Scottish Housing Market Review Q2 2024

Quarterly bulletin collating a range of previously published statistics on the latest trends in the Scottish housing market.

7. Mortgage Affordability

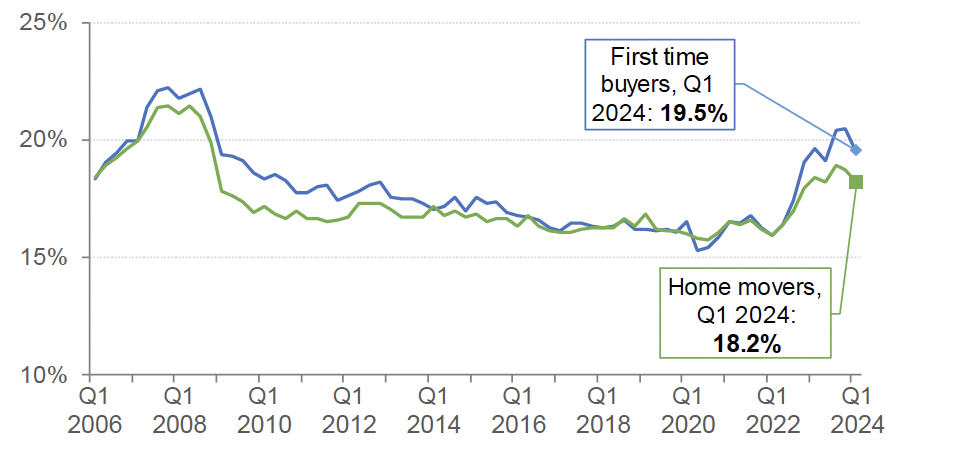

The impact of the increase in interest rates is reflected in measures of mortgage affordability. As illustrated by Chart 7.1, the share of borrower income taken up by principal and interest payments for new mortgages had reached a low in 2020 due to the fall in interest rates in response to the Covid pandemic. However, since then there has been a significant increase in mortgage payments as a share of income due to interest rate rises. From a low of 15.7% in Q3 2020, for home movers the share has increased to 18.2% in Q1 2024, while for first-time buyers the share has increased from a low of 15.3% in Q2 2020 to 19.5% in Q1 2024. However, over the latest quarter, the share of income taken up by mortgage payments decreased for both first-time buyers and home movers, by 1.0% points and 0.5% points respectively.

Source: UK Finance

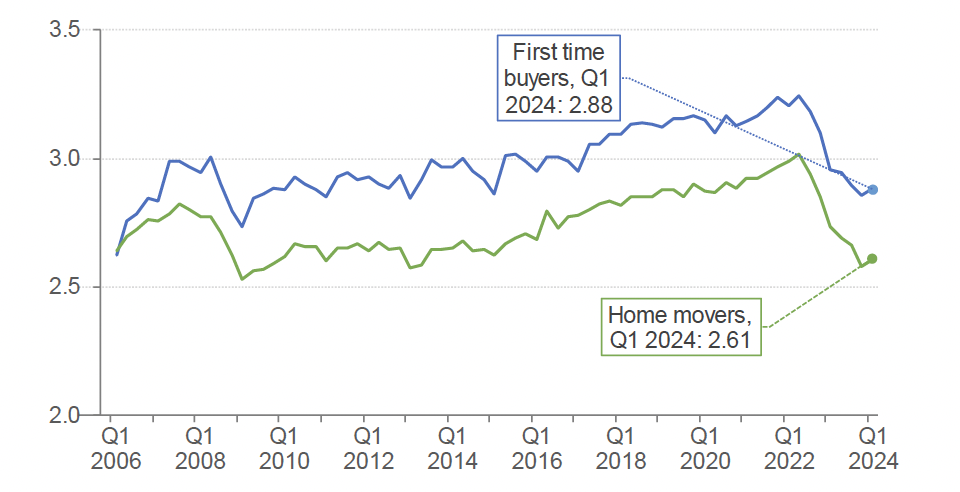

The same pattern (although in reverse) is illustrated in Chart 7.2 which shows that the average house-price-to-income ratio, which had fallen due to the impact of higher interest rates, ticked up in Q1 2024, to 2.6 for home movers and 2.9 for first-time buyers, although they remained lower than their historical average between Q2 2005 and Q1 2024 (2.7 and 3.0 respectively).

Source: UK Finance

Contact

Email: Jake.Forsyth@gov.scot

There is a problem

Thanks for your feedback