Scottish Housing Market Review Q3 2024

Quarterly bulletin collating a range of previously published statistics on the latest trends in the Scottish housing market.

8. Mortgage Arrears and Possessions

8.1. Arrears

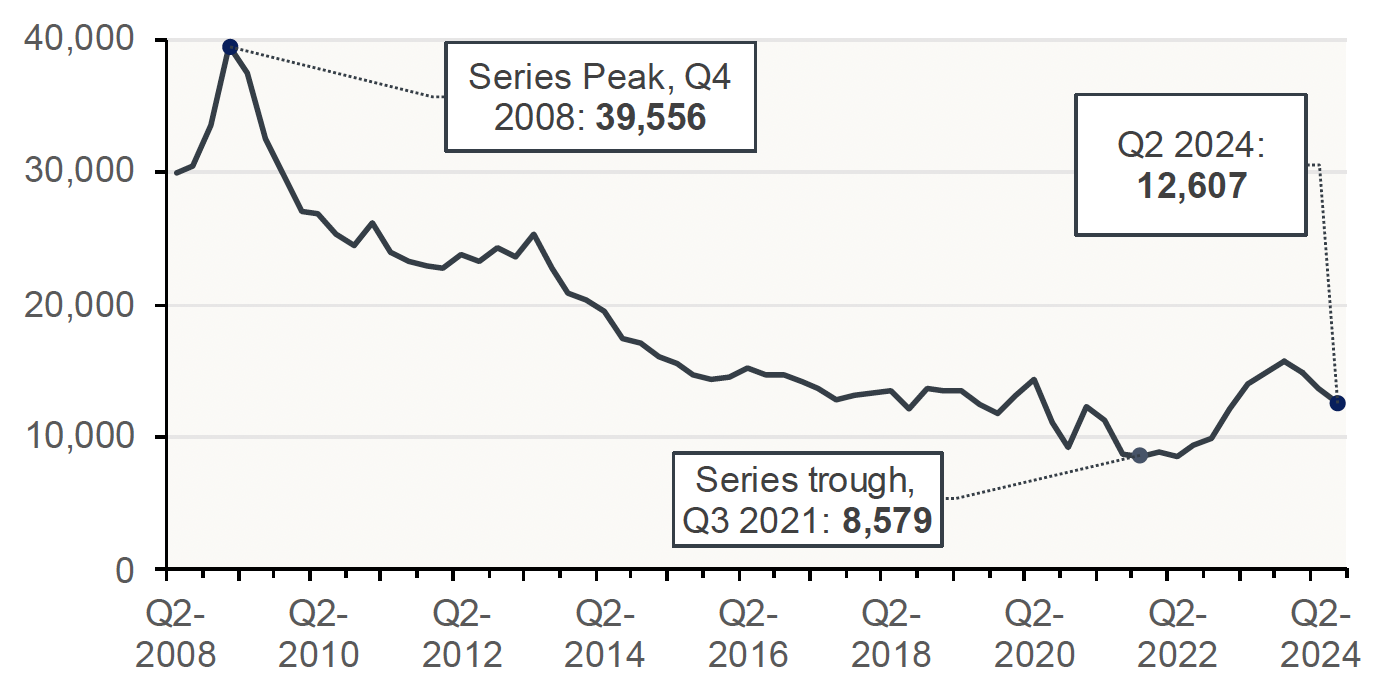

As shown in Chart 8.1, following a peak of 39,556 in Q4 2008 during the financial crisis, there was a long-term decline in the number of regulated mortgage accounts entering arrears across the UK, which continued during the Covid period, reaching a trough of 8,579 in Q3 2021.[6] This was followed by a steady increase over the next three years, with accounts entering arrears reaching 15,705 in Q3 2023. However, this has been followed by 3 consecutive quarterly declines, with 12,607 regulated mortgage accounts entering arrears in Q2 2024.

Source: FCA. Includes both securitised and unsecuritised loans.

