Scottish Local Government Finance Statistics 2022-23

Annual publication providing a comprehensive overview of financial activity of Scottish local authorities in 2022-23 based on authorities' audited accounts (where available).

3. Capital Expenditure and Financing

Capital expenditure is expenditure that creates an asset, it includes the initial costs of acquisition and construction, and costs incurred subsequently to add to, replace part of, or service the asset. Subsequent costs arising from day-to-day services of an asset, known as repairs and maintenance, is not capital expenditure. Capital expenditure purchases or constructs the buildings and infrastructure necessary to provide services, such as schools, care homes, flood defences, roads, vehicles, plant and machinery. Due to the nature of capital expenditure, it can fluctuate substantially between years.

Capital expenditure also includes grants a local authority provides to a third party to fund capital expenditure of the third party; direct expenditure on a third parties’ assets; and loans to third parties to support capital investment of a third party.

Capital expenditure can be financed by one or more of the following:

- capital grants and contributions;

- borrowing or credit arrangements;

- contributions from capital or revenue reserve funds;

- capital receipts from the sale of assets.

Chapter 4.1 provides more information on local authorities’ capital reserve funds.

3.1 Capital Expenditure

In 2022-23, total capital expenditure was £3,786 million, an increase of 13.3 per cent, or £444 million, from 2022-23. This includes expenditure on the Housing Revenue Account.

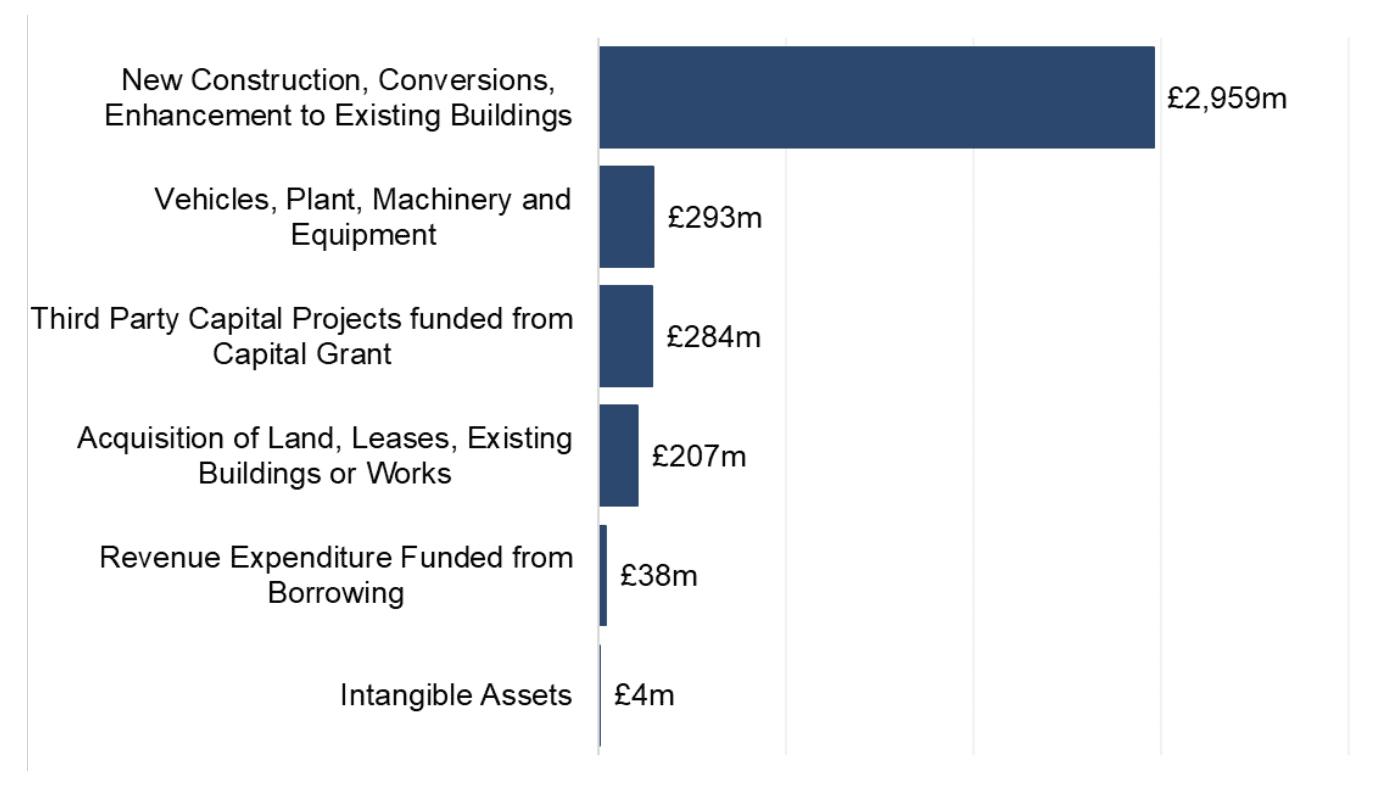

Chart 3.1 shows the split of capital expenditure into these six categories in 2022-23. The majority of capital expenditure, £2,959 million or 78 per cent, related to new construction, conversions & enhancements to existing buildings.

