Scottish Housing Market Review Q2 2024

Quarterly bulletin collating a range of previously published statistics on the latest trends in the Scottish housing market.

6. Mortgage Interest Rates

In March 2020, the Bank Rate was cut by a total of 65 basis points to 0.1% as a result of the Covid-19 pandemic. In response to the rise in inflation, the Bank of England increased the Bank Rate at fourteen consecutive Monetary Policy Committee meetings beginning in December 2021, taking Bank Rate to 5.25%, its highest level since 2008. However, the Monetary Policy Committee (MPC) has kept Bank Rate unchanged since August 2023.

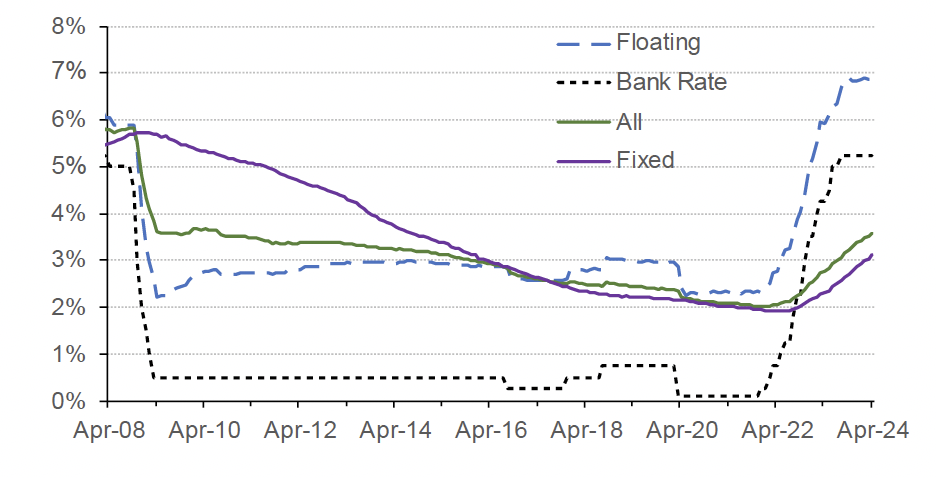

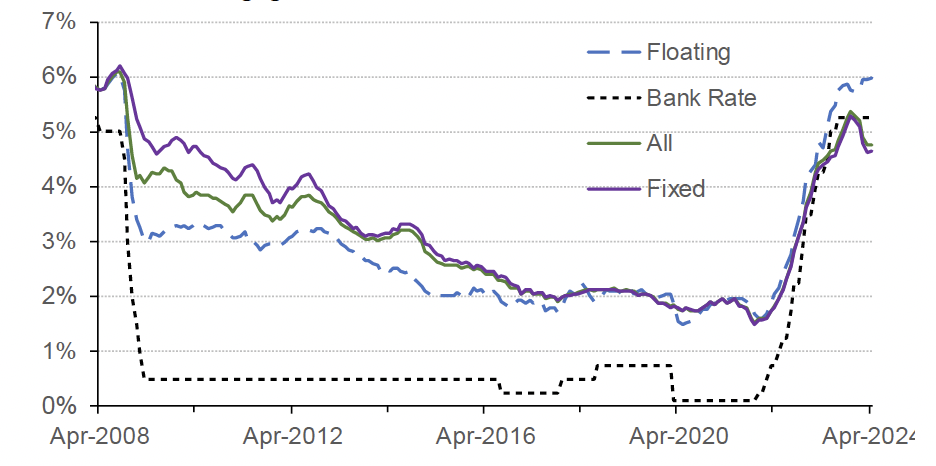

Chart 6.1 and Chart 6.2 show data on the effective (or average) interest rates on outstanding mortgage balances and new mortgage advances. (Source: Bank of England). The increases in mortgage rates have been below the cumulative 515 basis point increase in the Bank Rate since the most recent tightening cycle began in December 2021. The effective floating rate on outstanding mortgages has increased by 456 basis points to 6.86% and the effective floating rate on new advances by 437 basis points to 5.97% by April 2024. The effective fixed rate on new advances has increased by 307 basis points to 4.65%, while the effective fixed rate on outstanding mortgages has increased by 118 basis to 3.12% – this is due to the most common fixes being two and five years, which means that many fixed-rate mortgages have not yet reached their end of term since Bank rate has peaked; also, some would have reached their end of term and been refinanced at fixed rates when rates had not yet increased much. The effective rate on all outstanding balances (3.58% in April 2024) is closer to the effective rate on fixed-rate than floating-rate mortgages because of the large share of mortgages on fixed rates (see Chart 6.4).

