Scottish Housing Market Review Q3 2024

Quarterly bulletin collating a range of previously published statistics on the latest trends in the Scottish housing market.

5. Mortgage Approvals and LTVs

5.1. New Mortgage Advances

Most properties purchased in Scotland are financed by a mortgage: mortgage sales accounted for 63.7% (58,702) of total residential property sales between May 2023 and April 2024, while the share of cash sales was 36.3% (33,481) (Source: UK HPI).

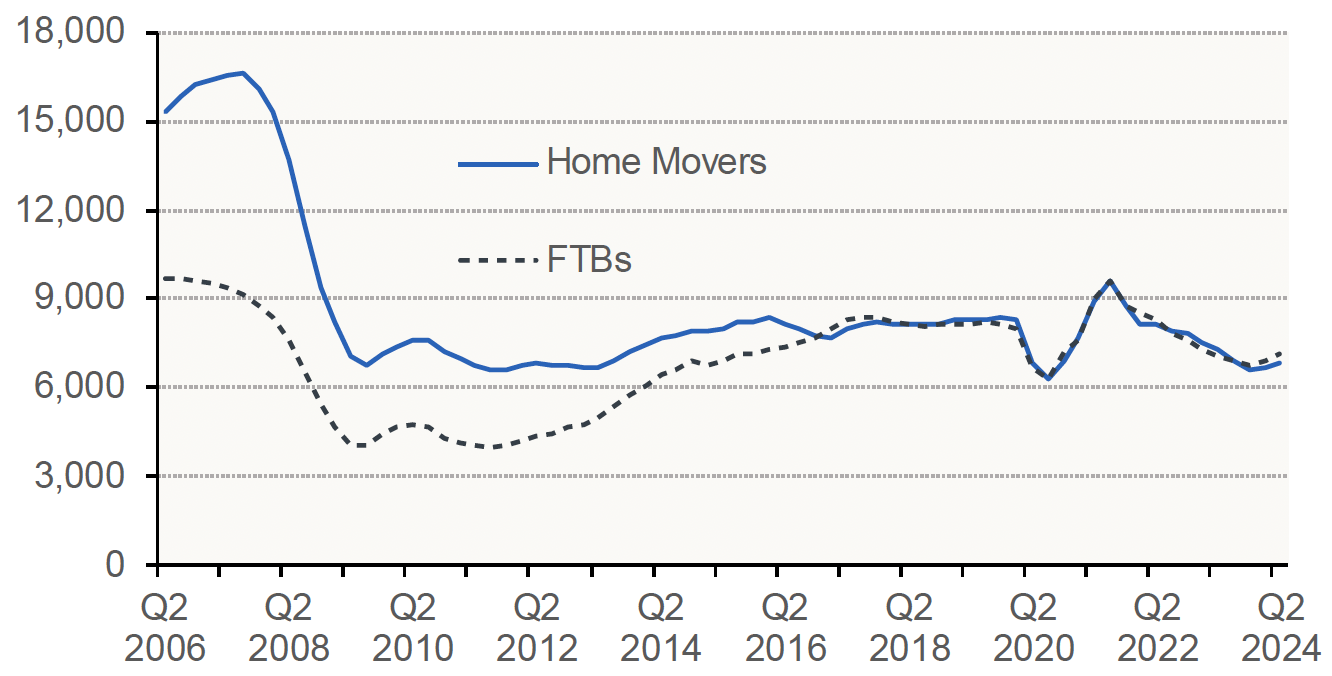

There were 8,080 new mortgages advanced to first-time buyers in Scotland in Q2 2024, an annual increase of 11.9%. Meanwhile, there were 7,680 new mortgages advanced to home movers in Scotland in Q2 2024, an annual increase of 9.2%. While total new mortgage advances fell consistently in 2022 and 2023, the latest findings are further evidence that this trend has come to an end. In the 6 months to June 2024 the number of mortgages advanced totalled 27,490, as compared to 25,330 in the corresponding period in 2023 (an annual increase of 8.5%).

