Student Finance and Wellbeing Study (SFWS) Scotland 2023-2024: main report

Student Finance and Wellbeing Study Scotland for academic year 2023 to 2024 explores student’s financial experiences whilst studying at college and university in Scotland.

5. Education-related income

5.1. Introduction

This chapter reports data from both the survey and the qualitative research to explore the income students received from education-related sources. This focuses on three main types:

- repayable education-related income (student loans for living costs and, where applicable, loans for tuition fees);

- non-repayable education-related income (from sources including bursaries, grants, allowances and scholarships); and

- discretionary funding.

5.2. Key findings

- Students' median total income from all education-related sources ranged from £3,699 for FE students, £6,689 for HN/undergraduates to £9,600 for postgraduates. It was £6,000 for students from under-represented groups.

- In terms of repayable education-related income, the median income was £6,300 for HN/undergraduate students, £7,000 for postgraduates and £6,930 for students from under-represented groups.

- For non-repayable education-related income, FE students received a median income of £3,699; HN/undergraduates £2,305; postgraduates £8,600 and for students from under-represented groups it was £3,861.

- Median income received from discretionary funding was £1,000 for FE students; £700 for HN/undergraduate students; and £500 for students of all levels of study from under-represented groups.

- Around 3 in 10 (29%) FE students said they were not aware of discretionary funding, compared with 26% of those from under-represented groups, 24% of HN/undergraduates and 20% of postgraduate students. FE students were, however, less likely to say they thought they would be ineligible for discretionary funding (19%) compared with all other student groups (28% of HN/undergraduate students).

- In the qualitative research, students expressed conflicting views of student loans. While they were viewed as being essential to cover living costs, repaying student loan debt was a source of anxiety for some participants.

- Students were positive overall about the impact of bursaries in terms of reducing money worries; however, the impact they had for students and their financial experiences varied according to the amount of the bursary.

- The reduction in, or in some cases removal of, FEB and EMA due to attendance requirements, worsened the already precarious finances of vulnerable FE students.

- Discretionary funding was viewed as an important source of income for some students who relied on it to fill in gaps in their finances to cover a range of costs including rent, tuition fees, travel to university or college, and other living costs whilst studying or during the summer break when loan and bursary instalments ceased.

5.3. Total education-related income

Responses from the survey were used to calculate students' total education-related income from student loans; bursaries, grants and scholarships; and discretionary funding. Students' total median income from education-related income is presented for FE, HN/undergraduate and postgraduate students, and for students from under-represented groups.

5.3.1. FE students

Among FE students, the median total education-related income of FE students was £3,699. As FE students are not eligible for student loans, their total education-related income consists only of non-repayable education-related income in the form of bursaries, grants, scholarships and discretionary funding.

- Median education-related income was similar for female and male FE students, and was £2,340 for those 16 to 19, and £3,760 for those aged 25 and over.

- Among those from the 20% most deprived areas, the median total education related income was £3,861, compared with £3,170 from those in the 80% least deprived areas.

5.3.2. HN/undergraduate students

The median total education-related income for HN/undergraduate students was £6,689. This included all three forms of education related income (student loans for living costs; bursaries, grants and scholarships, and discretionary funding).

- Among full-time HN/undergraduate students the median total education-related income was £7,000 while for part-time HN/undergraduates it was £1,500. This is due to part-time HN/undergraduate students being ineligible for student loans and for most bursaries.

- Median total education-related income was £6,930 for female HN/undergraduate students and £6,000 for males. HE students aged 16 to 19 had a median total education-related income of £6,000, while for those aged 25 and over it was £7,560.

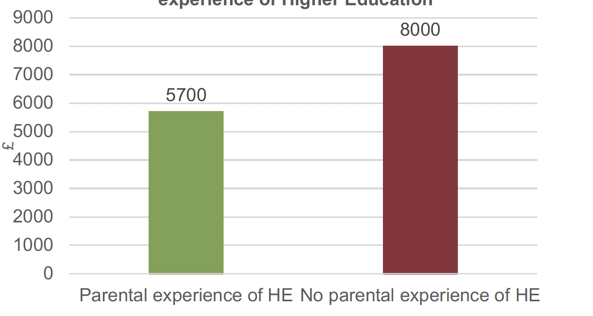

- Median total education-related income for HN/undergraduate students whose parents did not have experience of HE was £7,279 compared with £6,000 among those whose parents had HE experience.

- For those from the 20% most deprived areas, the median was £8,000, compared with £6,003 among HN/undergraduate students from the 80% least deprived areas.

- HN/undergraduate students who lived independently (renting or with a mortgage) received a median total education-related income of £7,000, while those who lived with their parents had a median total income of £6,000.

5.3.3. Postgraduate students

Postgraduate students received a median total education-related income of £9,600.

- Female postgraduate students had a median total education-related income of £9,180, while for males it was £11,400.

- Those postgraduate students aged 25 and over had a median education-related income of £9,000 compared with £13,228 for those aged 20 to 24.

- The median total education-related income for postgraduate students from the 20% most deprived areas was £13,000, and £9,000 for those from the 80% least deprived areas.

5.3.4. Students from under-represented groups

Among students from under-represented groups, the median total education-related income was £6,000.

- The median income for students aged 16 to 19 from under-represented groups was £5,400, and £6,840 for those aged 20 to 24, and £5,985 for those aged 25 and over.

- When looking at deprivation, the median education related income for those from the 20% most deprived areas was £6,377 compared with £6,000 for those from areas with lower levels of deprivation.

