Short-Term Let Licensing Implementation Update Report 2024

An update on the implementation of short-term let licensing.

5. Short-term let licensing application levels

Prior to licensing we did not have reliable data about the number of short-term lets in Scotland. While we now have official statistics on the number and characteristics of short term let licensing applications[20], it is important to note this is still a provisional and partial dataset that is subject to upward revision in future releases. This update therefore reports on initial statistics about application levels but does not reflect on these in the context of estimates recorded in the independent research undertaken in 2019. An explanation of why is provided below.

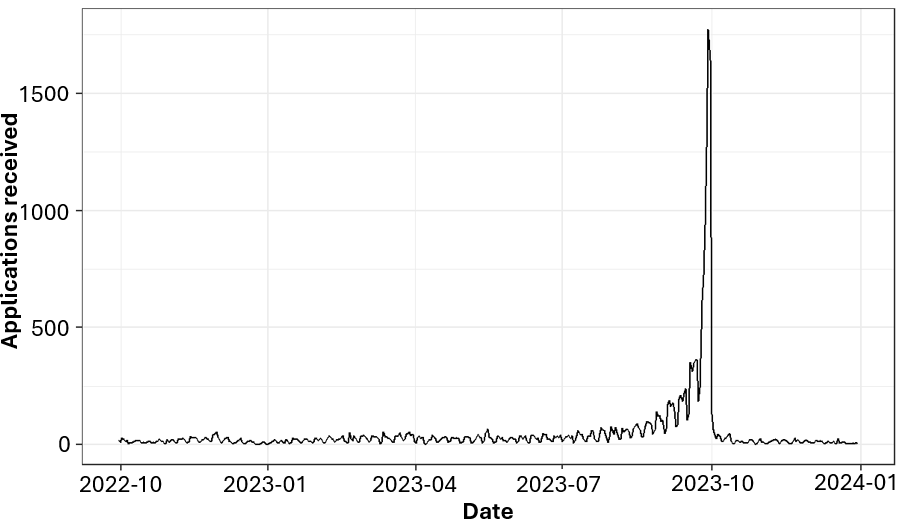

5.1 Application levels – 1 October 2022 to 31 December 2023

The latest official statistical release published on 23 May 2024 provides details of applications for full and temporary licences, and temporary exemptions, which were submitted and validated for statistical purposes by 31 December 2023. These statistics do not include all applications received in this period. Local authorities are not required to include applications in the official statistics that have not been reviewed or are incomplete (classed statistically as unvalidated), however, some authorities have voluntarily included this information in their statistical returns.

At the end of December 2023 the official statistics show there were at least 23,576 applications comprising:

- 14,539 validated applications across all 32 local authorities

- at least an additional 9,000 unvalidated applications across the 23 authorities who supplied data

For monitoring purposes we obtained estimates during telephone conversations with licensing authorities in October 2023, which indicated the total number of validated and unvalidated applications was in the region of 30,000 up to the end of September 2023, although this estimate will be subject to revision as applications are validated.

It is important to emphasise that the number of licensing applications does not equal the number of short-term lets accommodation units[21]. Accommodation on a single premises requires only one short-term let licence, such as for separate bookable rooms in a home-share or bed and breakfast, or multiple yurts in a field. Some authorities have also accepted one application for more than one self-catering unit on the same premises e.g. holiday lodges or cottages. Multiple short-term let accommodation units, which fall under the same short-term let licence are likely to have separate short-term let listings and be counted separately in market datasets, which are based on the number of listings[22]. The number of applications (and licences) will therefore be lower than the number of short-term let units in Scotland.

It is also relevant to highlight that the City of Edinburgh Council designated the whole of the City a short-term let control area in September 2022. Control areas are separate to licensing and have a different purpose, which is to actively manage the concentrations of short-term lets through planning requirements. We note the number of licensing applications in Edinburgh were fewer than expected and a high proportion of short-term lets have not been granted planning permission. This is also true in Glasgow where there are established planning policies already in place.

5.2 Transitional period for existing hosts

Licensing authorities originally had 9 months from the date of an application is made to them to come to a decision. During the transitional phase this was extended to 12 months for existing hosts who may continue trading while awaiting the outcome of their application. In cases where it is deemed necessary to submit a planning application (or an application for a certificate of lawfulness of use or development), the timeline can be paused for up to 3 months.

The fact authorities had a high number of unvalidated applications at the end of December 2023 is not surprising. The vast majority of existing hosts[23] submitted their applications in September 2023, immediately prior to the 1 October deadline.

Licensing authorities have told us many applications were incomplete, mainly lacking documentary evidence about mandatory licensing conditions such as electrical and gas safety certificates. Authorities have supported and continue to support applicants to resolve issues, which has enabled existing hosts to continue operating with minimal disruption and avoided unnecessary licence refusals. However, this has been resource intensive for authorities and presented challenges with the timely processing of applications.

Licensing authorities have adopted processes for considering applications within the statutory timeframe. Some applications have been suspended under the transitional provision to enable applicants to apply for planning permission or obtain a certificate of lawfulness of use or development and these licence applications will be determined by 1 January 2025. The Scottish Government has facilitated forums for the sharing of practice between authorities to support implementation.

5.3 Outcomes of licensing applications

At 31 December 2023, nearly half (7,260) of the validated applications received

(14,539) had been determined. Of these almost all (7,085 / 97.6%) were granted a

licence. Discounting IT anomalies (14), just two applications had been refused, one

of which was due to being submitted to the wrong local authority and the other was a

preliminary refusal due to planning (i.e. a refusal to consider the application where

the authority considers the use of the premises for a short-term let would constitute a

breach of planning control). The remainder (146) were withdrawn by the applicants.