Source: UK Finance

5.2. Mortgage Approvals

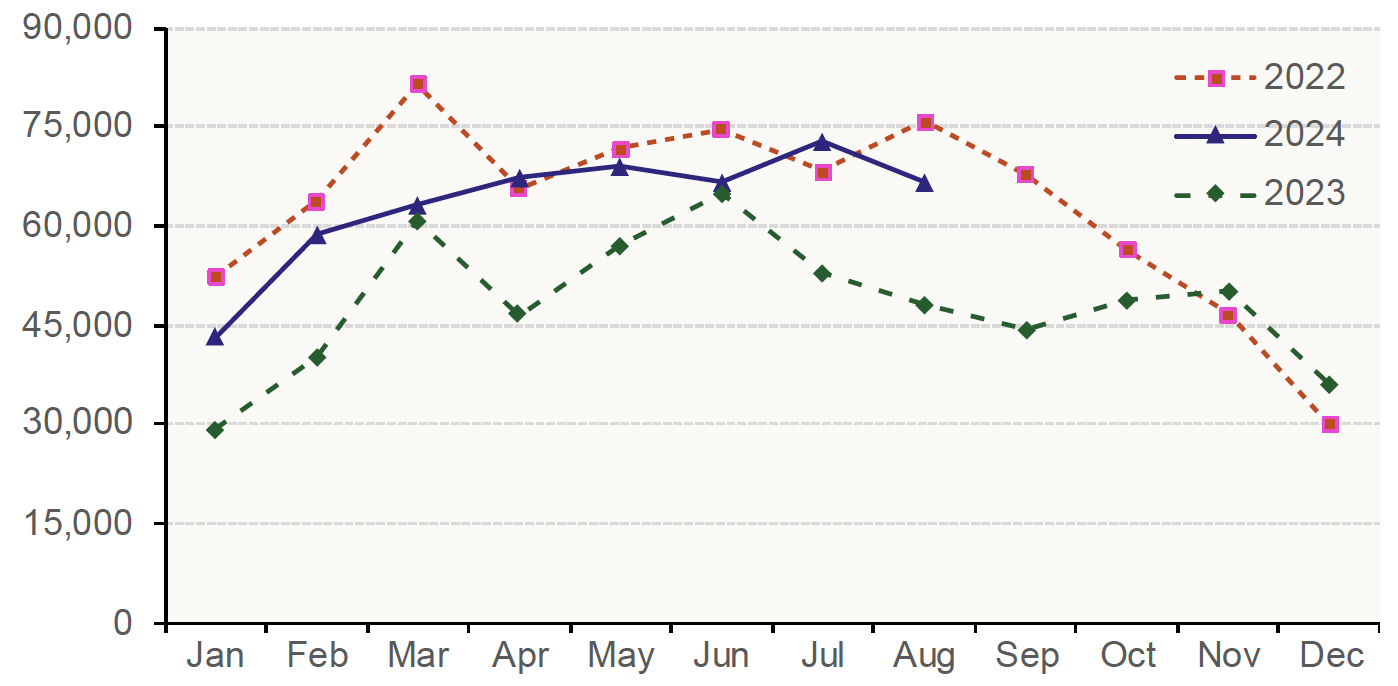

Chart 5.2 plots the monthly number of mortgage approvals across the UK for house purchase by individuals. Mortgage approvals for house purchase, which are the firm offers of lenders to advance credit fully secured on dwellings by a first-charge mortgage, are a leading indicator of mortgage sales as they reflect activity early in the buying process.

Approvals started to fall sharply in the second half of 2022 and remained at low levels throughout 2023: however, there are signs of increased activity in the market, the annual growth in approvals has been positive for every month since November 2023. Over the 8-month period to August 2024, approvals have risen by 27% relative to the corresponding period a year earlier, although this remains 5.5% below the level recorded in the 8 months to August 2019, prior to the pandemic. (Source: Bank of England)