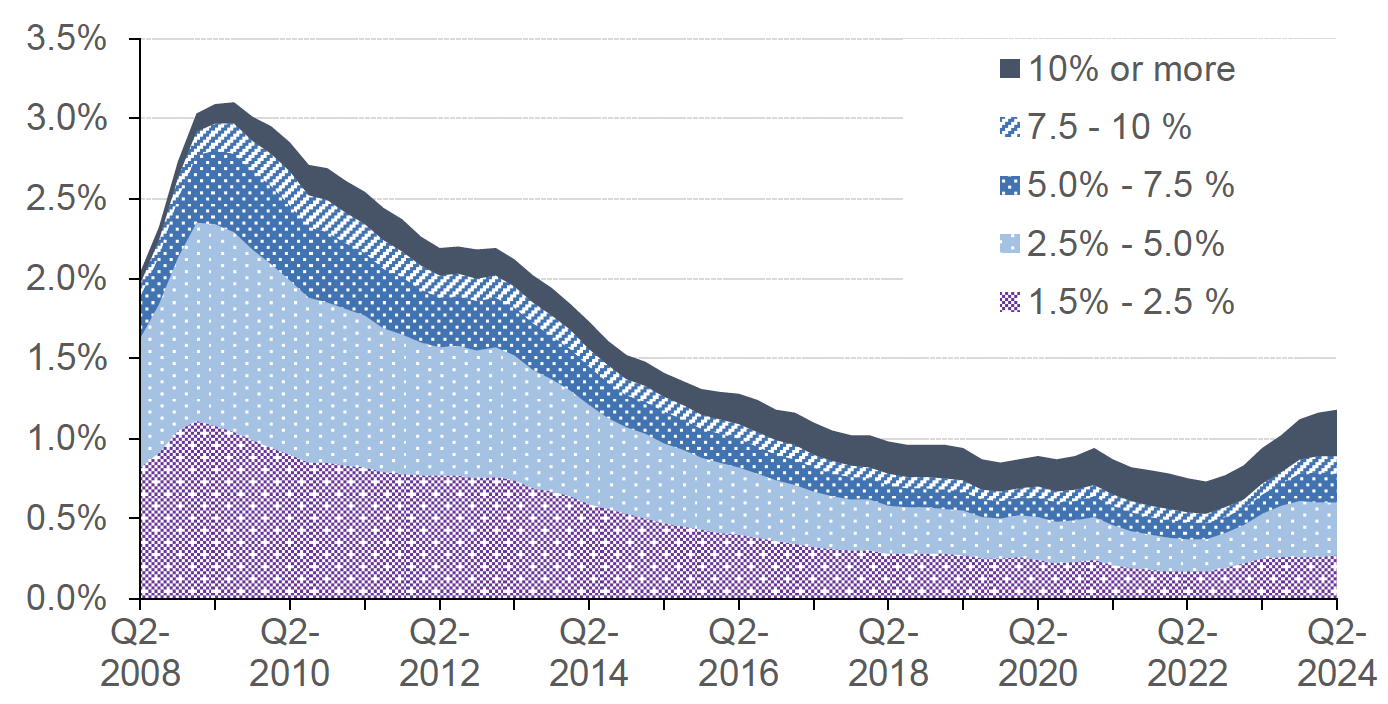

The share of lenders' outstanding regulated mortgage balances that were in arrears of more than 1.5% of the outstanding loan balance stood at 1.2% at the end of Q2 2024. This share had remained broadly stable during the pandemic but started to increase sharply at the end of 2022 and into 2023. Chart 8.2 plots the share of lenders' outstanding balances that were in arrears by degree of severity. As would be expected, the categories which have recorded the largest increase in share since the recent trough are the lowest arrears categories (1.5% - 2.5% and 2.5% - 5.0%) since it will take time for arrears to accumulate.

Source: FCA. Includes both securitised and unsecuritised loans; share is calculated as balances on cases which are in arrears expressed as a % of total loan balances.

UK Finance data shows that there was 18,540 buy-to-let (BTL) mortgages in arrears of 1.5% or more of the outstanding balance across the UK at the end of Q2 2024, compared to 13,770 a year earlier, a 35% increase. The number of BTL mortgages in arrears of 1.5% or more as a percentage of the total number of BTL mortgages was 0.95%. FCA data for non-regulated lending (which includes BTL lending but also some other types of lending, and is collected on a somewhat different basis[7]) shows that at the end of Q2 2024 mortgages which were 1.5% or more in arrears represented 1.36% of the total number of mortgages, up from 1.10% a year earlier.