- Among students from under-represented groups who lived with their parents the median total was £4,674, compared with £6,350 among those living independently (renting or with a mortgage).

5.4. Student loans

A key source of education-related income for HN/undergraduate and postgraduate students enrolled on Masters and Postgraduate Diplomas is student loans.

Eligible students enrolled on HNC/Ds, undergraduate degrees and postgraduate Masters courses are entitled to apply for a student loan for living costs. FE students, and those who undertake HN/undergraduate courses on a part-time basis, are not currently entitled to student loans for fees or living costs. For Masters students who are studying part-time, only the tuition fee loan is available. The amount of living cost loans HN/undergraduate students are entitled to is dependent on 1) whether they qualify as a young (under 25 years) or independent student (25 and over) and 2) their household income, with higher levels of loans available to those from lower income households. At the time of the research (2023 to 2024), living cost loans ranged from £6,000 to £8,000 per year.

In 2023 to 2024, postgraduate students on Postgraduate Diploma and Masters level courses were eligible for a tuition fee loan of up to £7,000 dependent on the course fees, which was paid directly to the institution. Students on these courses were also eligible for a living costs loan of up to £4,500 (for academic year 2023-2024), which was not means tested.

During the research, the Scottish Government announced the provision of increased financial support for students from the start of the 2024-2025 academic year. The new Special Support Loans will see total funding for HN/undergraduates rise by £2,400 to £11,400 for those students with a household income of less than £21,000. The Special Support Loan of £2,400 will also be provided in addition to the £9,000 Care Experienced Students' Bursary, but will not apply to Paramedic, Nursing or Midwifery students (who receive a non-means-tested, non-repayable annual bursary), part-time HN/undergraduates or FE students. For postgraduates, the uplift will see their funding rise to £13,900.

Repayment of both HN/undergraduate and postgraduate loans begins the April after a student graduates, but payments are not taken until students earn above a threshold, at the time of the research this was set at £27,660. Repayments are made directly to the Student Loan Company from graduates' wages and consist of 9% of their income earned over the threshold. At the time this research was carried out, the interest rate was set at 6.25%.

The following sections consider first the total repayable education-related income received by students who responded to the survey, before then considering the qualitative findings around students' experiences of and attitudes towards student loans.

5.4.1. Total repayable education-related income

This section reports on the survey data which are used to calculate the median income received by students from repayable education-related sources i.e., student loans. As FE students do not receive student loans, this section reports only on HN/undergraduate and postgraduate students enrolled on eligible Masters or Postgraduate Diploma courses.

HN/undergraduate students

Almost half (49%) of HN/undergraduate students received education-related income through student loans. As only students who were Scottish-domiciled were eligible to take part in the study, this section relates to living cost loans only. Part-time HN/undergraduate students are not eligible for living cost loans.

- There was little difference in the proportion of female and male students who had income from student loans, however, there were differences in terms of age, with 55% of those aged 16 to 19 reporting that they received income from student loans compared with 38% of those aged 25 and over.

- Two-fifths (40%) of HN/undergraduate students who lived with their parents received income from student loans, compared with 54% of those living independently (renting or with a mortgage).

The median total repayable income from student loans for HN/undergraduate students was £6,300 during the academic year 2023 to 2024.

- The median was £6,000 for those aged 16 to 19, and £7,785 for those under 25.

- HN/undergraduate students whose parents had no HE experience had a median income from student loans of £7,000 (compared with £6,000 for those with a parent with HE experience).

- HN/undergraduate students from the 20% most deprived areas had a median income from student loans of £7,938, while those from the 80% least deprived areas had a median income from student loans of £6,000.

Postgraduate students

Among postgraduate students, only those enrolled on Masters or Postgraduate Diploma courses are eligible for tuition fee and/or living cost student loans. A quarter (25%) of postgraduate students had some form of student loan (tuition fee and/or living costs loan).

- Among those aged 20 to 24, 37% received income from student loans, compared with 23% among those aged 25 and over.

- A higher proportion of postgraduate students who lived with their parents received income from a student loan compared with those who lived independently (renting or with a mortgage), 37% and 22% respectively.

The median total income from student loans (including both tuition fee loans and living cost loans) for the academic year 2023 to 2024 was £7,000 for postgraduate students. Figure 5.1 shows the median total income from student loans of postgraduates whose parents had experience of HE compared with those whose parents did not.

Students from under-represented groups

More than a quarter (29%) of students from under-represented groups received income from student loans.

- More than two-fifths (45%) of students from under-represented groups aged 20 to 24 received student loan income, compared with around a quarter (24%) who were aged 25 and over and around 3 in 10 (29%) of those aged 16 to 19.

- A third (33%) of those who lived independently (renting or with a mortgage) received income from student loans compared with just under a quarter (23%) who lived with their parents.

The median income from student loans for students from under-represented groups was £6,930 in academic year 2023 to 2024. It was £7,000 for female students and £6,300 for male students.

- Among those aged 16 to 19 the median income from student loans was £6,100, while for those aged 25 and over it was £7,740 and similarly, median income from loans was £6,000 for those whose parents had experience of HE and £7,650 for those whose parents did not have HE experience.

- For those students from under-represented groups from the 20% most deprived areas, the median income from student loans was £8,100, compared with £6,300 for those living in the 80% least deprived areas.

- Students from under-represented groups who lived with their parents had a median income from student loans of £6,264 compared with £6,930 for those who lived independently (renting or with a mortgage).

