Scottish Housing Market Review: Q2 2023

Quarterly bulletin collating a range of statistics on the Scottish housing market, such as house prices and transactions, rental trends, cost and availability of finance, etc.

7. Mortgage Affordability

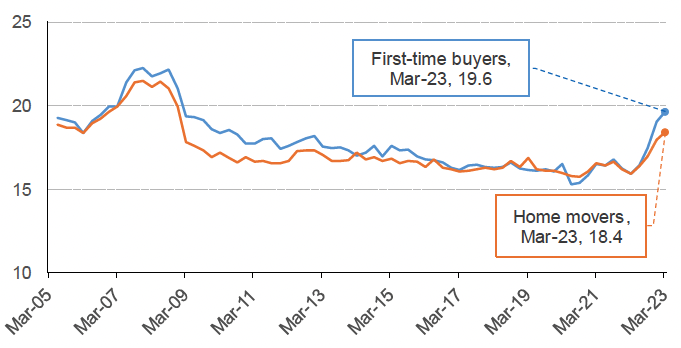

The impact of the increase in interest rates can be seen in measures of mortgage affordability. As illustrated by Chart 7.1, over the year to March 2023, the average share of income which is taken up by mortgage payments for new loans for home purchase has increased by 2.5% points for home movers to stand at 18.4%, and by a larger 3.4% points for first-time buyers to stand at 19.6%.

Source: UK Finance

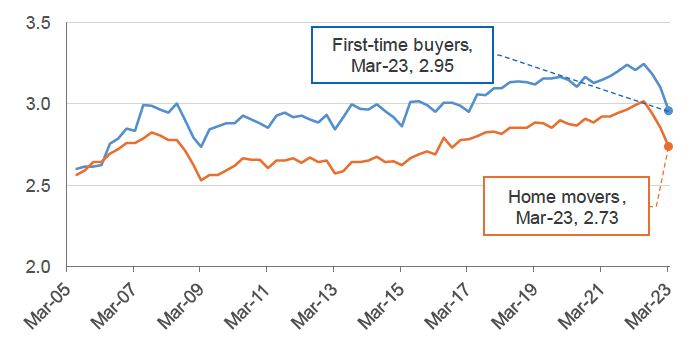

The trends shown in Chart 7.1 are mirrored in Chart 7.2 which shows that over the year to March 2023, the average house-price-to-income ratio has decreased by 0.26 for home movers, to stand at 2.73, and by a similar amount (0.25) for first-time buyers, to stand at 2.95.

Contact

Email: jake.forsyth@gov.scot

There is a problem

Thanks for your feedback