Scottish Housing Market Review Q3 2023

Quarterly bulletin collating a range of previously published statistics on the latest trends in the Scottish housing market.

7. Mortgage Affordability

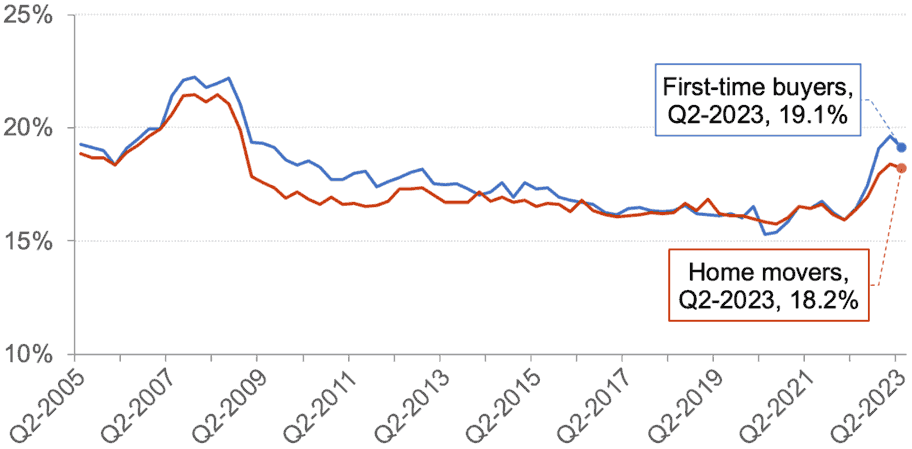

The impact of the increase in interest rates can be seen in measures of mortgage affordability. As illustrated by Chart 7.1, the share of borrower income taken up by principial and interest payments for new mortgages had reached a low in 2020 due to the fall in interest rates in response to the Covid pandemic. However, since then there has been a significant increase in mortgage payments as a share of income due to interest rate rises. From a low of 15.7% in Q3 2020, for home movers the share has increased by 2.4% points to 18.2% in Q2 2023, while for first-time buyers the share has increased from a low of 15.3% in Q2 2020 to 19.1% in Q2 2023, an increase of 3.8% points.

Source: UK Finance

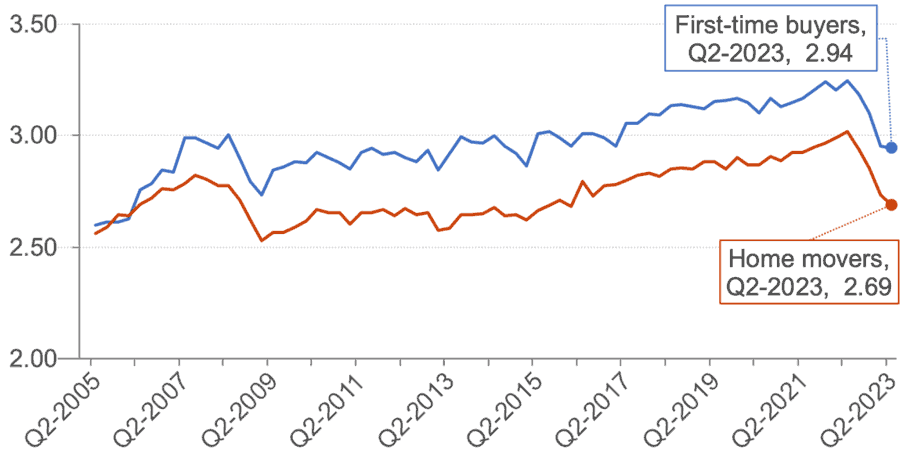

The trends shown in Chart 7.1 are mirrored in Chart 7.2 which shows that the average house-price-to-income ratio has decreased to 2.69 for home movers in Q2 2023, its lowest level since Q1 2016, while for first-time buyers it has decreased to 2.94, its lowest level since Q1 2015.

Source: UK Finance

Contact

Email: Bruce.Teubes@gov.scot

There is a problem

Thanks for your feedback