Scottish Housing Market Review Q1 2024

Quarterly bulletin collating a range of previously published statistics on the latest trends in the Scottish housing market.

5. Mortgage Approvals and LTVs

5.1. New Mortgage Advances

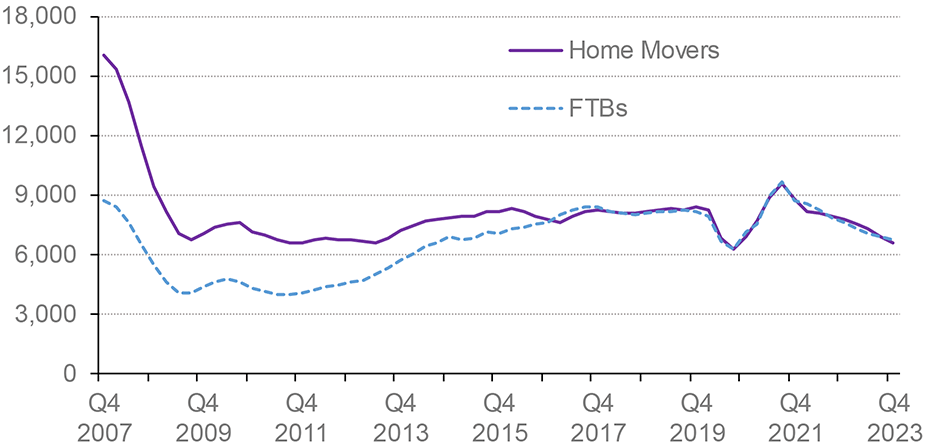

Chart 5.1 plots the number of new mortgages advanced to first-time buyers and home movers in Scotland. There were 6,810 new mortgages advanced to first-time buyers in Scotland in Q4 2023, an annual decrease of 7.7%. Meanwhile, there were 6,660 new mortgages advanced to home movers in Scotland in Q4 2023, an annual decrease of 15.6%. This is the ninth consecutive quarter that the annual change in lending to first-time buyers and to home movers has been negative.

Comparing 2023 as a whole to 2022, new mortgage advances to first-time buyers decreased by 11.3%, whilst for home movers there was a decrease of 15.0%. (Source: UK Finance).

These trends are likely to reflect the impact of increase in mortgage rates (see Section 6) on activity levels in the housing market, which had previously rebounded strongly after the release of Covid-19 pandemic restrictions.

Source: UK Finance

5.2. Mortgage Approvals

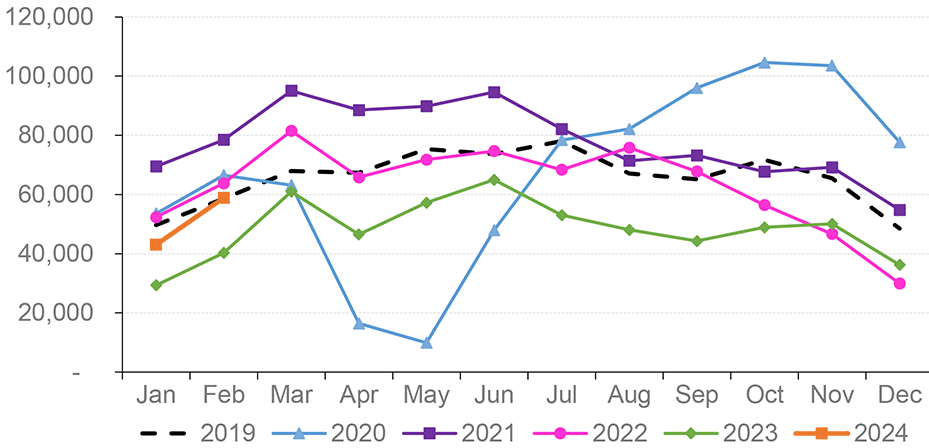

Chart 5.2 plots the monthly number of mortgage approvals across the UK for house purchase by individuals. Mortgage approvals for house purchase are the firm offers of lenders to advance credit fully secured on dwellings by a first-charge mortgage. This data is a leading indicator of mortgage sales as it reflects activity early in the buying process.

Mortgage approvals across the UK rebounded strongly in the latter half of 2020 after the easing of Covid-19 restrictions, before stabilising around 2019 (pre-covid) levels in the second half of 2021 and much of 2022 (see Chart 5.2). Subsequently, beginning in the last quarter of 2022 and continuing into 2023, approvals began to fall significantly below pre-covid levels. However, in the latest 3-month period (to February 2024), approvals have risen by 39% relative to the corresponding period a year earlier, although this remains 18% below the level recorded in the 3 months to February 2020, immediately before the pandemic started (Source: Bank of England).