Please note, ‘Third party capital projects funded from capital grant’ and ‘Revenue expenditure funded from borrowing’ are also included in authorities’ revenue figures.

Source: LFR CR

Table 3.1 shows a breakdown of capital expenditure between 2018-19 and 2022-23. New construction, conversions and enhancements to existing building has consistently accounted for the majority of capital expenditure over this period. This type of capital expenditure has increased by 12.8 per cent, or £336 million, between 2021-22 and 2022-23.

All categories have increased between 2021-22 and 2022-23, with the exception of Intangible Assets which decreased from £30 million to £4 million.

| Expenditure Type | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 |

|---|---|---|---|---|---|

| Acquisition of land, existing buildings or works | 169 | 633 | 66 | 151 | 207 |

| New construction, conversions & enhancements to existing buildings | 2,317 | 2,616 | 2,013 | 2,623 | 2,959 |

| Vehicles, plant, machinery & equipment | 225 | 228 | 232 | 222 | 293 |

| Intangible assets | 5 | 17 | 20 | 30 | 4 |

| Revenue expenditure funded from capital grant and borrowing | 262 | 301 | 273 | 316 | 322 |

| Total Capital Expenditure | 2,977 | 3,794 | 2,604 | 3,341 | 3,786 |

Please note, ‘Revenue expenditure funded from capital grant and borrowing’ is also included in authorities’ revenue figures.

Source: LFR CR for 2019-20, 2021-22 and 2022-23, and CR Final for all other years

3.1.1 Capital Expenditure by Service

Chart 3.2 shows capital expenditure in 2022-23 by service. HRA had the largest share of expenditure at £1,073 million, followed by Roads & Transport (£654m) and Education (£652 million).

Please note, ‘Other’ includes Social Work, Central Services and Trading Services.

Source: LFR CR

Chart 3.3 shows capital expenditure for 2018-19 to 2022-23 for the six services with the highest capital expenditure in 2022-23. Roads & Transport increased by 21.5 per cent (£116 million) and Non-HRA Housing increased by 9.2 per cent (£19 million). Capital expenditure reduced for the following services: Environmental Services (-34.6 per cent, -£80 million), Building, Planning & Development (-20.5 per cent, -£61 million) and Education (-2.6 per cent, -£18 million).

This chart excludes expenditure for Culture & Related Services; Social Work; Trading Services; and Other, including Central Services which, combined, accounted for 21 per cent of total capital expenditure in 2022-23.

Source: CR Final for 2018-19, and LFR CR from 2019-20 onwards

3.1.2 General Fund Capital Expenditure by Council

In any given year, capital expenditure per person varies substantially between local authority areas. This will in part reflect the different priorities of local authorities, however it also reflects differences in the timing of capital projects. Expenditure on capital projects can be highly variable as some projects can be high-value and infrequent, and expenditure per head in local authority areas will move, possibly substantially, from year to year as projects begin or wind down.

Chart 3.4 shows capital expenditure on General Fund services per person by council. In 2022-23, the average capital expenditure per person across all councils was £491, an increase from £432 per person in 2021-22. Spend per person ranged from £192 per person in Clackmannanshire to £2,151 per person in Na h-Eileanan Siar.

Source: LFR CR and Scotland’s Census 2022

3.2 Capital Financing

Chart 3.5 shows how local authorities financed their capital expenditure in 2022-23. This includes expenditure on the Housing Revenue Account. The two main sources of financing were borrowing from the Loans Fund, £1,533 million, and grants & contributions, £1,617 million, which together accounted for over four-fifths (83 per cent) of all capital financing in 2022-23.

Capital grants and contributions are provided to local authorities to fund capital investment. This includes grants and contributions received from the Scottish and UK Governments; other government agencies and Non-Departmental Public Bodies (NDPBs); other local authorities; and private developers. The Scottish Government provides two types of capital grant funding to local authorities – a General Capital Grant (GCG) and a number of specific capital grants. The General Capital Grant accounted for just over two-fifths of grants and contributions in 2022-23[5].

More information on borrowing is provided in Chapter 3.3 and more information on the Loans Fund is provided in Chapter 5.1.1.

Please note that ‘Grants & Contributions’ and ‘Borrowing from Loans Fund’ include amounts used to fund grant to third party capital projects which will also be included in the revenue figures.

