Scottish Housing Market Review Q3 2024

Quarterly bulletin collating a range of previously published statistics on the latest trends in the Scottish housing market.

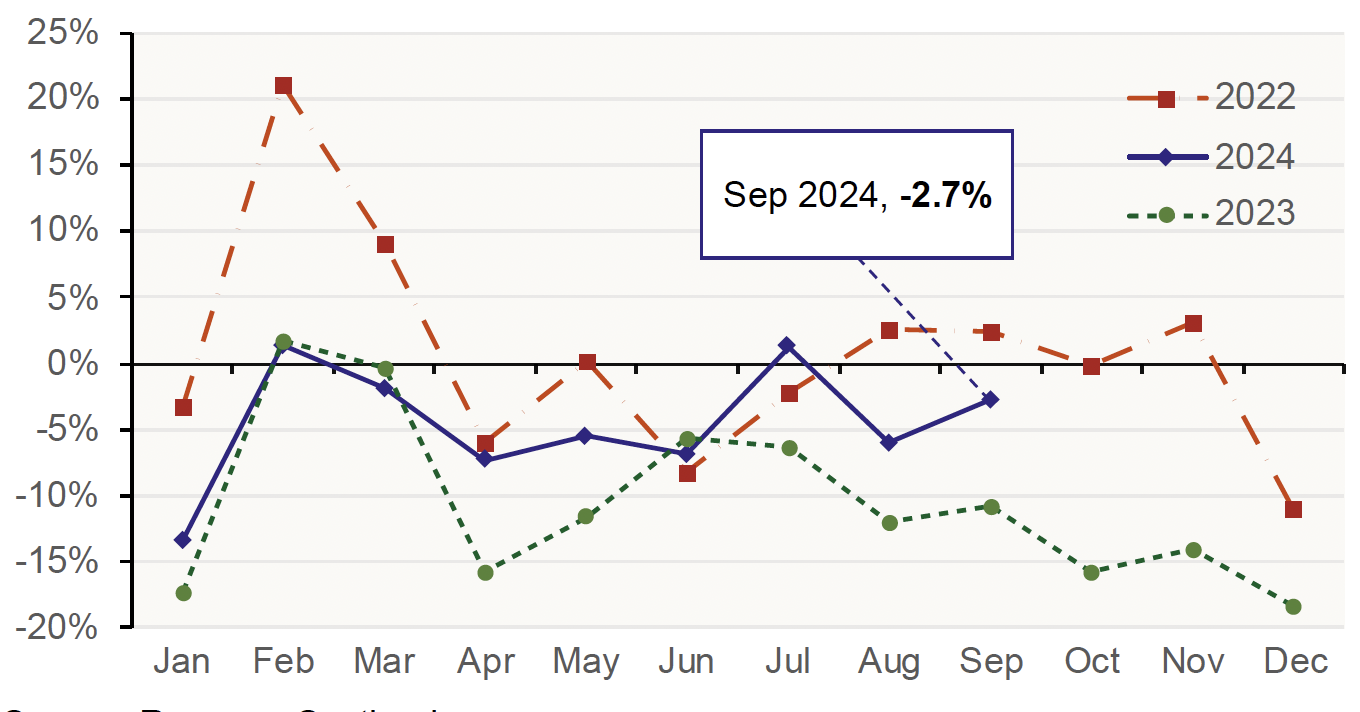

3. Residential Land and Buildings Transaction Tax

Residential Land and Buildings Transaction Tax (LBTT) revenue excluding the Additional Dwelling Supplement (ADS) fell sharply in the early months of 2020-21 due to the impact of Covid restrictions on residential transactions. However, since 2021-22 revenues have been above their pre-pandemic levels, with revenue in 2021-22 45% higher and in 2022-23 62% higher than in 2019-20. While revenue fell by 9% annually in 2023-24, it remained 47% above 2019-20 levels. The recent uptick in prices and transactions is feeding into LBTT revenues, with provisional estimates indicating that the total revenue payable from April 2024 to September 2024 was £255 million, 13% higher than the £226 million for the corresponding period a year earlier.

Source: Revenue Scotland

Contact

Email: jake.forsyth@gov.scot

There is a problem

Thanks for your feedback