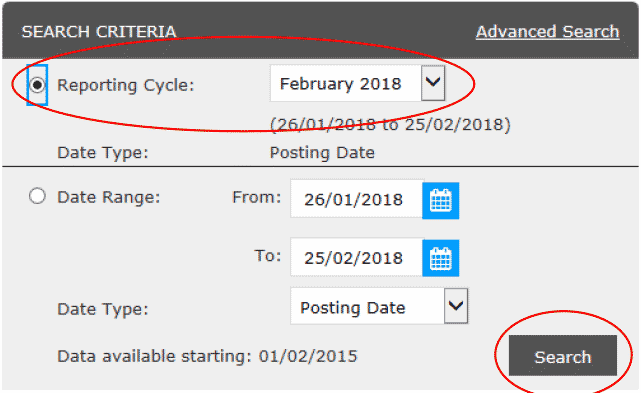

Using the Reporting cycle, select the cycle you want to review and click Search.

Note: the cycles have been created with the correct ePC dates, for example: February 2018 will cover the 26th January to the 25th February.

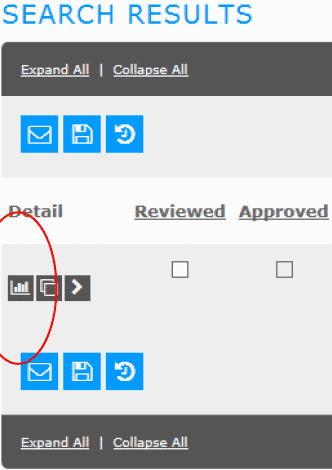

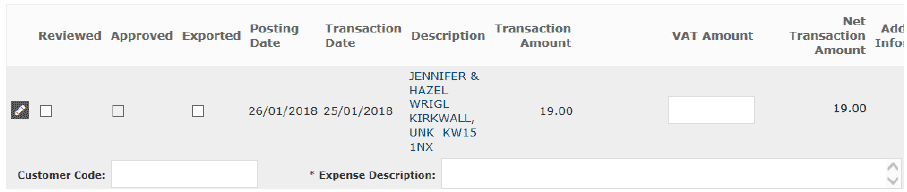

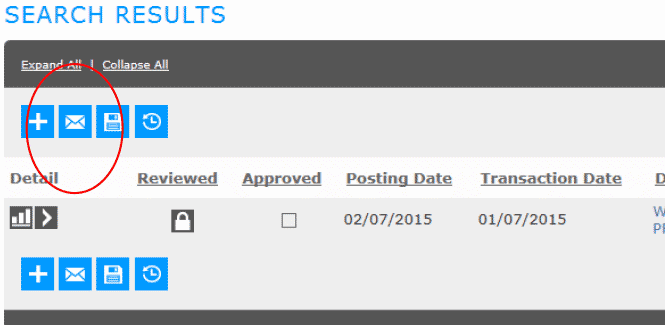

The search results will show all transactions made within the date range selected. Click on Transaction icon (first icon) to begin the process.

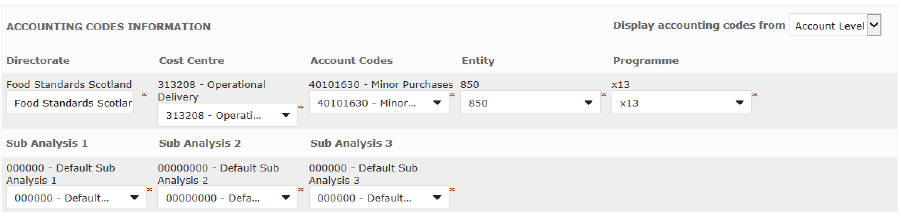

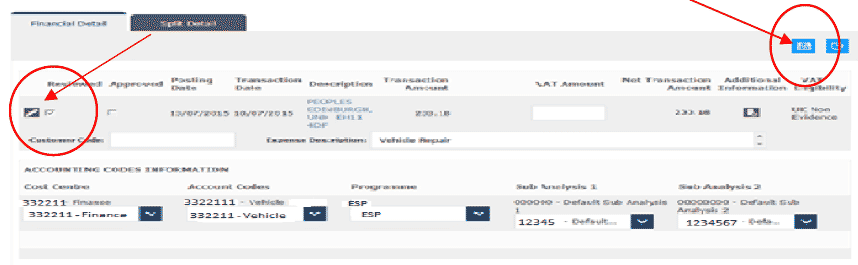

This screen provides all the financial information needed and the card holder must ensure that all the codes are correct:

A. Check that the Accounting Code Information is correct. This is set to your default Cost centre, Account Code, Programme, Entity and Sub Analysis Codes from your application form.