Source: LFR CR

Chart 3.6 shows capital financing by type from 2018-19 to 2022-23. Except for capital funded from revenue, all types of financing have increased between 2021-22 and 2022-23, reflecting the overall increase in capital expenditure incurred in 2022-23. Grants & contributions and Borrowing from the Loans Fund continue to be the main sources of capital financing.

The fluctuations in borrowing reflect the nature of capital and can be influenced by the type of expenditure being undertaken in each year. In particular, the decrease in borrowing between in 2020-21 will reflect the overall reduction in capital expenditure due to the impacts of the Covid-19 pandemic.

Please note that ‘Grants & Contributions’ and ‘Borrowing from Loans Fund’ include amounts used to fund grants to third party capital projects which will also be included in the revenue figures.

Source: CR Final for 2018-19, and LFR CR from 2019-20 onwards

Financing from credit arrangements was notably high in 2019-20 compared to other years, this was due to the significant one-off sale and leaseback transactions for Culture and Related Services by Glasgow City Council. In addition, during 2022-2023, Glasgow City Council secured a further £200 million in credit arrangements as part of a sale and leaseback arrange to fund its £200 million equal pay settlement. The properties involved included Kelvingrove Art Gallery, Kelvin Hall, the Gallery of Modern Art and the City Chambers[6].

3.3 Borrowing and Credit Arrangements

Local authorities can borrow to fund capital expenditure, either through the borrowing of money or by way of a credit arrangement, such as a lease. The cost of repaying debt, including the interest costs, is expenditure to the revenue accounts. The costs of servicing debt in 2022-23 are provided in Table 2.5, which shows the cost of repayments and interest payable.

The Local Government (Scotland) Act 1973 provides councils with a general power to borrow money. Other local authorities’ powers are set out in legislation specific to that authority. The Local Authority (Capital Finance and Accounting) (Scotland) Regulations 2016 sets out the purposes for which a local authority may borrow.

Table 3.2 provides a summary of borrowing and credit arrangements in 2022-23. Local authorities financed £1,533 million of capital expenditure from borrowing in 2022-23. From Chart 3.6, this was an increase of 6.4 per cent, £92 million, compared to 2021-22.

In 2022-23, local authorities also entered into credit arrangements, recognising debt of £265 million, an increase of 349.1 per cent, or £206 million, from 2021-22. Around £200 million of this relates to Glasgow City Council’s sale and leaseback transaction.

| Category | General Fund | HRA | Total |

|---|---|---|---|

| Advances for Capital Expenditure | 932 | 583 | 1,515 |

| Advances for Consented Borrowing | 18 | 0 | 18 |

| Total Loans Fund Borrowing | 950 | 583 | 1,533 |

| Credit Arrangements | 265 | 0 | 265 |

| Total Borrowing and Credit Arrangements | 1,215 | 583 | 1,798 |

Please note that ‘Advances for Capital Expenditure’ includes borrowing from the Loans Fund used to fund grants to third party capital projects which will also be included in the revenue figures.

Source: LFR CR

Trends for borrowing from the Loans Fund and credit arrangements between 2018-19 and 2022-23 are shown in Chart 3.6 and discussed in Chapter 3.2.

3.4 Capital Receipts

Capital receipts is the term used to recognise income from the sale or disposal of an asset, such as land or council housing. As shown in Table 3.3, local authorities generated £324 million in capital receipts in 2022-23. This is an increase of £258 million compared to 2021-22. Over £226 million of this relates to Glasgow City Council’s sale of assets.

| Category | 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 |

|---|---|---|---|---|---|

| General Fund | 92 | 537 | 68 | 44 | 292 |

| HRA | 19 | 5 | 25 | 22 | 32 |

| Total | 111 | 541 | 93 | 67 | 324 |

Source: LFR CR

Capital receipts may only be used to fund capital expenditure or for a purpose specified by statute, or statutory guidance. Local authorities can also hold capital receipts in a capital reserve for future use. This means the value of capital receipts raised in year may not equal the amount used in year. Table 3.4 sets out how capital receipts were used in 2022-23.

| Use | General Fund | HRA | Total |

|---|---|---|---|

| Fund capital expenditure | 44 | 32 | 76 |

| Repay debt | 22 | 1 | 23 |

| Fund transformation projects | 5 | 0 | 5 |

| Fund premiums incurred on refinancing | 0 | 0 | 0 |

| Fund deferred premiums | 0 | 0 | 0 |

| Fund impact of Covid-19 | 0 | 0 | 0 |

| Total capital receipts used in year | 71 | 33 | 104 |

Source: LFR CR

Local authorities used a total of £104 million capital receipts in 2022-23. The majority of these were used to fund capital expenditure and repayment of debt, which accounted for 73 and 22 per cent of capital receipts used respectively.

Contact

Email: lgfstats@gov.scot

There is a problem

Thanks for your feedback