Effective monthly interest rates on mortgage lending to households: UK (Data as at month-end, to April 2024)

Source: Bank of England

More recent data shows that despite the downward trend in consumer price inflation (which reached the target rate of 2% per annum in May 2024) and the levelling off of Bank Rate, the average 2-year and 5-year fixed rate mortgages have both edged up for 5 consecutive months to July 2024. On 1 July 2024 the average 2-year fixed rate was 5.95% and 5-year fixed rate was 5.53%, up by a cumulative 39 and 35 basis points respectively since 1 February 2024 (Source: Moneyfacts[1]). The fact that the five-year rate is lower than the two-year rate reflects market expectations that the interest rates will moderate in the future.

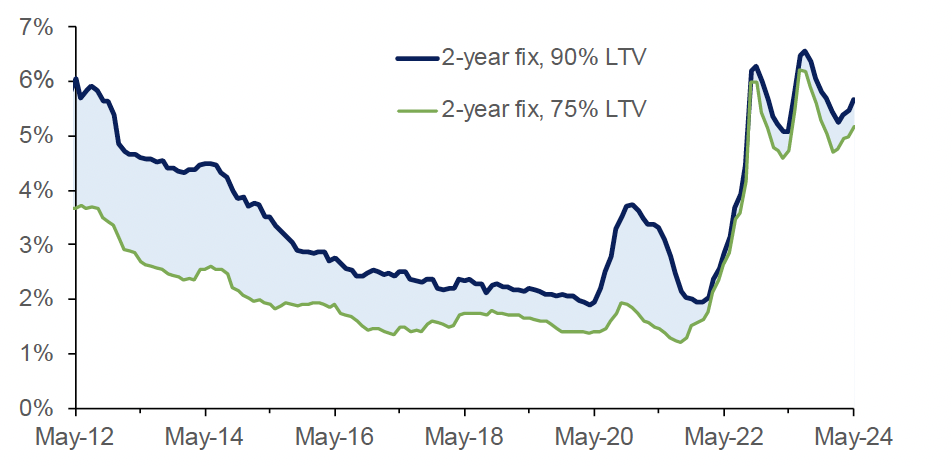

As shown in Chart 6.3, the spread between the average advertised rate on 2-year fixed-rate 90% LTV and 75% LTV mortgages was elevated during the Covid pandemic, peaking in December 2020 and then again in April 2021 at 189 basis points. Since then, the spread has been small, standing at just 52 basis points in May 2024, significantly below the average levels that prevailed prior to the pandemic (Source: Bank of England).

Source: Bank of England

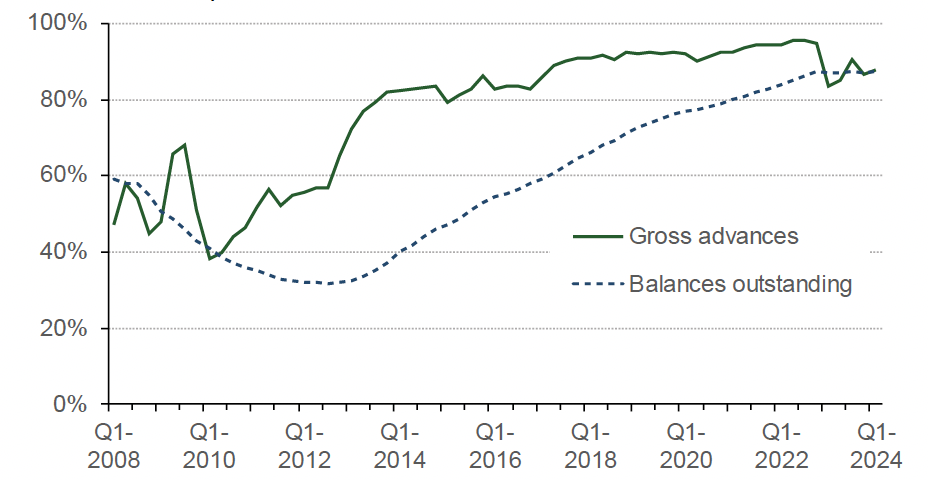

Chart 6.4 shows that the vast majority of regulated[2] mortgages are on fixed rates. However, following a period of sustained increase, there was a sharp drop in the share of new mortgages on fixed rates in Q1 2023, to 83.1% from 94.5% the previous quarter. It is possible that the spike in advertised mortgage rates towards the end of 2022 following the UK Government mini-budget in September 2022 led to an increased share of customers choosing a variable-rate mortgage in the hope that mortgage rates would fall once the mortgage-market volatility subsided.

More recently, there has been a small increase over the quarter in the share of new lending at fixed rates, to 88% in Q1 2024 (83% in Q1 2023). The share of outstanding regulated balances on fixed rates stood at 87% in Q1 2024, while the corresponding figures for non-regulated[3] mortgages was 86% for gross lending and 79% for outstanding balances (Source: FCA).

Source: FCA

Contact

Email: Jake.Forsyth@gov.scot

There is a problem

Thanks for your feedback