Scottish Government Equality and Fairer Scotland Budget Statement 2025 to 2026 Easy Read Version

The Easy-read version of the Equality and Fairer Scotland Budget Statement 2025-26

Things the Budget Statement for 2025 to 2026 tells us

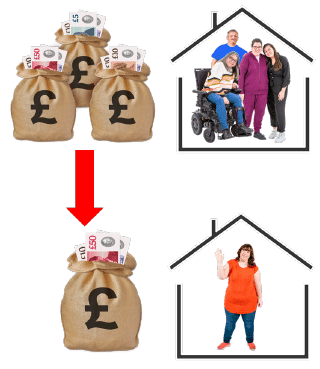

The Scottish Budget this year shares money from households that have more income to other households that have less income.

Income means the amount of money earned by adults living together in the same shared home.

Households with different incomes will be helped by the money spent by the Scottish Government on public services we all use like:

- health

- schools

- transport

- early learning and childcare

Spending on public services is expected to be more important for households with lower incomes.

The Budget Statement also tells us about the different tax rates.

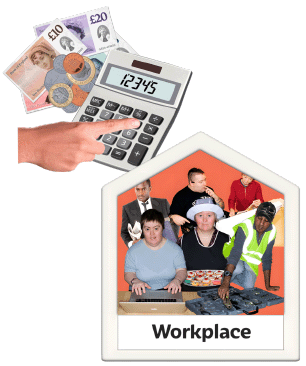

Tax is money we pay to the Scottish Government when we:

- buy some things, like a home

- earn money from working or when we get our state pension

The state pension is money you get from the Government every month when you reach the age of around 66.

The income tax rates you pay depend on how much money you earn.

We pay different rates of income tax on different parts of our income.

Usually the more money you earn the more income tax you will pay.

Some income tax rates are different in Scotland compared to other countries in the UK.

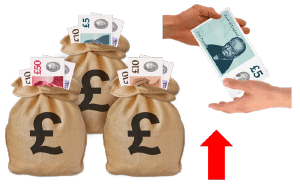

Because of changes made to income tax in the budget:

- households with a low income will pay a little less tax in 2025 to 2026

- households with the very highest income will pay about 1 hundred and 30 pounds more tax over the year

There is a weekly payment called the Scottish Child Payment for households on low income and with children.

Contact

Email: MainstreamingEIHR@gov.scot

There is a problem

Thanks for your feedback