However, you can change this for each transaction by selecting the drop down menu next to each code and selecting the appropriate code.

If there are codes you require access to that are not already available on the appropriate menu then you can email the ePC team who will add them.

B. Enter an Expense Description. This is a mandatory requirement and will help the hierarchy better understand the nature of the purchase and enable the correct agreed description to be shown on the monthly ePC500 report.

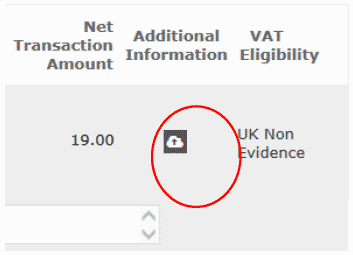

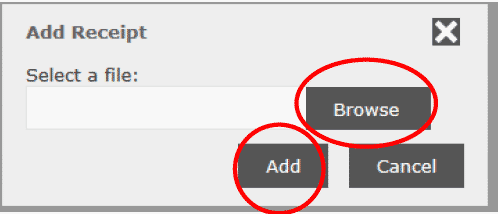

C. You should add a receipt (including pdf documents of up to 4Mb) to the transaction (optional but best practice to do so) by clicking on Additional Information. This is where a copy of the invoice or receipt of the purchase should be saved.

Click on “Browse”“Add” and add the scanned receipt from your files held on your computer and then click

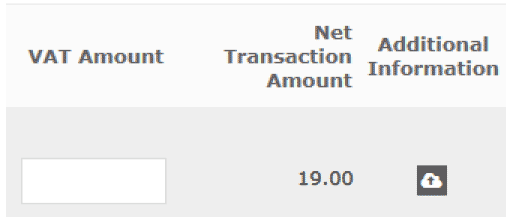

D. Make sure that a VAT receipt is kept when VAT is recoverable. Ensure the Tax details are correct in the Additional Information field and the VAT amount is correct.

Note: VAT will not be reclaimed automatically. Card holders should reclaim VAT where this is recoverable using the VAT 4 form on Saltire. Or use the policy, paragraphs 2.12 for appropriate advice. Alternatively, if you are a partner organisation speak to your finance team.

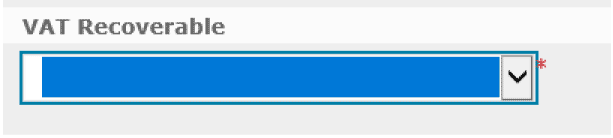

E. Select VAT Recoverable from the drop down list. If VAT is recoverable see above re VAT 4 form. This option is mandatory.

F. Tick the “Reviewed box” and then “Save”

3.1 Alert the card approver

You must now let your approver know that there are transactions to be approved.

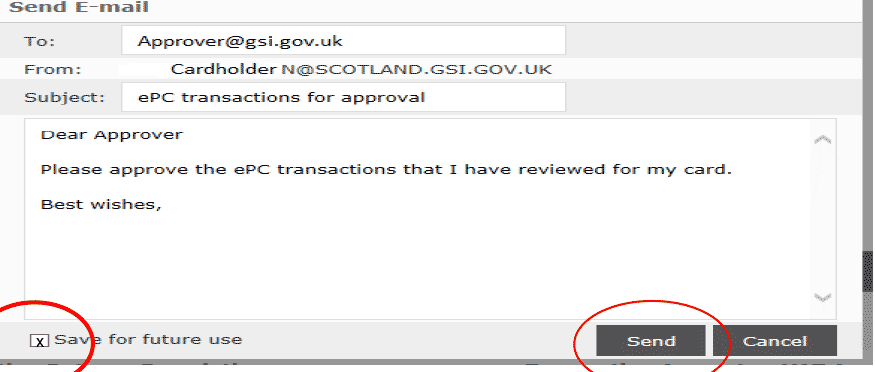

Send an email from SDoL by clicking on the email icon. If this step is taken then the approver will be better informed that actions await their approval and a clearer audit trail exists.

Fill out your approvers email address and a short message that you have transactions to be approved. To make this task easier in further transactions check the box at the bottom of the email.

Click “Send”

Your actions are now complete.

Contact

Email: EPC_mailbox@gov.scot

There is a problem

Thanks for your feedback