5.4 Characteristics of short-term lets

The official statistics of short-term let applications provide a breakdown of the different types of licences applied for (home sharing, home letting, home sharing/home letting and secondary letting) and the type of premises (detached, semi-detached, self-contained flat and unconventional dwelling).

As set out in Table 1, the statistics indicate that for applications validated by 31 December 2023, secondary lettings accounted for nearly four-fifths (79.1%) of all applications, with secondary lettings with a maximum occupancy of between 3 and 6 people comprising over half (52.4%) of all applications. The next most common type of short-term let licence is home sharing (10.6%), for which the most common maximum occupancy category is 1 to 2 people (4.2% of all applications).

| Maximum occupancy | Home letting | Home sharing | Home sharing & letting | Secondary letting | Total by size |

|---|---|---|---|---|---|

| 1 to 2 | 1.3% | 4.2% | 1.3% | 13.0% | 19.8% |

| 3 to 4 | 2.3% | 2.7% | 1.7% | 30.6% | 37.4% |

| 5 to 6 | 1.3% | 1.6% | 0.8% | 21.8% | 25.5% |

| 7 to 8 | 0.5% | 0.9% | 0.3% | 7.5% | 9.2% |

| 9 to 10 | 0.3% | 0.4% | 0.2% | 3.0% | 3.9% |

| 11 to 12 | - | 0.3% | 0.1% | 0.9% | 1.3% |

| 13 to 14 | - | 0.2% | - | 0.6% | 0.8% |

| 15 to 16 | - | 0.2% | - | 0.5% | 0.7% |

| 17 to 18 | - | 0.1% | - | 0.2% | 0.4% |

| 19 to 20 | - | - | - | 0.3% | 0.3% |

| 21 to 22 | - | - | - | 0.2% | 0.2% |

| 23 to 24 | - | - | - | 0.1% | 0.1% |

| Above 24 | - | - | - | 0.4% | 0.4% |

| Missing data | - | - | - | 0.1% | 0.1% |

| Total by type | 5.8% | 10.6% | 4.5% | 79.1% | 100% |

“-“ denotes that the share rounds to 0.0%

With respect to the type of premises, the majority of validated applications received by 31 December 2023 related to houses, with detached houses comprising 38%, semi-detached houses 14% and terraced houses 10% of all applications. Self-contained flats accounted for 32% of all applications, and unconventional dwellings (such as yurts, camping pods etc.) the remaining 7%.[25]

As this is a partial dataset, given the significant number of applications which are unvalidated at the time of this publication, this profile may change as more applications are validated.

5.5 2019 Independent Research

In 2019 the Scottish Government commissioned Indigo House to undertake research[26] to assess the impact, positive and negative, of short-term lets in Scotland, with a focus on communities, particularly on neighbourhoods and housing. Indigo House conducted secondary data analysis, using listings data sourced from Inside Airbnb[27], to consider the incidence of short-term lets in Scotland. Limitations were acknowledged in the report[28], namely that not all hosts advertise their accommodation using Airbnb. However, this was felt to account for a significant proportion of short-term lets based on the available data at that time.

The analysis resulted in a total figure of 31,884 active listings for the whole of Scotland. By way of comparison, this figure is close to the total of 31,000 active listings for Scotland reported by Airbnb in its UK Insights Report[29] from 2018, although below the 35,000 active listings as at 1 January 2019 reported by Airbnb in their submission to the 2019 Scottish Government consultation on short-term lets.[30] One possible reason for the difference is how an “active” listing is defined.[31]

The distribution of the cleansed data was examined, revealing significant geographic clustering. The presence of short-term lets was also compared to the total dwelling stock in Scotland, in order to derive an estimated penetration rate for individual locations. An analysis of hosts was also undertaken including the category of hosts and the number of listings by host.

5.6 New data sources

Since the 2019 research, and particularly in the last year or so, new data sets have been published that could potentially provide useful information about trends in the short-term let sector. These include data published by:

- the Office for National Statistics (ONS)[32], which provides quarterly data (from Q3 2023) on guest nights, nights and stays and monthly data (from January 2023) on hosts, listings and bed spaces for three major online platforms (Airbnb, Expedia Group and Booking.com). If a host advertises on multiple platforms the data is not deduplicated; therefore, the number of hosts, listings and bedspaces, in particular, will be overstated.

- VisitBritain[33] produced by Lighthouse, which provides monthly estimates of the number of listings on four major online platforms (Airbnb, Booking.com, Vrbo and TripAdvisor) across the UK’s nations and local administrative units (LAUs)[34] from 2019. The listings data is deduplicated[35] when the same property is advertised on more than one platform to try to provide an estimate of unique listings across the four platforms.

- VisitScotland[36] produced by Key Data, which provides monthly estimates of the number of listings on Airbnb and Vrbo across Scotland and its 32 local authority areas from January 2023. There is currently no deduplication in this dataset; therefore some properties may appear twice if advertised on both platforms.

However, it is important to note that these data sources are not directly comparable to each other or the 2019 independent research as they differ in their methodology, coverage and time period for which the data is available. Furthermore, they are not directly comparable to the Scottish Government official statistics, which relate to applications for licences,[37] and which, as set out above, are still partial data. It is too early to assess any impact of the licensing scheme given the short period of time the scheme has been in place and the range of other factors which have impacted the sector in recent years including Brexit, the Covid pandemic and the cost crisis.

We will continue to monitor these different sources and work with stakeholders to understand the emerging picture, as licensing embeds.

Contact

Email: shorttermlets@gov.scot

There is a problem

Thanks for your feedback