Scottish Housing Market Review Q3 2023

Quarterly bulletin collating a range of previously published statistics on the latest trends in the Scottish housing market.

11. Lending to House Builders, Insolvencies & Construction Prices

11.1. Lending to House Builders

The value of loans outstanding to UK firms involved in the construction of domestic dwellings rose by £1.9bn from February to March 2020, an increase of nearly one-third (31%), as shown in Chart 11.1. The sudden increase likely reflected the need for credit to fund short-term liabilities owing to covid restrictions on construction activities and home moves, which had adversely affected firms' income. In addition, firms may have drawn down funds as a precaution, given the economic uncertainty.

From May 2020 to September 2021 the value of loans steadily decreased, falling below pre-covid levels; however, it then returned towards pre-pandemic levels, at least in nominal terms, with the value of outstanding loans for the first eight months of 2023 2.5% below the same period in 2019. But with the sharp increase in general inflation as well as in construction output prices (compare Chart 11.3), this represents a significant real-terms reduction in lending.

Source: Bank of England

11.2. Insolvencies

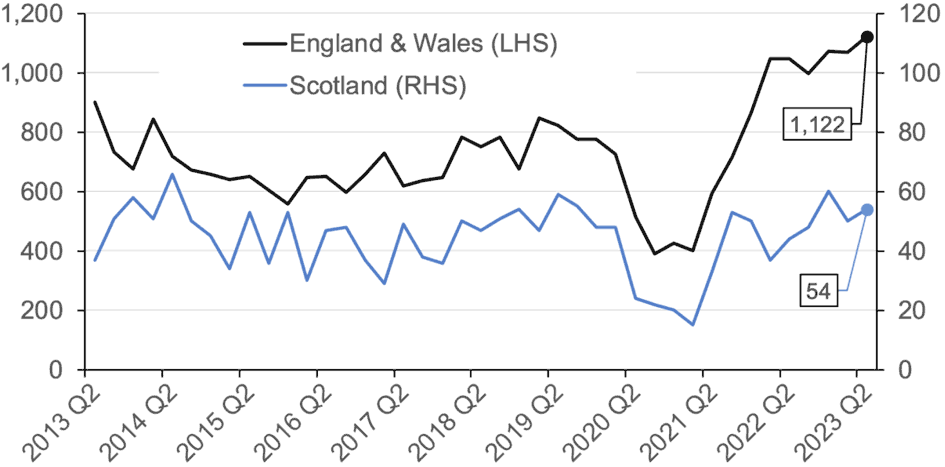

Chart 11.2 shows that during the pandemic insolvencies of construction companies registered in Scotland fell from 48 in Q1 2020 to 15 in Q1 2021, with a similar proportional fall evident for England and Wales, likely due to the business support in place. However, with this support unwinding, new-build construction-output prices increasing (as shown in Chart 11.3) and cost-of living pressures potentially impacting demand, insolvencies for construction companies registered in Scotland have been increasing since Q2 2021. Latest data indicates that in 2022-23, there were 212 insolvencies in the construction sector in Scotland. While this represents an increase of 15% compared to the previous year, it is similar to the number of insolvencies in 2019-20, immediately prior to the pandemic. It might have been expected that there would be a spike in insolvencies above the pre-pandemic level, due to those insolvencies which were merely postponed rather than avoided during the covid period as a result of the business support in place at that time; indeed, this seems to be the case in England and Wales, were there were 16,571 insolvencies in 2022-23, 32% higher than the 12,574 recorded in 2019-20 immediately prior to the pandemic.

Source: The Insolvency Service

11.3. Output and Input Prices for New Housing

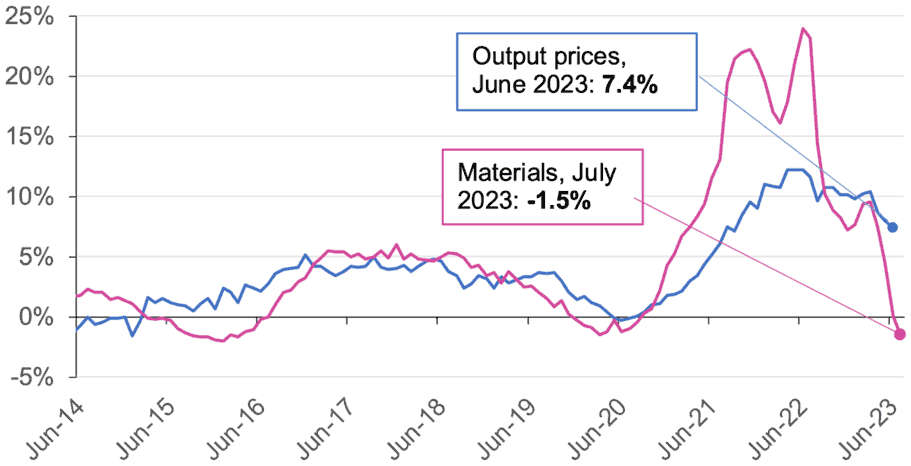

ONS construction-output price data shows that the index for new housing, which covers a range of costs associated with building new public and private housing, increased by an annual 7.4% in June 2023 (Chart 11.3).

Data from the UK Government (also illustrated in Chart 11.3) shows that the annual growth rate in the cost of construction materials used in new house building, which had reached as high as 24.0% in June 2022, and thus contributed significantly to output-price inflation for new housing, has fallen sharply, moving into negative territory (-1.5%) in July 2023. There is significant variation around this average with the highest price increases recorded for screws (+26.6%), doors and windows (metal) (+22.7%) and ready-mixed concrete (+20.5%), and the largest decreases recorded for fabricated structural steel (-28.6%), concrete reinforcing bars (-27.2%) and imported sawn or planed wood (-23.5%).

Source: ONS and UK Government

Data from the ONS Business Insights and Conditions Survey (BICS) which has been weighted for Scotland similarly suggests that prices of goods and services which are bought by businesses in the construction sector in Scotland are stabilising: the majority (60.5%) of construction businesses that responded to the survey said that prices had remained unchanged in July 2023 relative to the previous month, while 27.2% reported that prices had increased. This compares to March 2022, when the majority of business (70.0%) reported that prices had increased from the previous month, while 19.1% reported that they had stayed the same.

There is less evidence from BICS that labour costs have stabilised: while the share of construction business reporting that business staffing costs have increased over the last three months has fallen from 60.6% in Wave 55 (survey live from 19 April to 1 May 2022) to 50.9% in Wave 86 (26 June to 9 July 2023), this is still higher than the share reporting that costs have stayed the same, although this has increased from 32.4% in Wave 55 to 41.1% in Wave 86.

Contact

Email: Bruce.Teubes@gov.scot

There is a problem

Thanks for your feedback