Scottish Income Tax 2025 to 2026: factsheet

A factsheet on the changes made to Scottish Income Tax for 2025-26.

Income Tax Policy Proposal: Scottish Budget 2025-26

- The Starter rate band will increase by 22.6% and the Basic rate band will increase by 6.6%. This will increase the thresholds for paying both the Basic and Intermediate rate of tax by 3.5%.

- This increase is significantly above inflation, which is 1.7%, based on the Consumer Price Index from September 2024.

- The Higher, Advanced and Top rate thresholds will be frozen at their current levels in cash terms to the end of this Parliament (2026-27).

- The UK Government confirmed in the 2024 Autumn Statement that the UK-wide Personal Allowance will remain frozen at £12,570.

- The Scottish Fiscal Commission (SFC) has forecast that Income Tax will raise just under £20.5 billion in 2025-26 in Scotland.

The tax rates you pay in each band if you have a standard Personal Allowance of £12,570 are shown in Table 1.[1]

2024-25 |

2025-26 |

|||

|---|---|---|---|---|

Band |

Rate |

Band |

Rate |

|

Starter |

£12,571* - £14,876 |

19% |

£12,571*- £15,397 |

19% |

Basic |

£14,877 - £26,561 |

20% |

£15,398 - £27,491 |

20% |

Intermediate |

£26,562 - £43,662 |

21% |

£27,492 - £43,662 |

21% |

Higher |

£43,663 - £75,000 |

42% |

£43,663 - £75,000 |

42% |

Advanced |

£75,001 - £125,140** |

45% |

£75,001 - £125,140** |

45% |

Top |

Over £125,140 |

48% |

Over £125,140 |

48% |

*Assumes individuals are in receipt of the standard Personal Allowance.

**Those earning more than £100,000 will see their Personal Allowance reduced by £1 for every £2 earned over £100,000.

Impact on individual taxpayers of changes to Scottish Income Tax

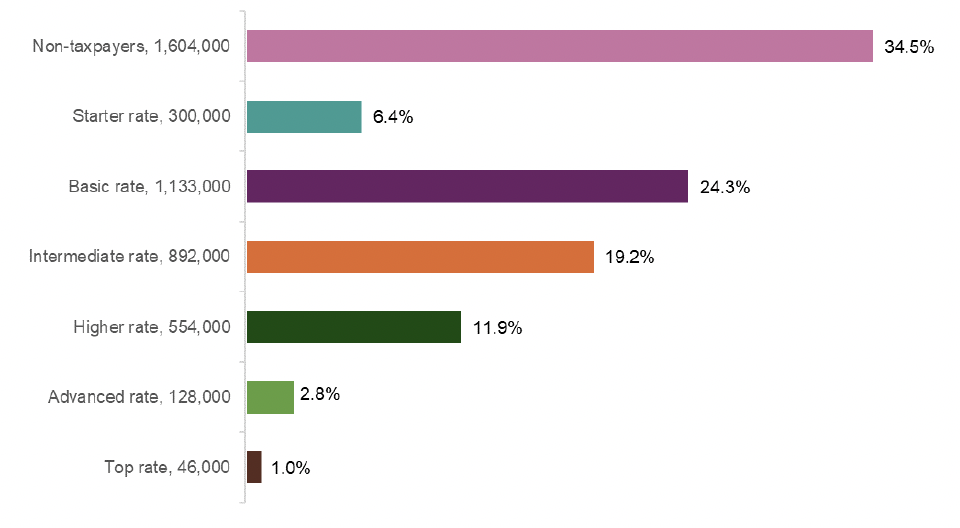

- It is estimated over 34% of Scottish adults (over 1.6 million out of 4.65 million adults) are not affected by the 2025-26 policy changes as their income is below the UK-wide Personal Allowance of £12,570.

- Those earning less than around £30,300 – which is around 51% of Scottish taxpayers – will continue to pay slightly less Income Tax in 2025-26 than if they lived elsewhere in the UK.

- No taxpayer will pay more Scottish Income Tax in 2025-26 than they did in 2024-25 on their current income.

The impact of Income Tax policy in 2025-26 on different taxpayers can be considered by comparing take home pay in 2025-26 to a scenario where all tax bands are increased in line with inflation, which is the SFC’s baseline assumption.

This is illustrated in the table below alongside a comparison of take-home pay resulting from Scottish Income Tax policy compared to the rest of the UK in 2025-26. For a given income, the table below shows:

- The impact of Income Tax policy in 2025-25 relative to the SFC baseline, (assumed inflationary increase to all bands).

- The impact of Income Tax policy in 2025-26 compared to Income Tax policy in 2024-25.

- The impact of Scottish Income Tax policy in 2025-26 compared to Income Tax policy in the rest of the UK.

For example, in 2025-26 taxpayers earning the median income of £29,800 will be £5 better off than if they lived elsewhere in the UK and £15 better off in 2025-26 than they were in 2024-25. They will also be £12 better off than if all Income Tax bands had increased by inflation.