Source: Bank of England

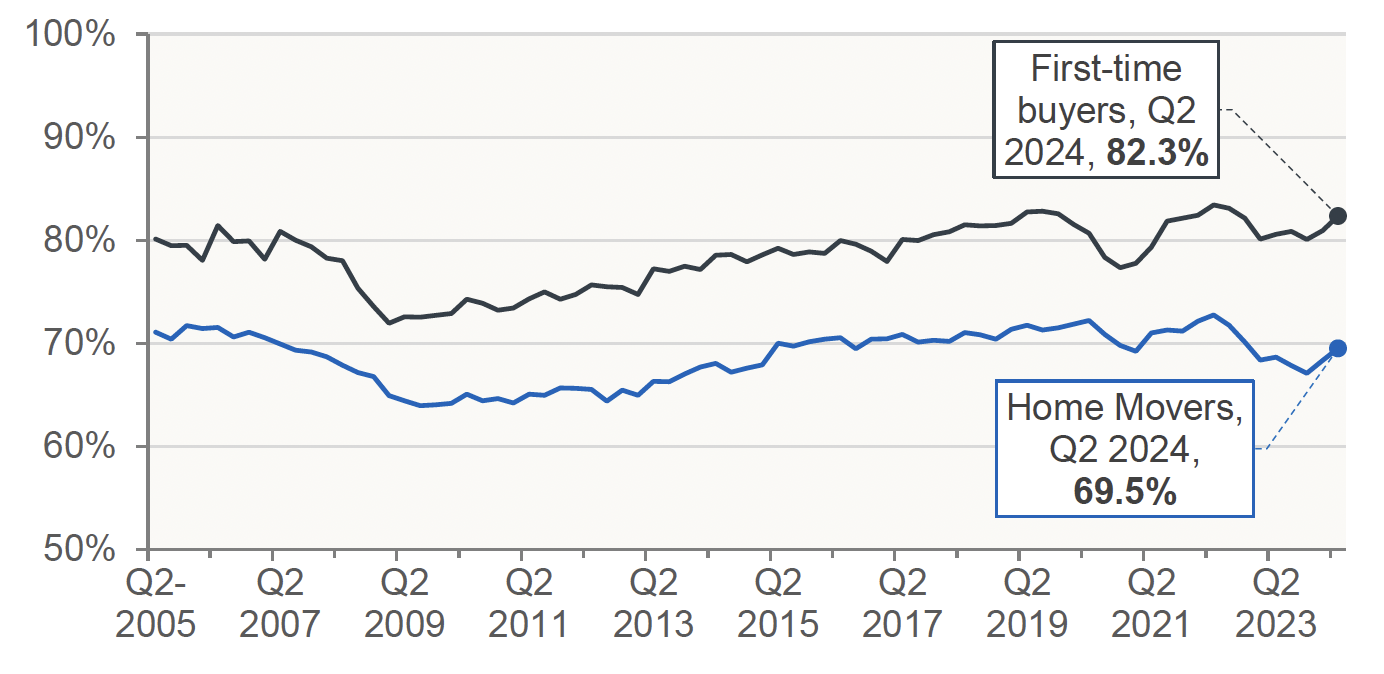

5.3. Loan-to-Value (LTV) Ratios

Chart 5.3 shows that after initially falling following the covid pandemic, mean LTV ratios on new mortgages advanced to both first-time buyers and home movers in Scotland recovered to their pre-pandemic levels, before declining again as the upward trend in interest rates beginning at the end of 2021 fed through to mortgage lending. The mean LTV ratio for first-time buyers has now recovered to 82.3% in Q2 2024, up from 80.9% in Q1 2024 and close to its recent peak of 83.1% in Q2 2022. In contrast, while the mean ratio for home movers also rose from 68.3% in Q1 2024 to 69.5% in Q2 2024, it remains below its recent peak of 72.7% in Q2 2022. (Source: UK Finance).