5.4.2. Qualitative findings on student loans

This section outlines the qualitative findings from the interviews and focus groups to explore students' attitudes towards, and their experiences of, student loans. The views of students who were ineligible for student loans are also explored here. The majority of students who took part in an interview or focus group who were entitled to a loan (full-time HN/undergraduate/Masters students) had taken one out.

Decisions to take a loan, and its impact

Students in the qualitative interviews and focus groups had different reasons for deciding whether or not to take out a loan. The main reason for taking out a loan was because students felt their living costs, or fees, would not be affordable without it. This was mentioned by both HN/undergraduate and postgraduate students. For postgraduate students, the Masters loans were viewed as having been critical to them being able to progress their studies as a result of what was seen as the high cost of tuition associated with Masters courses.

Student loans were often viewed as a necessary part of being a student, something which had to be accessed to cover living costs or fees in order to reach the goal of obtaining a qualification. Often, conflicting feelings of being 'scared' about having student loan debt were expressed at the same time as recognising that loans can be helpful. For some, accessing a student loan had enabled them to study away from home allowing them a greater choice of institution.

"It certainly was helpful for getting it [a loan]. On the other side, you've always got in the back of your mind, well, I like this money, it helps me buying things, it helps me buying food […] but you do always know, well, it's got to be repaid at some point. (Student parent focus group)"

"I know that it's something I have to pay back eventually but it is something that I've really needed because otherwise I wouldn't have been able to study away from home. I would've had to apply to [universities in home city]. I would've had to stay at a university closer to home and I feel that that would've really limited my potential because [my university] has a lot of […] resources I wouldn't have been able to access otherwise. (Part-time HNC/HND student)"

While the loan was essential for some students, for those who had other sources of income to rely on it was viewed differently. In these circumstances the loan was viewed as providing a 'backup' or safety net while students waited to hear if they had successfully accessed scholarships or in place of receiving financial support from their parents. Some students who were funded entirely by their parents' financial contributions had chosen not to take out a loan this year, though one had taken out a partial loan previously. This points to the fluidity of the system, with some students moving in and out of the loans system, taking on a loan as and when required.

Attitudes towards student loan debt

Among the interview and focus group participants a range of different attitudes to student loans were expressed, incorporating those who were debt averse and those who were more relaxed about taking on student loans. Their views are outlined below.

Debt aversion

While student loans were perceived as being necessary to cover the costs of studying, the prospect of repaying them could be a source of worry and anxiety. Student loans were described as 'scary' and 'intimidating', and students spoke of their 'fear' and 'dread' at having to repay them. In some cases, worries about repaying student loans exacerbated students' existing financial worries. This was particularly the case for students whose student loan was their main source of income and for those who were unable to rely on financial contributions from family. A fourth year student who was estranged from their family spoke of how 'terrifying' it was when they calculated that they owed 'nearly £25,000'. They compared their experiences of finance with those of their peers who the student felt were able to rely on the support of their parents (both financial and non-financial) and reduce or completely avoid student loan debt.

"I did the unthinkable and double-checked how much I'm going to have to pay back. I owe SAAS nearly £25,000. That's terrifying […] The last two years have been an eyeopener. Some people do in fact have the support that means they will graduate university in Scotland loan-free, debt-free. The eyeopener is that the fact that you can get a higher loan for being in direr circumstances is great while you're studying but it completely screws you over afterwards because you have a higher level of debt to pay back than your peers who maybe were fine taking the minimum amount. (Estranged student focus group)"

While SAAS process and assess student loan applications, loan payments for living cost loans and repayments are handled by the Student Loans Company. However, when discussing their student loan debt, all of the students we spoke with linked this debt to SAAS rather than the Student Loans Company. It was also common for students to refer to their 'SAAS loan', rather than recognising the funding as being provided by the Scottish Government. This points to a lack of knowledge and understanding among students as to how student loans work.

As a result of concerns about debt, some students who were fully funded by their parents' financial contributions chose not to take out student loans, or to take partial loans to reduce their overall debt.

"[The loan] wasn't the maximum I was entitled to. I was applying for it and I didn't feel compelled to go into more debt just to have more money now. I wouldn't be spending it on anything useful, so I just figured out the amount I needed roughly, and I put that as £2,000. (Full-time undergraduate student)"

The prospect of repaying student loans was a source of anxiety, particularly for students with experience of poverty or financial difficulties growing up, and for those who had had to rely on commercial debt. Care experienced students in receipt of the CESB expressed relief that they were not entitled to take out student loans. Whilst student loans differ to commercial debt in terms of their terms and conditions, interest rates etc, students were nonetheless fearful of student loans, particularly those who had used commercial debt in the past.

"I've got really, really bad debt anxiety. The thought of being in debt really does scare me because once you're in it, it can be really hard to get out of. As much as it is really good that they give people the loans, it's also really daunting. (Care experienced student focus group)"

Rising interest rates were a source of concern for those who were worried about repaying their student loans. HN/undergraduate and postgraduate students from a range of different backgrounds mentioned the impact of the recent rise in interest rates as a deterrent to taking out student loans. Research participants who had previously taken out a student loan at a time of low interest were taking steps to repay it early to minimise the impact of rising interest rates.

"When I was in high school my teachers told me it's a good idea to take the SAAS payment, 'they're very low interest'. Because I think it was at about 1% and, yeah, now it's up to 6% which would make me a bit reticent I guess to go and take out more student loans from SAAS. (Full-time undergraduate student)"

Limited concern about student loans

Not all students who participated in the qualitative research expressed concern about repaying student loans. Some said they did not know, or were not yet thinking about, how much student loan debt they had accrued so far. There were students (both HN/undergraduate and postgraduate) who said they had not calculated the amount of student loan debt owed so as to avoid thinking about it. Others were not as actively concerned about student loans because they were of the view that they would never earn enough to repay the debt in full, or because they were dealing with more pressing financial concerns such as not being able to afford basic essentials.

