BiFab: intervention analysis

We commissioned Ernst & Young to undertake an evaluation of the BiFab intervention following a recommendation from Audit Scotland that the Scottish Government seek to learn lessons from its experience of recent financial interventions in private companies.

Recommendations

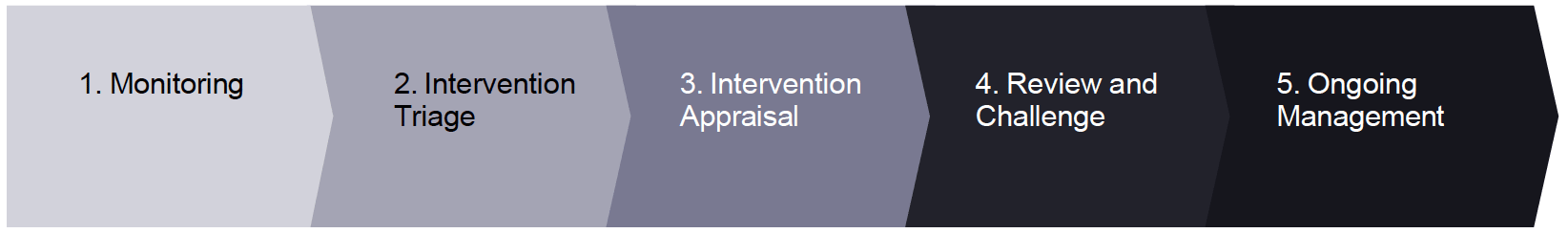

Each of the lessons learned set out on prior pages inform the recommendations noted below. We have organised EY’s recommendations into a framework to facilitate the effective management of interventions from monitoring to management.

Graphic text below:

1. Monitoring

2. Intervention Triage

3. Intervention Appraisal

4. Review and Challenge

5. Ongoing Management

The nature of reactive intervention requests mean civil servants are often under significant pressure to produce time constrained, balanced advice against a backdrop of national interest. A standardised intervention triage & assessment framework should be established to minimise the impact of these factors. We understand the newly formed Strategic Commercial Assets Division (SCAD) has considered some of the items noted below.

1. SG should formalise monitoring of companies of strategic importance in Scotland

1.1 SCAD should identify key sectors in Scotland of strategic importance.

1.2 SCAD should continue to engage with public sector agencies across Scotland to share information and to identify where firms are in financial or operational difficulty.

1.3 SG should engage with overseas agencies such as Scottish Development International to ensure companies of strategic importance with overseas headquarters are captured and monitored.

1.4 Should a company begin to show early signs of distress, in line with its scope, SCAD should identify and engage the required advisor skillsets (e.g. legal, financial, technical) and prepare for potential intervention action.

The actions above will increase SG oversight and reduce the risk of unforeseen intervention requests arising.

2. SG should implement a standardised triage process for intervention requests to quickly establish an initial “go”/”no-go” decision

2.1 Where an intervention request is received, intervention could not be considered further without clear documentation of extenuating circumstances.

2.2 A standardised intervention information request list should be created and provided, placing the onus on the business to provide the required information and support the rationale for intervention. Where the company is unable or unwilling to provide the required information, intervention should not be considered further.

2.3 A checklist should be created to support an initial ‘go’/’no-go’ when appraising intervention decisions, including; “does the business have a viable, long term future in Scotland?’, ‘has the business considered alternative means of support?’, ‘has the business provided the required information to support due diligence?’.

3. A standardised intervention appraisal process should be put in place to ensure consistency. A ‘streamlined’ process should also be documented to allow SG to quickly assess requests in time-pressured situations

3.1 Intervention objectives should be documented in a timely manner, with “SMART” principles, and in a setting that allows input and challenge from suitably experienced civil servants to ensure appropriateness and alignment with SG’s strategic aims. SG may benefit from the development of a bank of standardised objectives, aligned to the strategic vision for consideration when rapid responses are required.

3.2 SG should document critical success factors for the intervention, and review thresholds which document clearly the aims and limits (e.g. maximum financial exposure, maximum shareholding). Progress against these can be regularly reassessed throughout the intervention, for example, if there is a further call for funding.

3.3 Options appraisals including economic appraisal and benefit cost analysis should be performed, with options being appraised against set objectives, critical success factors and review thresholds. This could be included in financial or technical advisors’ scope to reduce the resource impact on SG/SCAD, linking in to the work of SG economists. This could also include wider commercial due diligence to understand the wider market commercials.

3.4 A minimum Benefit Cost Ratio (BCR) benchmark should be agreed, below which intervention should not be pursued. This benchmark should be reflective of the risk of the transaction.

3.5 Economic appraisal and benefit cost analyses should reflect the risk and include downside sensitivities, documenting the impact on intervention value for money, investment recovery and exit strategy.

3.6 SG funding should perform stakeholder mapping to understand other shareholder/stakeholder incentives and ensure all parties’ remain motivated and interests align.

3.7 Where there is insufficient time to undertake economic appraisal prior to the intervention, a ‘streamlined’ assessment should be completed prior to intervention. More detailed analysis should still be performed retrospectively to inform strategy for intervention management and develop maximum review thresholds, i.e. documented limits and positions SG is not prepared to adopt.

3.8 The introduction of SCAD has sought to address much of this, placing additional emphasis on ensuring a consistent approach for economic appraisal, options appraisal and evaluation of interventions. Implementation of a well documented process would further enhance consistency. Further, a ‘streamlined’ process could be documented which includes standard intervention options for consideration when reactive, time-pressured interventions are required.

4. An independent panel should be established to provide challenge and review of proposed interventions

4.1 A panel of experienced civil servants could ensure that the agreed due process had been followed and provide consistent, independent challenge of the case for intervention against a clearly documented framework for investment, for example:

Is there a clear case for intervention and does it align with SG’s wider strategic aims and objectives?

- Has an economic appraisal and benefit cost analysis been performed, including under ‘downside’ scenarios?

- Is there a viable exit strategy and clear route to recovery of SG investment?

- Is the intervention structure (e.g. equity investment, loan funding, provision of a guarantees) appropriate and within review thresholds?

- Is the intervention leveraging investment from equity holders where appropriate?

4.2 The panel could offer insight and challenge from previous interventions.

5. SG should establish a ‘Shareholder’ function with responsibility for managing ongoing interventions

5.1 SCAD is now responsible for ensuring the effective governance and stewardship of assets where SG has a sponsorship role. This goes some way to the establishment of a separate shareholder function within SG.

5.2 Central management and tracking of ongoing interventions by a specifically designed body will give continuity and consistency, ensuring interventions are tracked, evaluated and regularly re-assessed.

5.3 SG should continue to include enhanced reporting requirements as a condition of any intervention, including monthly provision of detailed financial information, performance vs KPIs and trading outlook.

5.4 SG should continue to be an ‘active investor’, where possible obtaining and utilising board representation rights to monitor and support performance. SG should also continue to identify where technical representation is required to ensure management are challenged (e.g. at Board meetings).

5.5 SG should continue to liaise with key industry players to support the company and wider industry.

5.6 SCAD should continue to provide updates to Ministers in relation to SG’s interests.

Future requests for further intervention will be bolstered by the above processes, allowing SG to take informed decisions.

Contact

Email: SCADPMO@gov.scot

There is a problem

Thanks for your feedback