8.2. Possessions

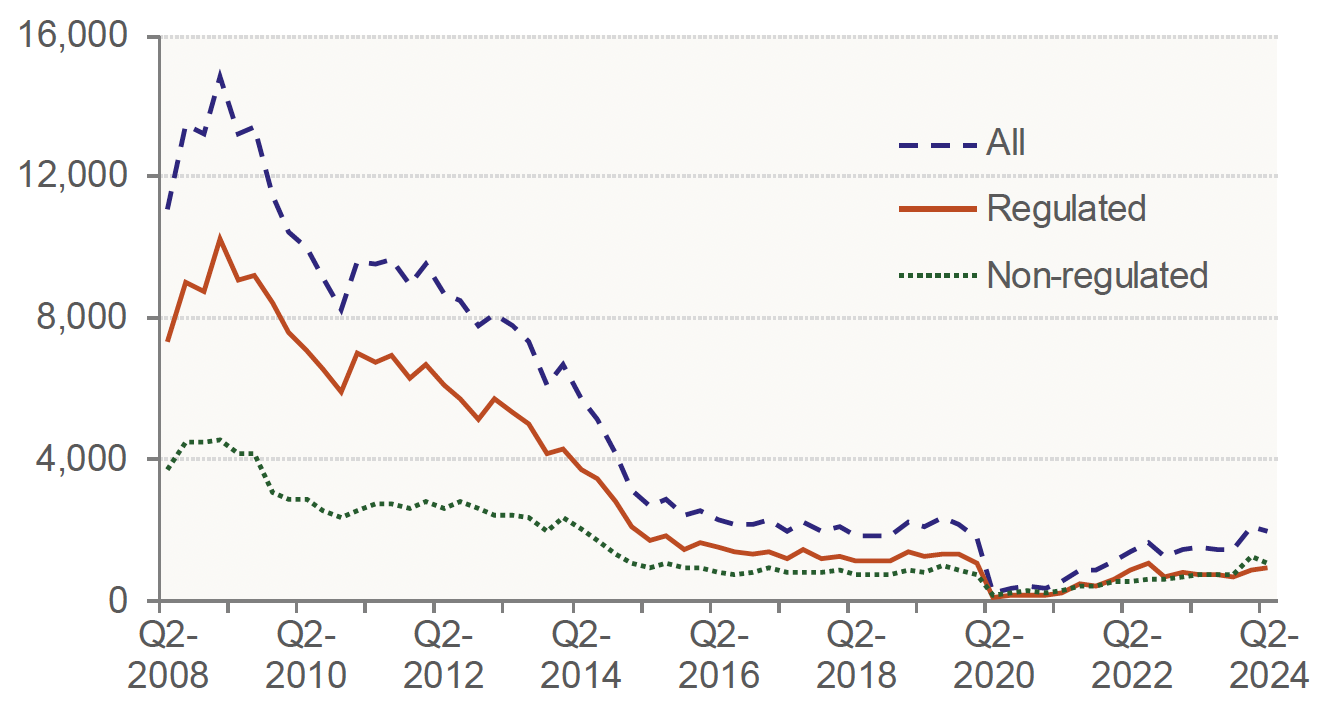

Over the year to Q2 2024, FCA data shows that the number of regulated mortgage possessions increased by 198 to reach 932 (up 27.0%). Despite the marked increase, the number of possessions is still below the quarterly average for 2019-20, the fiscal year preceding the pandemic (1,237).

With respect to non-regulated mortgage lending, FCA data show that there was a 33% annual increase in new possessions in Q2 2024. Similarly, UK Finance data on BTL mortgages (a component of non-regulated mortgage lending) shows a 51% annual rise in possessions across the UK to 710 in Q2 2024.

Source: FCA

Contact

Email: jake.forsyth@gov.scot

There is a problem

Thanks for your feedback