"It's almost something I don't think about, the fact that I need to pay it back. They're just the least of my worries, basically. (Estranged student focus group)"

"Future me's problem, frankly. I don't earn to be able to pay it off. Honestly, I couldn't even tell you how much I owe. It is so far from the realm of an issue for me right now. I know that it will come back at some point, but as long as I'm not actively adding to it at the moment, which I am lucky to not be in an overdraft, to not have taken out loans, etc., yet. Although it's looking more likely that I might have to. Yes, it's just not something I'm even - I don't think it bears consideration! I've still got a couple of years left. I'm so far away from earning enough. (Postgraduate student focus group)"

Students' beliefs in their ability to repay their loan were also linked to subject studied. Some said they were not worried about repaying their loans as they were comfortable about securing work after they completed their studies. This was particularly the case for those students enrolled on courses which led to careers in specific professions.

"I'm no' worried about the fact that I'll have to pay it. I think also, though, that might be quite attached to the fact that I'm studying [a degree in the professions] so I know the chances - when I get out of uni, I'm no' really gonnae struggle to find a job because they're in high demand. So maybe if I'd chosen something different, it'd be something I'd be a bit more worried about but I'm no' too worried. (Care experienced student focus group)"

Knowledge and understanding of student loans

A key factor in how students viewed taking out and repaying a student loan was the extent of their understanding of the student loans system. Some qualitative participants, from all qualification levels, displayed a poor understanding of how student loans work, and the terms and conditions attached to repaying those loans. For example, some students were vague as to whether or not the money they were awarded from SAAS was a loan or a bursary, or what the ratio of loan to bursary was within their SAAS payment. A student expressed relief upon realising during a focus group that their Paramedic, Nursing and Midwifery Student Bursary did not have to be repaid. Some postgraduate students reported that they were unsure whether they had taken out a loan as an undergraduate or what level of loan they had received, and at what point, for fees and/or living costs.

Students shared that they received limited information about the student loan before deciding whether to apply for one. They recalled their school teachers saying student loans were 'interest free', noting how this differs to the situation at the time of the research, when the interest rate was 6.25%. Others questioned the perceived lack of awareness around student loans and the ease with which students took them on, with little discussion of what the implications are in terms of repayment. There was a desire for more discussion at colleges and universities 'about the risks of getting yourself into debt' to help improve students' awareness. A student expressed concern that student loan repayments may affect their credit ratings. This is not the case, but it highlights the lack of understanding of the terms and conditions attached to student loans.

"I feel like a lot of people aren't aware of the actual risks of taking loans out and stuff because it's just easy-access money. Nobody is thinking, 'oh, I'm gonnae need to pay that back'. Then if you don't pay it back, your credit has bombed. So I feel like there should be a bit more awareness in learning places. (Care experienced student focus group)"

By contrast, there were some students who felt more comfortable with the idea of repaying their student loans. They found reassurance in their knowledge of student loans' terms and conditions, such as the fact that repayments do not begin until such time as you are earning over a specific threshold, that monthly repayments are generally small, and that the repayment period is time limited. Some suggested that because of the way repayments were linked to income, they may never pay off their loan in full.

"The thing about having a SAAS loan, right, is that you only have to pay back in increments. Those increments are relative to how much you earn. So, if you don't earn enough money in the future, you don't have to pay it back, and it's written off after 30 years, 35 years, something like that. (Postgraduate student focus group)"

FE and part-time HN/undergraduate students' views of loans

The qualitative research also explored the views of students who were not currently entitled to student loans, such as students studying FE or part-time HN/undergraduate courses. Some students expressed a desire to receive a student loan as a means of allowing students to undertake less paid work, experience less anxiety and focus more time on their studies.

"I would probably be taking it if it was so I could take more time off work and more time studying because that's…at the moment I struggle to find time to study outside of going into college and that sort of thing. (FE student focus group)"

However, other FE students expressed reluctance to take on student loan debt, saying they would do so only as a 'last resort' due to their concerns about repaying them. A lack of knowledge as to how student loans work was also evident among FE students, partly as a result of not exploring loans as a result of not being eligible for them. FE students who planned to progress to an HNC/D level and had researched their funding, had a better understanding of loans.

"I'd probably feel quite weird about [taking a loan], to be honest, because I don't know, the word loan is quite a scary thing to think about when you're quite young. I don't think I would shy away from it, but I think it'd be a last resort. (Full-time FE care experienced student)"

5.5. Non-repayable education-related income

5.5.1. Introduction

As outlined at the start of this chapter, non-repayable education related income is made up of a range of different sources of funding. These include non-repayable bursaries, grants and allowances funded by the Scottish Government for particular student groups or courses of study. A full list of bursaries, grants and allowances that were available to students at the time the research was undertaken in 2023-24 is included in Annex A.

Non-repayable education related income also includes students' scholarships. These may be provided by the students' university or college, an independent funding body or, in the case of postgraduate students only, the UKRI Research Councils.

5.5.2. Total non-repayable education-related income

This section reports on the survey data relating to students' income from non-repayable education-related income which, for ease, will be referred to as bursaries, grants and scholarships. However, it should be borne in mind that different groups of students are eligible for different types of non-repayable education-related income (see Annex A for further details).

