Scottish Housing Market Review Q3 2024

Quarterly bulletin collating a range of previously published statistics on the latest trends in the Scottish housing market.

7. Mortgage Affordability

The impact of the increase in interest rates is reflected in measures of mortgage affordability. As illustrated by Chart 7.1, the share of borrower income taken up by principal and interest payments for new mortgages had reached a low in 2020 due to the fall in interest rates in response to the Covid pandemic. However, since then there has been a significant increase: for home movers the share has increased from a low of 15.7% in Q3 2020 to 18.5% in Q2 2024, while for first-time buyers the share has increased from a low of 15.3% in Q2 2020 to 19.8% in Q2 2024.

Source: UK Finance

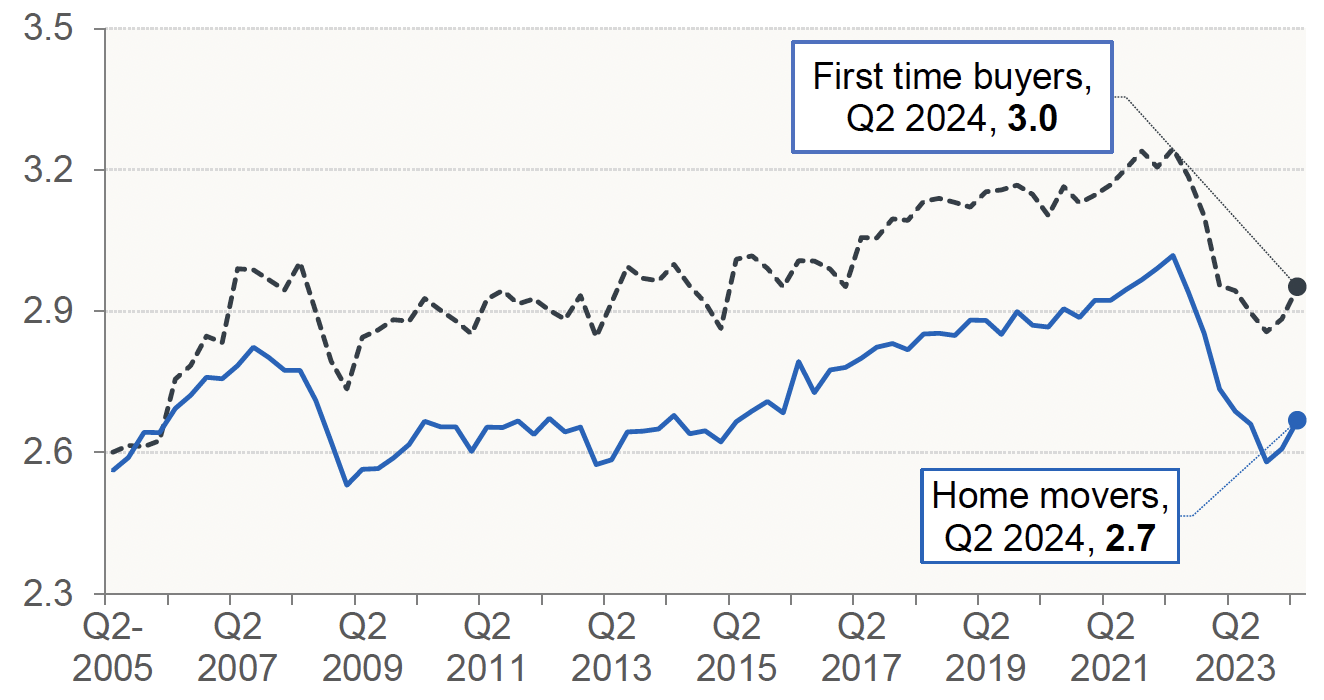

Chart 7.2 shows that the average house-price-to-income ratio in Q2 2024 was 2.7 for home movers and 3.0 for first-time buyers, which is for each series is similar to its long-term average between Q2 2005 and Q1 2024.