Source: Bank of England

5.3. Loan-to-Value (LTV) Ratios

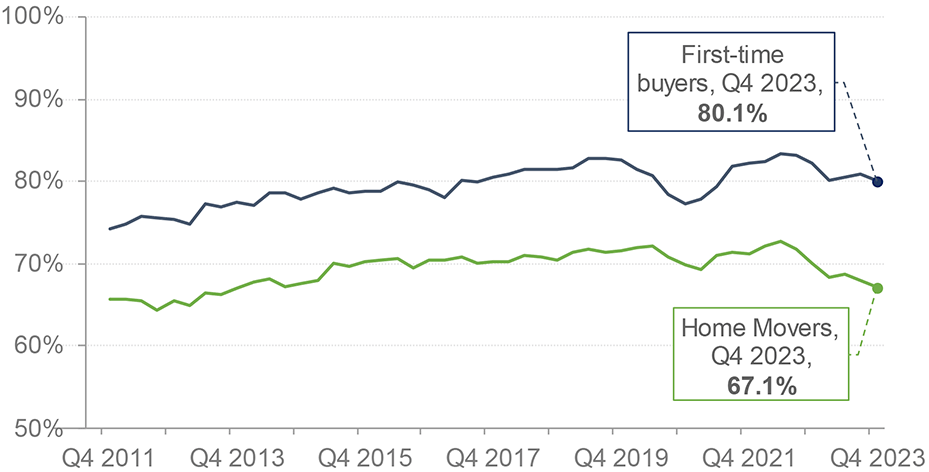

In Q4 2023, the mean LTV ratio on new mortgages advanced to first-time buyers in Scotland stood at 80.1%, down by 2.1 percentage points over a one-year period. Meanwhile, the mean LTV ratio for home movers in Scotland stood at 67.1% in Q4 2023, down 3.0 percentage points over a one-year period. This is shown in Chart 5.3. (Source: UK Finance).

Source: UK Finance

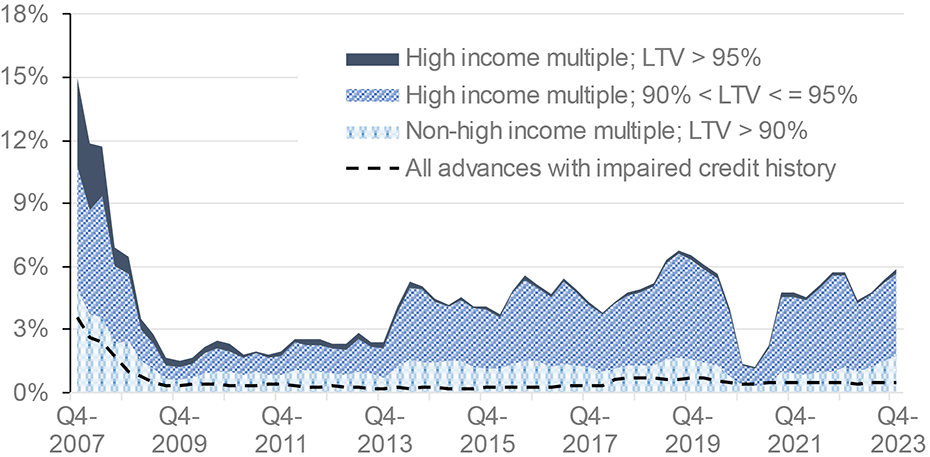

Chart 5.4 shows that while there was a reduction in new regulated residential lending at high LTV ratios across the UK during the onset of the Covid-19 pandemic, there was a strong rebound once covid restrictions were lifted. While the recovery has stalled due to the impact of higher mortgage rates, in Q4 2023 there was an increase in the share of all advances with an LTV greater than 90% (0.5% points compared to the previous quarter) as well as in the share of all loans with both an LTV greater than 90% and a high income multiple (0.3% points). On an annual basis, the share of all loans with an LTV greater than 90% increased by 0.1% points and the share of all loans with both an LTV greater than 90% and a high income multiple decreased by 0.3% points.

Source: FCA. Higher-risk lending is classified by the FCA as an LTV over 90% or an income multiple greater than or equal to 3.5 for single income purchasers / 2.75 for joint income purchasers.

These trends are in part the result of fluctuations in the availability of mortgage products, particularly those with higher LTVs. The market volatility following the UK Government Plan for Growth/mini-budget on 23 September 2022 resulted in a sharp fall in the total number of residential mortgage products to 2,258 on 1 October 2022. Since then, and aside from a temporary fall following higher-than-expected inflation figures released in mid-2023, the total number of products has been on an upward trend, reaching 6,004 on 1 March 2024. This represents the highest level recorded since March 2008, and is also far higher than a year ago (4,372). All LTV tiers had an increase in the number of mortgage products over the month to 1 March 2024. (Source: Moneyfacts UK Mortgage Trends Treasury Reports)

Mortgage shelf life is the length of time between the launch of a product and its repricing or withdrawal from the market, and average shelf life is an indicator of volatility in the mortgage market. Despite the average mortgage product shelf life increasing to 28 days on 1 February 2024, which was the highest since early 2023, the shelf life dropped significantly over the month to 1 March 2024, to 15 days (Source: Moneyfacts UK Mortgage Trends Treasury Reports).

The total number of buy-to-let (BTL) mortgage products also fell sharply after the UK Government mini-budget, decreasing by 52% from 2,075 on 1 September 2022 to 988 on 1 October 2022. Since then, in general, there has been an increase in the number of BTL products. The total number of BTL products on 1 March 2024 was 2,844, which is 444 (18.5%) higher than a year earlier (Source: Moneyfacts UK Mortgage Trends Treasury Reports).

Contact

Email: jake.forsyth@gov.scot

There is a problem

Thanks for your feedback