FE students

Almost two-thirds (64%) of FE students received non-repayable education-related income. There were no significant differences by subgroup. The median total income for FE students from bursaries, grants and scholarships was £3,699.

- For FE students aged 16 to 19 the median income from these sources was £2,340, while it was £3,760 for those aged 25 and over.

- FE students who lived in the 20% most deprived areas had a median income of £3,861 from bursaries, grants and scholarships, compared with £3,150 among those living in the 80% least deprived areas.

HN/undergraduate students

Around two-fifths (42%) of HN/undergraduate students received some form of non-repayable education-related income from bursaries, grants and/or scholarships. As shown in Table 5.1 the following were more likely to receive this type of income:

- Those aged 25 and over compared with those aged 16 to 19.

- Students living in the 20% most deprived areas, compared with those living in the 80% least deprived areas.

- Students living independently (renting or with a mortgage) compared with those living with their parents.

- Full-time students compared with part-time students.

The median total non-repayable education-related income for HN/undergraduate students was £2,305. It was £3,000 for full-time HN/undergraduate students, and £1,128 for those who were part-time. The median total income from bursaries, grants and scholarships for each of the sub-groups is shown in Table 5.1.

Student characteristics |

% |

Median (£) |

|

|---|---|---|---|

Sex |

Female |

42 |

3,500 |

Male |

43 |

1,711 |

|

Age |

16-19 |

38 |

2,000 |

20-24 |

44 |

2,000 |

|

25 and over |

43 |

3,600 |

|

Full-time / Part-time status |

Full-time |

49 |

3,000 |

Part-time |

20 |

1,128 |

|

Area deprivation (SIMD) |

20% most deprived areas |

50 |

2,500 |

80% least deprived areas |

40 |

2,240 |

|

Accommodation |

Living with parents |

37 |

2,000 |

Living independently (with a rent or mortgage) |

44 |

3,000 |

Postgraduate students

As postgraduate students are not eligible for bursaries, the main sources of non-repayable education-related income available to them are scholarships – from their university, an independent funding organisation or the UKRI research councils.

Almost half (47%) of postgraduate students received some form of non-repayable education-related income. Nearly three-fifths (58%) of those aged 20 to 24 received non-repayable income, compared with 45% of those aged 25 and over. Postgraduate students received a total median income from bursaries, grants and scholarships of £8,600.

- This was £7,900 for female students and £9,100 for male students.

- Postgraduate students whose parents had HE experience received a median income of £9,500 from non-repayable education-related income, while for those whose parents did not have HE experience it was £6,930.

Students from under-represented groups

Over half (55%) of students from under-represented groups received income from non-repayable education-related sources.

- Over half (57%) of those whose parents had experience of HE received this type of income compared with 50% of those whose parents did not have experience of HE.

- Around three-fifths (62%) of students from under-represented groups living in the 20% most deprived areas received some form of bursary, grant or scholarship, compared with just over half (53%) of those from the 80% least deprived areas.

Among students from under-represented groups, the median income from non-repayable bursaries, grants and scholarships was £3,861.

- The median income for female students was £3,900 and it was £3,000 for male students.

- Students from under-represented groups aged 16 to 19 received a median income of £3,042 from these sources while those aged 25 and over received a median income of £4,066.

- Those who lived with their parents had a median income of £3,600 compared with £4,050 for those who lived independently (renting or with a mortgage).

5.5.3. Qualitative findings on bursaries

The only grant that students who participated in the qualitative research had not received was the Dental Student Support Grant. This section considers how students accessed a range of bursaries, their impact and barriers. As postgraduate and part-time FE and HN/undergraduate students are not entitled to bursaries, this section is focused on full-time FE and HN/undergraduate students only. As the numbers of students in receipt of each type of bursary were small, this section explores students' access to bursaries more broadly, including any factors that made accessing bursaries easier or more challenging, and their overall impact, rather than looking at each type of bursary individually. However, where relevant, issues pertaining to specific bursaries are explored.

Several key themes emerged in discussion with students around access to bursaries. These related to awareness and understanding of available bursaries, application processes and evidence required of students to prove they met the eligibility criteria. Each of these is discussed below.

Awareness and understanding of available bursaries

Students' awareness of bursaries available to them was mixed. Those in receipt of FEB, EMA, YSB and ISB were generally aware of bursaries on offer and noted that their household income made them eligible for these. Some FE students had found out about the FEB when they applied for their course, with college staff said to have encouraged them to apply for the bursary at the same time. Others, however, had less positive experiences, stating that they had to find out the information for themselves. Students were critical of the lack of information about bursaries on college websites, and had to contact their college to check for their eligibility and what information was required as part of the application process.

"So when I applied for the college, they sent us all an email saying make sure you apply for your funding and they basically hammered it into us you know you apply for it. They were very on top of making sure we'd applied for what was available and we've been getting emails recently that there's a one off grant available and that sort of thing, so any opportunity that comes up for funding they do let us know. (FE student focus group)"

"No, I wasn't sure at all until I got this email - I'm eligible and how much money I will get. Before that, I didn't know nothing. There weren't that much information in the website. (Full-time FE student parent)"

All care experienced student participants were aware of the CESB, having found out about it via different sources. Some recalled that they heard about it from their school teacher while others had only discovered it whilst doing their own research. A student who was in kinship care highlighted the importance of having received advice from a school teacher who helped them understand they were care experienced and therefore entitled to a CESB, and guided them through the application.

