Scottish Housing Market Review Q4 2024

Quarterly bulletin collating a range of previously published statistics on the latest trends in the Scottish housing market.

1. Sales

1.1. Scottish Sales Performance: National

Source: Registers of Scotland

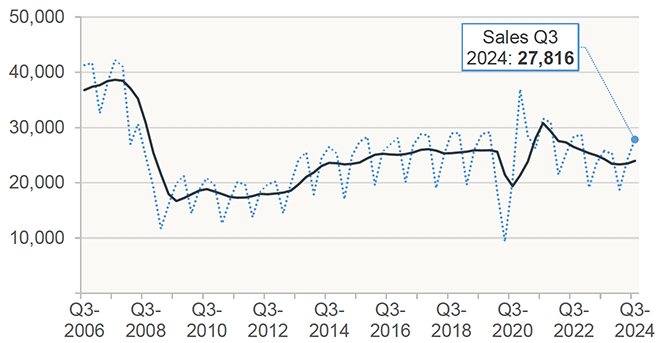

Chart 1.1 shows the volume of transactions for each quarter and the 4-quarter moving average which gives a better indication of the longer-term trend.[1]

Registers of Scotland statistics show that there were 27,816 residential property sales registered across Scotland in Q3 2024 – relative to Q3 2023, this was an increase of 7.9% (2,035). This is the second consecutive quarter where the annual change in transactions has been positive, and the highest annual growth rate since Q3 2021.

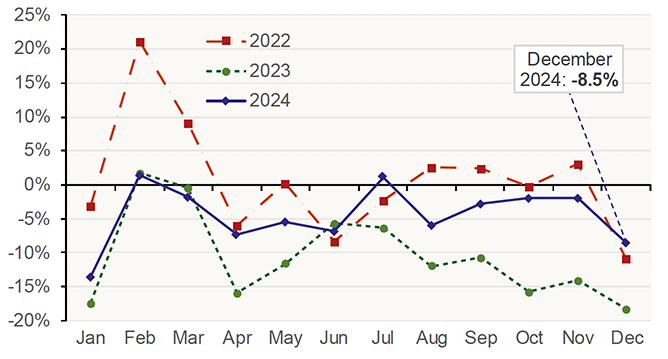

Chart 1.2, which uses Revenue Scotland data to plot the percentage difference between monthly residential LBTT returns over the period 2022 to 2024 relative to the corresponding month in 2019 (with 2019 chosen as the baseline to reflect pre-Covid market conditions), provides a more refined picture on sales trends. The data shows that the total number of residential LBTT returns was 100,810 in 2024, which is higher than 2023 when it stood at 93,940 (an increase of 7.3%). However, despite the latest upturn in sales activity, the volume of LBTT returns in 2024 was 4.4% lower than in 2022 (105,410).

Source: Revenue Scotland

1.2. Scottish Sales Performance: Local Authorities

Table 1.1 sets out the level and annual change in quarterly transactions by local authority. The volume of transactions at local authority level can fluctuate significantly, particularly in smaller local authorities such as the island local authorities. To remove some of this volatility, the change in transactions in the last 4 quarters compared to the preceding 4 quarters is also presented.

Table 1.1 shows that housing market activity has increased across most areas in Scotland: in the four quarters to Q3 2024 compared to the previous four quarters, 28 out of the 32 Scottish local authorities had an increase in transactions. The local authorities with the highest growth rates were the Shetland Islands (12.0%, 28 additional transactions) and Argyll & Bute (8.1%, 132 additional transactions), while Dumfries & Galloway (-1.5%, 34 fewer transactions) and East Ayrshire (-1.4%, 29 fewer transactions) saw the greatest reduction in housing market activity.

Table 1.1 Local Authority residential property transactions registered

| Local Authority | Sales – Q3 2024 | Q3 2024 on Q3 2023 | 4 quarters to Q3 2024 on previous 4 quarters |

|---|---|---|---|

| Aberdeen City | 1,305 | 11.3% | 3.2% |

| Aberdeenshire | 1,147 | -4.0% | -1.3% |

| Angus | 506 | 1.4% | 0.4% |

| Argyll and Bute | 580 | 29.5% | 8.1% |

| Edinburgh City | 3,158 | 13.4% | 3.6% |

| Clackmannanshire | 243 | -2.8% | -0.8% |

| Dumfries and Galloway | 631 | -5.1% | -1.5% |

| Dundee City | 725 | 12.4% | 3.2% |

| East Ayrshire | 528 | -5.2% | -1.4% |

| East Dunbartonshire | 514 | 9.1% | 2.6% |

| East Lothian | 594 | 2.9% | 0.8% |

| East Renfrewshire | 469 | 0.9% | 0.2% |

| Falkirk | 757 | 3.3% | 0.9% |

| Fife | 1,883 | 6.4% | 1.8% |

| Glasgow City | 3,107 | 12.2% | 3.2% |

| Highland | 1,132 | 10.1% | 2.7% |

| Inverclyde | 331 | 4.4% | 1.2% |

| Midlothian | 547 | 11.4% | 3.2% |

| Moray | 457 | 4.8% | 1.3% |

| Na h-Eileanan Siar | 84 | 20.0% | 4.7% |

| North Ayrshire | 689 | 6.5% | 1.7% |

| North Lanarkshire | 1,479 | 8.9% | 2.3% |

| Orkney Islands | 114 | 8.6% | 2.6% |

| Perth and Kinross | 893 | 11.5% | 3.2% |

| Renfrewshire | 1,049 | 2.5% | 0.7% |

| Scottish Borders | 547 | 4.8% | 1.3% |

| Shetland Islands | 83 | 50.9% | 12.0% |

| South Ayrshire | 665 | 12.9% | 3.4% |

| South Lanarkshire | 1,791 | 7.3% | 2.0% |

| Stirling | 470 | 1.3% | 0.4% |

| West Dunbartonshire | 393 | 9.8% | 2.7% |

| West Lothian | 947 | 11.4% | 3.2% |

| Scotland | 27,816 | 7.9% | 2.2% |

Source: Registers of Scotland

Contact

Email: jake.forsyth@gov.scot

There is a problem

Thanks for your feedback