Scottish Housing Market Review: Q2 2023

Quarterly bulletin collating a range of statistics on the Scottish housing market, such as house prices and transactions, rental trends, cost and availability of finance, etc.

11. Lending to House Builders, Insolvencies & Construction Prices

Lending to House Builders

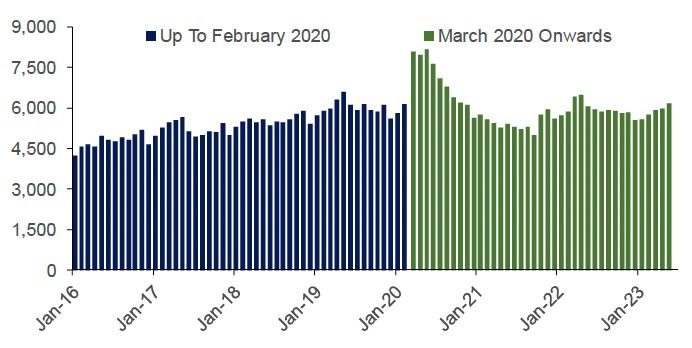

The value of loans outstanding to UK firms involved in the construction of domestic dwellings rose by £1.9bn from February to March 2020, an increase of nearly one-third (31%), as shown in Chart 11.1. The sudden increase likely reflected the need for credit to fund short-term liabilities owing to Covid-19 restrictions on construction activities and home moves, which had adversely affected firms' income. In addition, firms may have drawn down funds as a precaution, given the economic uncertainty.

From May 2020 to September 2021 the value of loans steadily decreased, falling below pre-covid levels. However, the value of loans seems to have returned towards pre-pandemic levels, at least in nominal terms, with the value of outstanding loans for 2022 so far 1.1% below the same period in 2019. However, with the sharp increase in general inflation as well as in construction output prices (compare Chart 11.3), this represents a significant real-terms reduction in the total amount of lending.

Source: Bank of England

Insolvencies

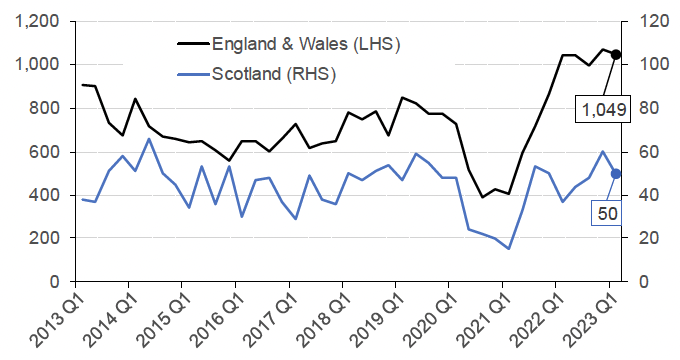

Chart 11.2 shows that during the pandemic insolvencies of construction companies registered in Scotland fell from 48 in Q1 2020 to 15 in Q1 2021, with a similar proportional fall evident for England and Wales, likely due to the business support in place. However, with this support unwinding, new build construction output prices increasing (as shown in Chart 11.3) and cost of living pressures potentially impacting demand, insolvencies for construction companies registered in Scotland have been increasing since Q2 2021. Latest data indicates that in the year to Q1 2023, there were 202 insolvencies in the construction sector in Scotland. While this represents an increase of 7% compared to the previous year, it is 4% below the number of insolvencies in the year to Q1 2020, immediately prior to the pandemic. This suggests that in Scotland, in contrast to the position in England and Wales, there has not yet been a spike insolvencies above the pre-pandemic level, which may have been expected due to those insolvencies which were merely postponed rather than avoided during the covid period due to the business support in place at that time.

Source: The Insolvency Service

Construction Prices

Data from the ONS on the annual change in the construction output index price of new build housing (public and private), which covers the range of costs associated with building new public and private housing, shows an annual increase of 10.4% to April 2023 (Chart 11.3).

Data from BEIS (also illustrated in Chart 11.3) shows that the annual growth rate in the cost of construction materials used in new house building, which had reached as high as 24.0% in June 2022, has been moderating more recently, to stand at 7.6% in April 2023. The annual change has been driven in particular by screws etc. (+33.7%), insulating material (+28.4%) and ready-mixed concrete (+24.5%).

Source: ONS and BEIS

Data from the Business Insights and Conditions Survey (BICS) indicates that fewer businesses in the construction sector in Scotland have increased their prices in recent months, which could indicate easing cost pressures. 25.4% of the construction businesses in the survey responded that they had increased prices in the month to May 2023, as compared with 35.3% in the month to April 2023, and 42.7% in the month to March 2023.

Contact

Email: jake.forsyth@gov.scot

There is a problem

Thanks for your feedback