"No, I don't think I would have been able to do it myself. It's just like the questions just triggered me a bit, like because I didn't even know what like Kinship Care meant until I was sitting with my teacher and she was telling me. I wouldn't have known what [option] to pick. […] I didn't even know you could access they kind of stuff. So no I probably wouldn't be able to do it my own. (Full-time HNC/HND care experienced student)"

By contrast, the ESB did not appear to be well known among HE estranged student participants, who were in receipt of a range of different types of bursaries, including the ISB and ESB. Some estranged students linked this variation to a possible reluctance among students to self-declare as estranged. It was suggested that students may be more willing to identify themselves as estranged if they were made more aware (via both SAAS and their college or university) of the range of financial support available to students who are estranged. Students (both estranged and others) noted that the onus appeared to be on students to find information for themselves rather than receiving assistance to navigate the system.

Estranged students also expressed some confusion in relation to bursaries with some questioning whether they had received the bursary they were eligible for. There were also some estranged students who said they had 'ticked the box' but had been refused a bursary and received only a loan. They faced additional financial challenges as a result.

"I just didn't get the bursary. That's what confused me so much. If I can get the loan, then why can I not get the bursary along with it? That's why I'm struggling so much, because I don't get the bursary along with it so I don't get half as much as what I should to live with. (Estranged student focus group)"

This confusion extended beyond estranged students. An undergraduate student who was eligible for a bursary did not apply for it because they did not think it was possible to do so without accessing, in their case, an unwanted loan. This meant they potentially missed out on an additional £50 per month.

Application processes

Students had varied experiences of applying for their bursaries both through colleges and SAAS. Some students, including those accessing a range of different bursaries, found it straightforward to apply to their college or SAAS for a bursary. Others found it more difficult. This could be due to the challenge of explaining nuances of their family's financial situation, for example, where parental or household income had been impacted by recent job changes it was not always clear how to explain this in the forms. It was also the case that the process of understanding the questions and completing application forms could be challenging, and this could have knock on effects on students' ability to access the funding. For example, there were students who made mistakes when completing their application which led to delays in receiving their funding.

Providing evidence to prove eligibility

In the interviews and focus groups, students also explored issues relating to the need to provide evidence relating to their bursary applications for both colleges and SAAS. While providing evidence was straightforward for some students, others felt the level of evidence required was intrusive. Student parents, disabled students and estranged students all raised challenges in providing evidence to access bursaries. The volume of evidence required of students, and the difficulty of collecting some evidence (e.g. on estrangement, disability, or their children if they were applying for childcare support) was also problematic for some. Students described the experience of providing evidence for their applications as 'stressful'. Estranged students also discussed some of the challenges associated with having to prove their estrangement in order to access their funding, particularly those who became estranged in the midst of their studies. They also highlighted the frequency with which they were expected to prove their estrangement, noting how stressful it could be having to provide the same evidence each year despite their personal circumstances not changing during that time.

"It's like how can you re-prove that you're still estranged from your family? How can you be like, 'Yep, still ongoing'? It's just - I don't know - hard for estranged students. (Estranged student focus group)"

"For me, when I was filling out the letter thingy and that, they wanted social work stuff and I didn't have that. Then I had to get a letter from the doctor but I didn't have that either. At the time, I hadn't had any support from anyone except from my high school. That's how I got my estranged bursary the first time so I thought that should get me it the second time and if they need anything else, they can let me know. It just automatically got rejected and I didn't have any other proof to show them that I was estranged so I was just left. 'We know you're estranged. I've seen that but we can't give you it because you don't have enough proof.' (Estranged student focus group)"

The impact of receiving a bursary

Students were positive overall about the impact of receiving bursaries. They spoke of how bursaries reduced their worries about paying bills or, for those in receipt of CESB or PNMSB, removed worries about accruing student loan debts. Some said they felt under less pressure to have to supplement their income with paid work or that they were less reliant on their overdraft as a result of receiving a bursary.

"I mean it has been very helpful because it pays for my bus fares and my food so I don't have to worry…and the electricity and that sort of thing so I don't have to worry too much about…I don't have to work if I don't need to but I'd have to budget extremely well for it and it would be… I probably would be going into my overdraft or having to take out a couple of loans if I didn't have that sort of thing. (FE student focus group)"

The impact of bursaries varied according to the size of award. For those students funded entirely through bursaries (some students with FEB, or those in receipt of CESB or PNMSB) the perceived impact was considerable. This was especially the case for those receiving relatively large payments from FEB which covered both accommodation and other costs. Care experienced students highlighted the benefit of not having to worry about student loan debt and the broader impact this could in turn have on mental health and ability to socialise. It was also viewed as a means of helping address some of the additional challenges care experienced students may face.

"I guess it's great that care experienced young people can access that [CESB] and no' have to worry about loans. It definitely is a small thing that they can do to try and even the playing field. (Care experienced student focus group)"

Where students received smaller bursaries (e.g. FEB topping up Universal Credit or ISB/YSB), the reported impact was understandably smaller. Nonetheless, even those students who were receiving £28 top-ups to Universal Credit or £50 per month YSB spoke of how they had benefitted from this in terms of being able to, for example, pay for their travel between home and their college/university. Those who were not eligible for bursaries also commented on the ways that bursaries could help students to remain in college and reduce their financial stress.

"It's great for students who don't have as good a financial stability as others, and it helps them still be in college while also not having to worry as much about whether or not they can pay their bills, or pay even for food. I think it's really good to keep people in college as well. (Full-time FE student)"

Barriers to accessing bursaries

Students also highlighted several aspects which minimised or counteracted the positive impact of bursaries.

