Tied pubs - Scottish Pubs Code: consultation 3 – analysis report

This summary presents key themes from the analysis of responses to a public consultation on a Scottish Pubs Code for tied pubs (the Code). This was the third consultation on this subject.

5. Gaming machines

The draft Code prevents a new tenant from being required to purchase or rent gaming machines from the pub-owning business or a supplier nominated by the pub-owning business. However, tenant representatives have suggested that existing tenants should have similar rights on gaming machines.

Existing lease terms are not covered by the Code but, to give existing tenants similar opportunities to new tenants, it is proposed that a pub-owning business should not be able to restrict a tied pub tenant from purchasing or renting a single non-tied gaming machine, in addition to any agreement on gaming machines set out in their lease.

Question 18: Do you agree or disagree with the following statement:

tied pub tenants should be able to purchase or rent a single gaming machine per licensed premise, in addition to any gaming machine(s) already provided for in their lease?

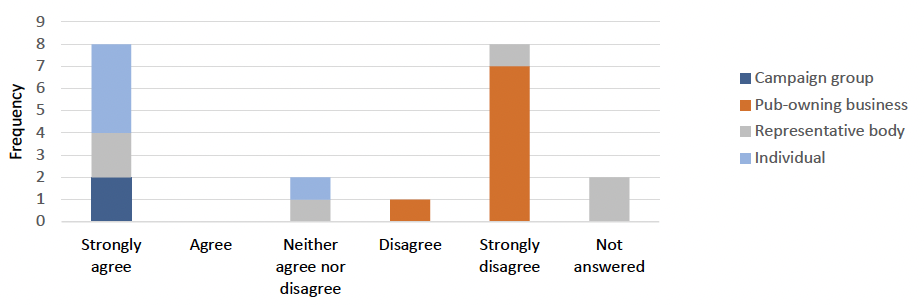

Responses to Question 18 by respondent type are set out in Chart 14 below.

Respondents were divided on this issue with Individual and Campaign group respondents largely strongly agreeing that tied pub tenants should be able to purchase or rent a single gaming machine per licensed premise, in addition to any gaming machine(s) already provided for in their lease. Pub-owning business respondents either disagreed or strongly disagreed.

Please explain your answer.

Sixteen respondents gave their reasons, although in some cases commenting on tied gaming machines per se rather than the single machine covered by the question.

Comments in support of the proposal

The ability to have an additional gaming machine free-of-tie was seen as fairer (Campaign group) and as providing a more level playing field between new and existing tenants (Major representative body for tenants). It would also provide tenants with a greater opportunity for profit (Representative body and Individual respondent) and a more sustainable business (Campaign group). As in respect of guest beers, it was argued that pub-owning businesses should not be allowed to increase rent levels or change other contract terms to compensate for loss of income (Representative body and Campaign group).

Reasons for disagreeing with the proposal

In contrast, it was argued that the draft Code already prevents a mandatory requirement on tied pub tenants to purchase or rent a gaming machine and that this already exceeds the scope of the Act (Pub-owning businesses and the Major representative body for pub-owning businesses). It was also suggested that the tied pubs legislation was intended to give greater flexibility around beer purchase, so gaming machines are outwith this scope, and that there is no evidence to suggest that a tie for gaming machines is unfair (Pub-owning businesses).

Others commented on the impact on existing rental assessments, drawn up using a model by which the share of income from gaming machines going to the pub-owning business is reflected in lower rent for the tenant (Pub-owning businesses and the Major representative body for pub-owning businesses). A new right to obtain a single gaming machine from elsewhere during the term of an existing lease would therefore result in overall loss of income for the pub-owning business, and it was argued to be unfair for the state to interfere with an existing contractual arrangement without compensating the party that is worse off as a consequence (Pub-owning business). The argument that existing tenants should have the same rights as new ones was also seen as flawed, as new tenants who choose to source gaming machines from elsewhere will pay more rent (Pub-owning business).

In practical terms it was suggested that:

- Loss of income for the pub-owning business could be accentuated if free-of-tie machines are placed in more favourable locations relative to tied machines (Pub-owning businesses).

- As pub-owning businesses use reputable companies to count/declare takings, non-declaration of cash could also rise (Pub-owning business).

Question 19: What would be the impact of this proposal on tenants?

Fourteen respondents answered Question 19, in some cases referring to their answer at the previous question.

Respondents who thought that tenants should have the right to purchase or rent a single gaming machine free-of-tie saw positive impacts in the ability for tenants to find better deals, thereby making gaming machines more profitable and tenancies more sustainable (Representative body, Campaign group and Individual respondents). It was also suggested that existing tenants would not be at a disadvantage relative to new ones (Major representative body for tenants).

The alternative view, largely from Pub-owning business respondents, was that rents will increase and tenants will need to comply with additional legal/tax obligations with respect to the takings from gaming machines. Other negative impacts anticipated included:

- New agreements with tied tenants being delayed until the legislation is in place (Pub-owning business).

- Reduced investment in the short term and increased uncertainty (Pub-owning business).

Question 20: What might be the impact on pub-owning businesses?

Thirteen respondents answered Question 20, in some cases referring to their answer at Question 18.

Most of the potential impacts identified were negative, including:

- Loss of income from the gaming machine that is removed (Representative body, Individuals and Pub-owning business).

- Loss of income from other tied machines if tenants put free-of-tie machines in the best locations (Pub-owning businesses and the Major representative body for pub-owning businesses) or switch off tied machines (Pub-owning business).

- Adding complexity to the rent reassessment process in the absence of information on income from the free-of-tie machine (Pub-owning business).

- A risk that unregulated machines enter licensed premises (with a potential loss of tax revenue for the Government) (Pub-owning business).

A potential positive impact, suggested by and Individual respondent, could be existing tenants staying in their tenancies for longer.

Contact

Email: tiedpubs@gov.scot

There is a problem

Thanks for your feedback