Source: UK Finance

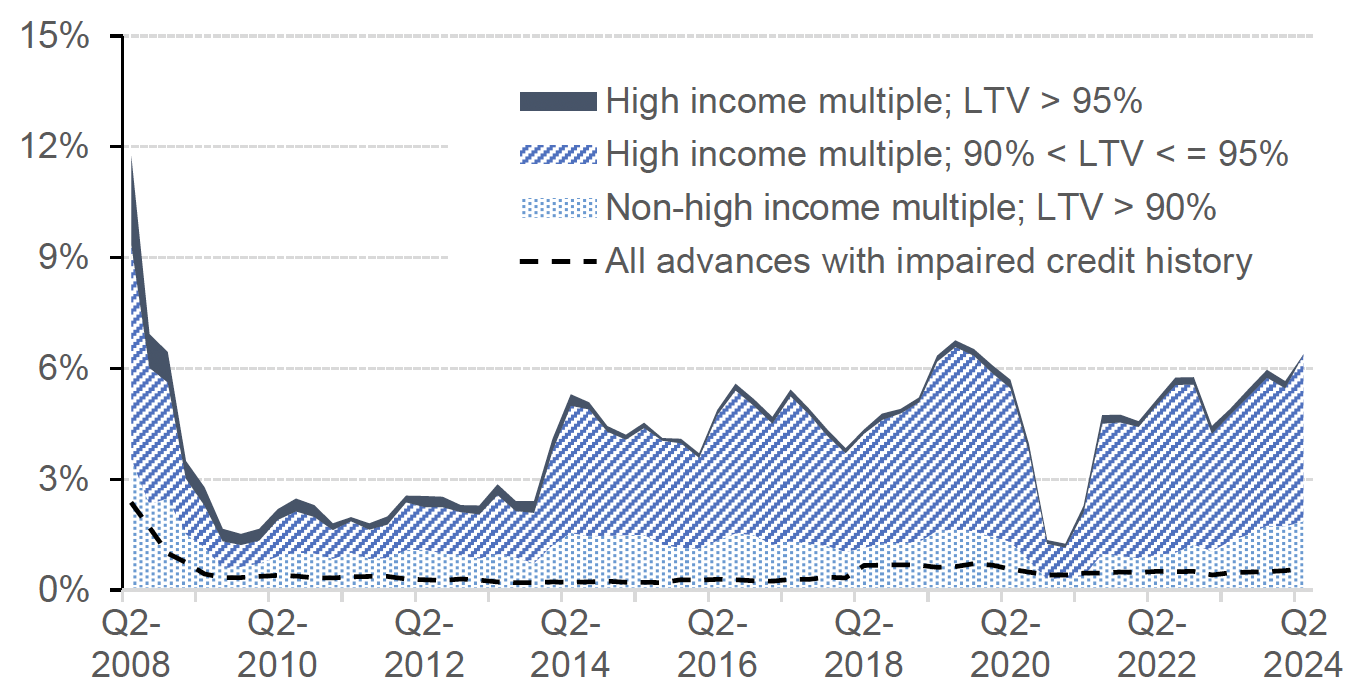

In Q2 2024 there was a increase in the share of all regulated residential lending across the UK with an LTV greater than 90%, which rose by 0.7 percentage points to 6.4%. This is close to its peak for the period after the financial crisis and before the covid pandemic, when it reached a high of 6.8% in Q3 2019. The share of all lending with both an LTV greater than 90% and a high income multiple increased by 0.6 percentage points to 4.5%, the highest since a similar level was recorded in Q4 2022. This recovery in higher-risk lending will have contributed to the increase in the mean LTV ratio for first-time buyers in Scotland discussed above.

Source: FCA. Higher-risk lending is classified by the FCA as an LTV over 90% or an income multiple greater than or equal to 3.5 for single-income purchasers or 2.75 for joint-income purchasers.

After a small drop in recent months, the total number of mortgage products increased by 122 to stand at 6,645 in October, only slightly lower than the 6,658 products available in July 2024, which was a more-than-15-year high. This strong performance is evident across the various LTV bands, including higher LTV bands – the number of products with a maximum LTV of 90% is similar to its level immediately prior to the covid pandemic, while the number of products with a maximum LTV of 95% is only a little lower than its pre-pandemic level. (Source: Moneyfacts UK Mortgage Trends Treasury Reports)

Mortgage shelf life is the length of time between the launch of a product and its repricing or withdrawal from the market, and average shelf life is an indicator of volatility in the mortgage market. The average mortgage product shelf life was unchanged over the month to October, standing at 21 days. This is the same as its average over the previous 12 months. (Source: Moneyfacts UK Mortgage Trends Treasury Reports)

The total number of buy-to-let (BTL) mortgage products increased for the fifth consecutive month, to stand at 3,277, the highest level since June 2022, and also above the level recorded prior to the pandemic. As for the residential sector, the number of products increased across most LTV bands. (Source: Moneyfacts UK Mortgage Trends Treasury Reports)

Contact

Email: jake.forsyth@gov.scot

There is a problem

Thanks for your feedback