A particular barrier for FE students was the reduction (or removal in some cases) of FEB and EMA payments in response to poor attendance or lateness. Students receiving these bursaries are eligible on the basis of their household income, yet several students who participated in the qualitative research said their FEB or EMA had been cut or removed entirely. Other students spoke of peers who had been impacted by this or were themselves fearful of it happening. Students recognised that colleges needed some way of ensuring that those in receipt of a bursary attend college. However, they called for colleges to be more understanding of the circumstances students may face. This included student parents who missed classes to care for sick children, disabled students whose physical or mental health conditions made it difficult to attend college every day, as well as students who reported that were unable to afford to travel to college every day.

"You have to keep your attendance above 90% which […] back when I was doing the other qualification I did struggle with because my mental health wasn't great. So attending in class was really hard for me so it does…again for some of the people that I go to college with if its 80% you do get a portion of your bursary but anything under80% attendance for the period they look at, you don't get your bursary so it can be a bit worrying if you have to take a couple of days off and that sort of thing. (FE student focus group)"

In some instances, this approach to FEB or EMA worsened the already precarious finances of vulnerable students. For example, an estranged student had their bursary top-up removed after missing classes as a result of their worsening mental health. This led to the student not being able to afford to use heating in the middle of winter.

As outlined above, issues with bursary applications and submitting the correct evidence meant that some students experienced delays in receiving their bursary funds. This caused additional stress for students who were unsure if they would receive their funds, and led to increased financial instability for others who had to borrow from family and friends to tide them over until their bursary was received.

"You have to wait ages for a decision. I was accepted in June after I had to do like a little interview with them. I got all the forms in a week after I got accepted, I got all the forms together and I got them in. I didn't get my acceptance letter till a week before I started college, I started in September. So it was stressful, thinking are they going to pay the tuition, pay the fees, will I get a bursary? (Full-time FE student parent)"

Eligibility rules in relation to HE funding meant that some students who could benefit from a bursary missed out. Barriers relating to the number of years a student can access HE funding for were raised by students in a focus group with care experienced students. HN/undergraduate students in receipt of the CESB receive two additional years of funding to support those who start study but are unable to continue. However, care experienced participants did not express awareness of this. One of the care experienced HN/undergraduate students had used up their allocated years of funding, meaning that they were no longer eligible for the HE CESB. There was a consensus that care experienced students may move in and out of education courses for some time before they find the right course for them, by which time they may have used up the funding they are eligible for. Care experienced students highlighted experiences of trauma which have the potential to impact on educational decision-making.

"I think because of what I went through when I was younger and stuff, I was dealing with a lot - PTSD and stuff like that - for years. Looking back, had I been in the right place to make the decision to have just not tried to go to university, that would have been for the best and then I still would have had access to funding. Again, when you're young, if you don't have a family to support you, it's hard to see that. I was always just trying – 'oh, this is what everybody else my age is doing. I need to be doing this'. Then because of these issues that you're facing also, it makes it harder. Then maybe, I think, by the time you've come through some of the things that come along with being care experienced, you realise, 'oh, actually, I've hit this age limit and aged out'. So you're kind of left, I guess. (Care experienced student focus group)"

5.5.4. Qualitative findings on additional governmental support for specific groups of students

In addition to loans, bursaries and discretionary funding, the government also provides additional support to specific groups of students who meet a defined set of eligibility criteria. This includes disabled students, student parents, care experienced students and carers. Students who participated in the qualitative research discussed their experiences of receiving such support.

Disabled students

At FE level, disabled students can apply to their college for additional support funded by the Scottish Government, such as travel costs. FE students with additional support needs may be eligible for funding from the Additional Support Needs (ASN) for Learners allowance, which provides allowances for additional support materials, non-medical personal help (NMPH) and extra travel costs.

HN/undergraduate and postgraduate disabled students with a range of disabilities, are eligible for the Disabled Students' Allowance (DSA) which similarly provides allowances for additional support materials, non-medical personal help (NMPH) and for large support items such as laptops, ergonomic equipment, and disability-related software.

Disabled students who participated in the qualitative research were from all study levels, from FE to postgraduate study. Only a small number of students who said they had a disability or a long-term health condition had applied for the Disabled Students' Allowance or the ASN for Learners allowance. Reasons for not applying for this support included: not knowing the support was available, not knowing if they would be eligible for support or not requiring additional support. For example, an HE student with hearing loss who needed to self-fund purchase of equipment to help them engage with lectures and tutorials, was not aware of DSA. Students with mental health conditions or impairments were among those who did not know if they would be eligible for support. There were disabled students who felt that college and university support for disabled students was not well advertised which made it more difficult for students to know support was available. In some instances, even when students became aware of support, they faced challenges making an application due to a lack of response from their institution's support team.

"I think the way it is at college if you don't ask then they don't tell you basically hey. I think that's kind of how the culture is. They don't tell you 'oh you could be entitled to this', it's more you have to find out yourself. (Full-time FE care experienced student parent)"

In contrast, disabled students who had applied for DSA or the ASN Learners Allowance, did so after their institution made them aware that they were eligible for this support. This occurred because students had declared a disability when they applied to study at their institution. There were students who were offered support with their application from a disability advisor and as a result they found the application process straightforward. In comparison, there were students who completed the application without support and found it long and repetitive.

