Scottish Housing Market Review Q3 2024

Quarterly bulletin collating a range of previously published statistics on the latest trends in the Scottish housing market.

4. Private Rental Sector

4.1. Private Housing Rental Prices

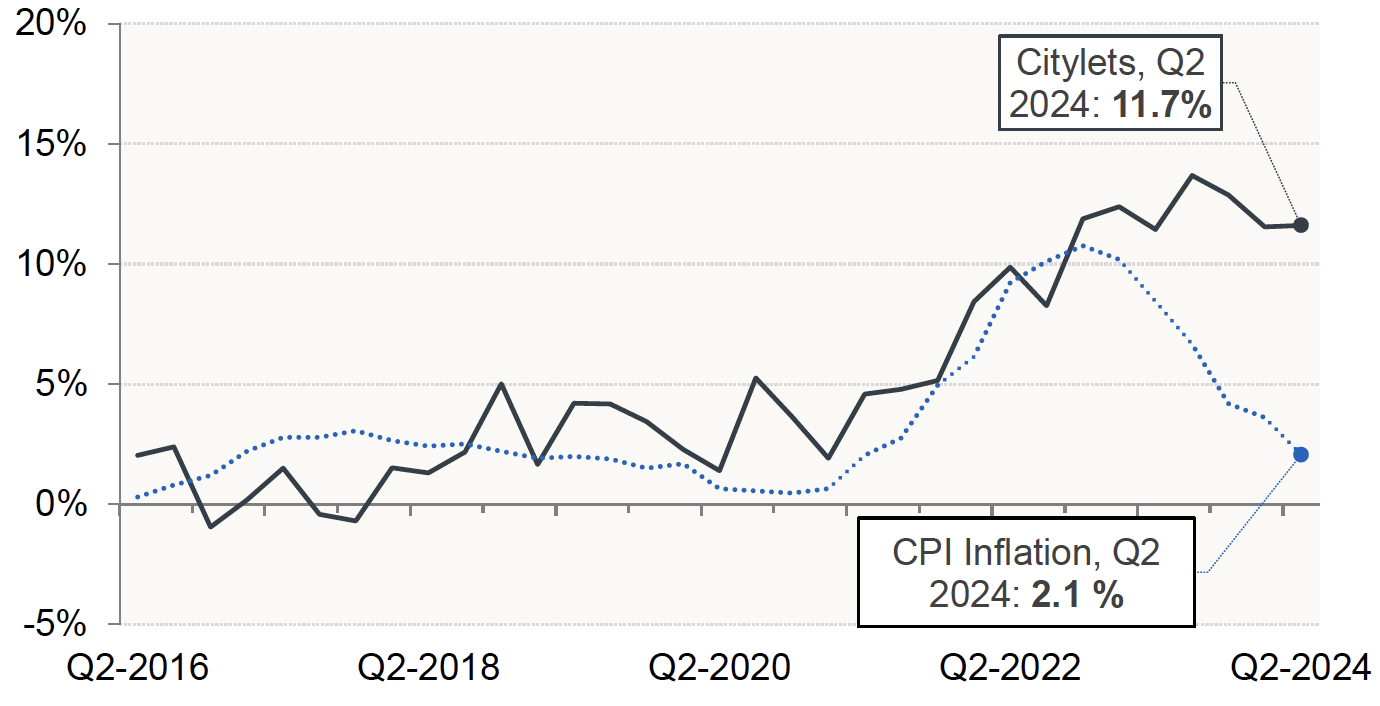

Letting agencies only cover around half of the private rented sector, and each letting agent's data will be affected by its market coverage, which will vary by geography and market segment. Subject to these caveats, there are signs that growth in new-let rents (which are not subject to the current temporary modification to rent adjudication) is below recent peaks. Citylets data shows that while annual growth in new-let rents in Q2 2024 (11.7%) was similar to Q1 2024 (11.5%), it was below its peak of 13.7% in Q3 2023. Furthermore, the annual growth rate in new-lew rents in Q2 2024 from Rightmove, at 7.9%, was not only lower than the peak of 14.5% in Q3 2023 but also lower than the 9.8% recorded in Q1 2024.

Chart 4.1 shows that the rate of Consumer Price Inflation has eased over the last 6 quarters, falling from a peak of 10.8% in Q4 2022 to 2.1% in Q2 2024, which has kept real increases in new-let rents high. For example, real-terms growth in new-let rents recorded by Citylets has risen from 7.6% in Q1 2024 to 9.4% in Q2 2024.

Source: Citylets and ONS

Contact

Email: jake.forsyth@gov.scot

There is a problem

Thanks for your feedback