Scottish Housing Market Review Q1 2024

Quarterly bulletin collating a range of previously published statistics on the latest trends in the Scottish housing market.

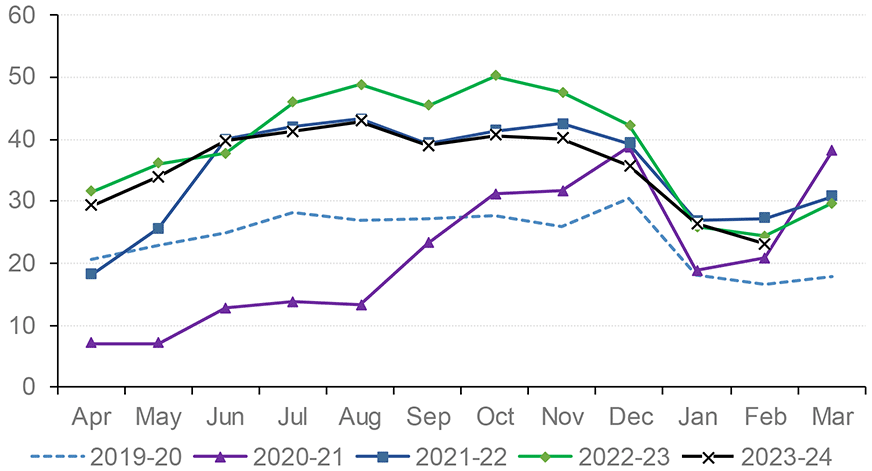

3. Residential Land and Buildings Transaction Tax

Residential Land and Buildings Transaction Tax (LBTT) revenue excluding the Additional Dwelling Supplement (ADS) fell sharply in the early months of 2020-21 due to the impact of Covid restrictions on residential transactions. However, since the latter half of 2020-21, revenues have generally been significantly above their pre-pandemic levels in 2019-20, boosted not only by the sharp rebound in transactions (see Chart 1.1) as Covid restrictions were lifted but also by significant house-price inflation (see Chart 1.2). As a result, revenue for the 2021-22 fiscal year was 43% higher than in 2019-20, while in 2022-23 revenue was 17% higher than in 2021-22 and 68% higher than 2019-20.

However, the recent decline in transactions has led to revenue for the first eleven months of 2023-24 being 10% less than the corresponding months of 2022-23, although it was still 46% higher than the corresponding months of 2019-20.

Source: Revenue Scotland

Contact

Email: jake.forsyth@gov.scot

There is a problem

Thanks for your feedback