Example Income of Scottish taxpayers in 2025-26 |

Impact on take home pay (2025-26) |

||

|---|---|---|---|

Policy impact relative to SFC baseline |

Position relative to tax paid in 2024-25 |

Position relative to the rest of the UK in 2025-26 |

|

£15,000 |

£1 |

£1 |

£24 |

£20,000 |

£5 |

£5 |

£28 |

£20,400 (25th percentile) |

£5 |

£5 |

£28 |

£24,242 (Real Living Wage) |

£5 |

£5 |

£28 |

£29,800 (Median Income) |

£12 |

£15 |

£5 |

£35,000 |

£12 |

£15 |

-£47 |

£40,000 |

£12 |

£15 |

-£97 |

£44,500 (75th percentile) |

-£98 |

£15 |

-£318 |

£45,000 |

-£98 |

£15 |

-£428 |

£50,000 |

-£98 |

£15 |

-£1,528 |

£60,000 |

-£98 |

£15 |

-£1,782 |

£70,000 |

-£98 |

£15 |

-£1,982 |

£80,000 |

-£136 |

£15 |

-£2,332 |

£90,000 |

-£136 |

£15 |

-£2,832 |

£100,000 |

-£136 |

£15 |

-£3,332 |

£130,000 |

-£199 |

£15 |

-£5,363 |

£800,000 |

-£199 |

£15 |

-£25,463 |

Impact of Income Tax changes on Scottish households

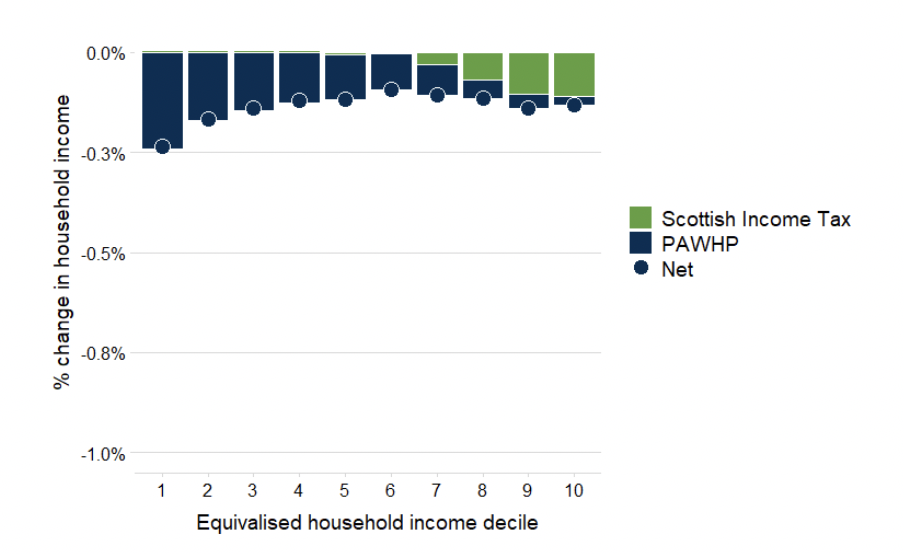

- Increases to the Basic and Intermediate rate thresholds have a small positive impact in the bottom half of the income distribution. The negative impact of frozen thresholds principally falls on the highest earning 20% of households, with the top 10% paying an average of 0.1% of their income (around £130) more.

- Scottish Income Tax changes – Increases to the Basic and Intermediate rate threshold, while freezing the Higher, Advanced and Top rate thresholds, mean that almost half (47%) of Scottish households are better off, with over three-quarters (76%) of households either better off or unaffected as a result.

- Overall, around 62% of households in Scotland are better off or unaffected under the Scottish tax and social security system compared to the rest of the UK.

Source: OCEA analysis using UKMOD

International Comparison of Scottish Income Tax

- The below figure sets out an international comparison of estimated Income Tax and social security contributions (NICs) as a share of gross income and social security across the household income distribution in Scotland, England and across other EU countries[3][4].

- The Scottish Income Tax system is progressive. Personal tax as a proportion of income is generally lower than the EU median across household deciles, with households around the median income paying less tax than the average household across EU countries.

- The average proportion of tax paid by households at the top and bottom of the distribution is estimated to be more similar to that seen in other EU countries.

- Household comparisons between Scotland and England will reflect differences in tax policy, but also differences in the distribution of household income.

Equivalised income decile |

Lowest decile |

Median |

Highest decile |

|---|---|---|---|

Scotland |

9% |

14% |

35% |

England |

11% |

15% |

35% |

All EU countries |

8% |

18% |

32% |

Western EU and Nordic countries |

9% |

19% |

35% |

Benelux and Nordic countries |

9% |

23% |

37% |

Analysis with UKMOD and EUROMOD figures

Contact

Email: Lorraine.King@gov.scot

There is a problem

Thanks for your feedback