Source: UK Finance

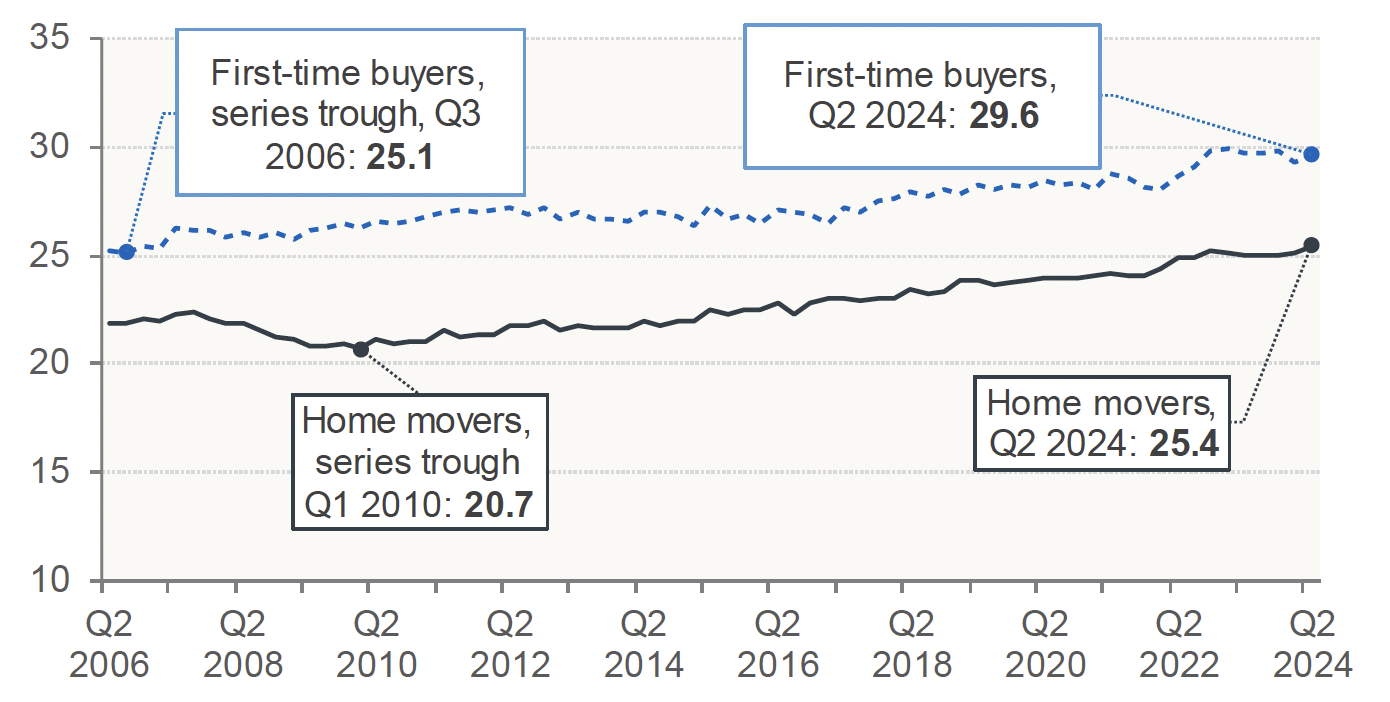

To make their monthly repayments more manageable, an increasing share of borrowers in the UK have responded by taking out longer mortgages. Data for the UK shows that this trend was evident for both first time-buyers and home movers: the proportion of first-time buyers who took out a new mortgage with a term between 36 and 40 years increased from 8% in March 2022 to 19% in March 2024, while over the same period, the share increased from 4% to 9% for home movers. Chart 7.3, which relates to Scotland, shows that this is part of a longer-term trend.

Source: UK Finance

Contact

Email: jake.forsyth@gov.scot

There is a problem

Thanks for your feedback