Scottish Housing Market Review: Q2 2023

Quarterly bulletin collating a range of statistics on the Scottish housing market, such as house prices and transactions, rental trends, cost and availability of finance, etc.

5. Mortgage Approvals & LTVs

New Mortgage Advances

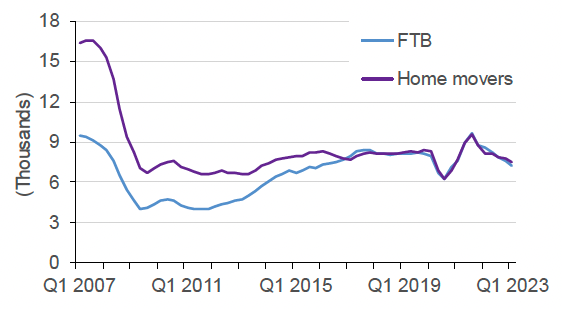

Chart 5.1 plots the number of new mortgages advanced to first-time buyers and home movers in Scotland. There were 5,520 new mortgages advanced to first-time buyers in Scotland in Q1 2023, an annual decrease of 19.7% (-1,350). Meanwhile, there were 5,570 new mortgages advanced to home movers in Scotland in Q1 2023, an annual decrease of 15.5% (-1,020). Comparing the 4-quarter period to Q1 2023 against the previous 4 quarters, new mortgage advances to first-time buyers decreased by 14.9% whilst for home movers they decreased by 7.4%. (Source: UK Finance). Comparing to the 4 quarters to Q1 2020, immediately before the pandemic, first-time buyer new mortgages (-8.7%) and home mover new mortgages (-8.9%) were down by similar amounts.

These trends are likely to reflect the impact of increase in mortgage rates (see Section 6) on activity levels in the housing market, which had previously rebounded strongly after the release of Covid-19 pandemic restrictions.

Source: UK Finance

Mortgage Approvals

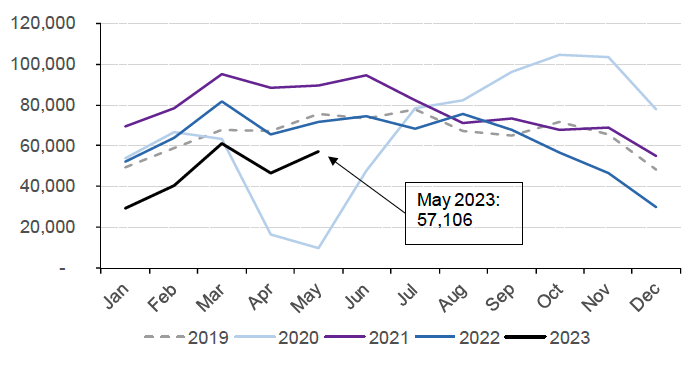

Chart 5.2 plots the monthly number of mortgage approvals across the UK for house purchase by individuals (Source: BoE). Mortgage approvals for house purchase are the firm offers of lenders to advance credit fully secured on dwellings by a first-charge mortgage. This data is a leading indicator of mortgage sales as it reflects activity early in the buying process.

Mortgage approvals across the UK rebounded strongly following the lockdown in the second half of 2020, with mortgage approvals increasing from 9,922 in May 2020 to 104,598 in October 2020 (see Chart 5.2). Mortgage approvals returned to more normal levels up until September 2022, but thereafter there has been a significant fall in approvals: over the period October 2022 to May 2023, approvals have on average been around a quarter (27%) lower than they were in the corresponding months of 2019, prior to the pandemic.

Source: Bank of England

Loan-to-Value (LTV) Ratios

In Q1 2023, the mean LTV ratio on new mortgages advanced to first-time buyers in Scotland stood at 80.1%, down by 2.3 percentage points over a one-year period. Meanwhile, the mean LTV ratio for home movers in Scotland stood at 68.4% in Q1 2023, down 3.8 percentage points over a one-year period. This is shown in Chart 5.3. (Source: UK Finance).

Source: UK Finance

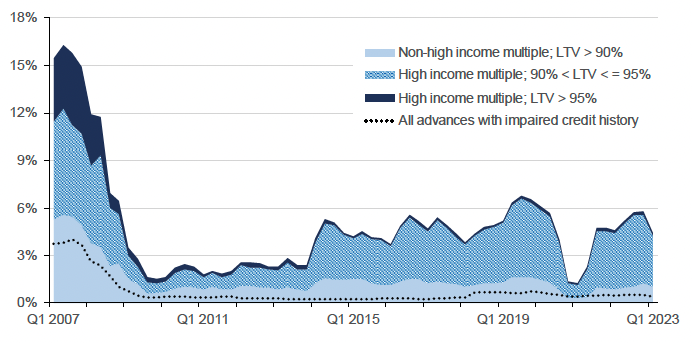

Chart 5.4 shows that while there was a reduction in new regulated residential lending at high LTV ratios across the UK which coincided with the Covid-19 pandemic, there was a strong rebound once Covid restrictions were lifted. However, in Q1 2023 there was a dip in higher-risk lending. The share of all advances with an LTV greater than 90% has fallen by 1.4 percentage points from Q4 2022 to stand at 4.4%, and within this the share of all loans with an LTV greater than 90% and a high income multiple has fallen by 1.2 percentage points to stand at 3.4%.

* Higher risk lending is classified by the FCA as an LTV over 90% and an income multiple greater than or equal to 3.5 for single income purchasers, or greater than or equal to 2.75 for joint income purchaser/s. (Source: FCA)

The trends set above have been have been partly the result of fluctuations in the number of high LTV mortgage products. Following a sharp fall due to the impact of the Covid-19 pandemic, there was a strong recovery in high LTV products offered by lenders, with the number of 95% LTV mortgages products increasing from 8 on 1 December 2020 to over 300 in the first 8 months of 2022. However, after the UKG Plan for Growth/mini-budget on 23 September 2022, the number of 95% LTV products dropped to 132 on 1 October, before recovering somewhat to 187 on 1 May 2023. (Source: Moneyfacts Mortgage Treasury Report).

After a smaller-than-expected decline in the annual rate of CPI inflation in April 2023 (published in May) led to a further 25 basis point rise in the Bank Rate at the May Monetary Policy Committee meeting, the total number of mortgage products available fell from 5,264 on 1 May to 4,967 (-5.6%) on 1 June 2023, the largest monthly decline since the fall-out from the mini-Budget in September 2022. This fall was experienced across most LTV levels; in contrast, the 95% category recorded a further increase, to stand at 229 on 1 June 2023, although this remained substantially below the 347 products available on 1 June 2022.

Buy-to-let mortgage products similarly fell across most LTV categories over the month of May, with the total number of mortgage products on 1 June 2023 (2,330) down by 385 (14%) relative to 1 May, although this remained higher than the 2,246 products available in February 2023.

The publication in June of another higher-than-expected CPI figure for May 2023, which was followed by a 50 basis point rise in the Bank Rate, has caused further volatility in the mortgage market, with lenders withdrawing some products, potentially in order to reprice them.

Contact

Email: jake.forsyth@gov.scot

There is a problem

Thanks for your feedback