"I think for me the funding they have in place is great and there's a lot of sort of grants that you can apply for if you need, like, I'm dyslexic so I've applied for that one as well where you can get the materials paid for that you need extra, like if you need assessments printed on coloured paper or anything you can get an extra grant for printing and that sort of thing. […] [the application] it was alright, they always feel to me very longwinded but it makes sense you need to know everything, incomings and outgoings and that sort of thing. It does feel very repetitive at times because you're constantly trying to get the same things. (FE student focus group)"

Disabled students received a variety of support equipment such as laptops, ergonomic equipment and disability-related software. All were positive about the impact of receiving this equipment, though some faced a delay in receiving their equipment due to making errors in the application.

"When I got accepted at the university, I had to get in contact with the Disability Team at the university and I had to send all my assessments that I had done […] when I was doing my degree and send them all that information and it actually took ages for it to come through. I don't know why it took so long, there were things wrong and I had to do this and I had to do that and it took quite a wee while. […] It gave me a specialised chair that would support me, it gave me a laptop, it gave me programmes on the laptop. I got a laptop thing to put the laptop on when you're in bed. I got a thing to rest my arm on when I'm on the computer so that's the kinds of things it gave me and it gave me somebody to read through my work and let me know what they thought. (Part-time postgraduate (Masters) student carer)"

"I'm dyslexic so I know about DSA […] The university told us previously when we started that you can get that. […] I contacted the Disability Services and then they basically…gave me a Disability Advisor and then I had a meeting with her and she filled out the majority of the paperwork for me. […] It was really good actually yeah. It was all done fairly quickly and the uni had all our stuff done within like a couple of weeks and processed. […] my Advisor told me so as part of my dyslexia I've got visual stress so I'm getting glasses that are tinted lenses and they'll help with my reading. I can get a printer, there's a whole bunch of stuff that I can get that helps sort of offset having dyslexia to an extent. (Full-time undergraduate student)"

Student parents

Institution-specific support for student parents in FE is available from the Discretionary Childcare Fund, to assist with the costs of childminders, after school clubs, day care, sitter services and pre-school education. Students must apply through their college.

HN/undergraduate students who are lone parents are eligible for the Lone Parents' Grant, an income-assessed grant of up to £1,305, and the Loan Parent Childcare Grant, a grant of up to £1,215, to help with childcare costs. Those on paramedic, nursing, and midwifery courses, who are in receipt of the PNMSB, are instead eligible for the Single Parent's Allowance of up to £2,303, and the Childcare Allowance for Parents of up to £2,466 to cover registered childcare. These are administered by colleges and universities.

Postgraduate student parents are not eligible for any additional support.

Student parents who participated in the qualitative research were from all study levels, from FE to postgraduate study. Almost all said they were struggling financially. Awareness of institutional support available for student parents varied from no awareness to those who had applied for support, both successfully and unsuccessfully.

There were student parents who were receiving support for childcare through their college via the Discretionary Childcare Fund or the Lone Parent Grant. For some, this funding covered all their childcare costs while others needed to top it up with income from paid work.

Student parents who were not receiving childcare support through their institution were either not aware that this support was available, or they did not need this support. Those who were only made aware of support as a result of participating in the research expressed frustration that they were not made aware of this funding. There were student parents who used free informal childcare support from family and friends because they could not afford to use the childcare support funding as it did not cover the full cost of their childcare. Without the support of family to care for their child, they suggested they would not have been able to study.

"I'm quite lucky with my childcare costs, my [family member], she watches my baby. And my other two are at school and she's not charging so I'm quite lucky when it comes to that. If there was childcare involved, I would have to really think twice about going to college because I couldn't afford it. […] I think they pay 80% but even 80% you're still left with 20% and if you've not got that 20%. (Full-time FE student parent)"

Carers

Student carers in FE are eligible for up to £67.55 per week (2023 to 2024) from their college in the form of a dependants' allowance; this is only available for full-time students whose dependant earns less than £67.55 per week, and applicants are required to provide evidence of their Carer's Allowance. There is also some institution-specific support available through discretionary funding.

Student carers enrolled on HN/undergraduate courses may be eligible for the Dependants' Grant, which is an income-assessed grant of a maximum of £2,640 from SAAS (2023 to 2024). Those on paramedic, nursing, and midwifery courses, who are in receipt of the PNMSB, are instead eligible for a Dependants' Allowance, which is an income-assessed grant of up to £3,640 (2023 to 2024). Scholarships and additional funding may also be available at specific institutions, and student carers are eligible to apply for any discretionary funding through their institution.

There is no additional support available for postgraduate student carers outwith the regular funding options.

All the carers who participated in the qualitative research were studying HN/undergraduate or postgraduate courses, with no participants studying at an FE level. None of the student carers disclosed that they were receiving the Dependants' Grant or Dependants' Allowance. Carers were either not aware of institutional support available for student carers or did not think they were eligible for the support.

"There are probably things like emergency funds, crisis funds, that I could tap into if there was a specific reason for it. I don't think I'm eligible - I might be eligible as a carer […] I've not ruled out going to student support if later this year or next we really start to struggle. At the moment I think we're all right as we are and I haven't felt the need to. (Full-time undergraduate student parent and carer)"

Instead, student carers' income came from a range of sources including paid work, bursaries, scholarships, Disabled Student Allowance and social security benefits. The benefits participants accessed included Carer's Allowance, Universal Credit and disability payments - Personal Independent Payment or Adult Disability Payment.

Care experienced students

Some care experienced young people can get support from the local authority. This varies depending on the young person's age and other factors. A care experienced young person aged 16 and 17, excluded from Universal Credit because of the special care leaver rules, should be receiving at least the amount they would otherwise be able to get under Universal Credit from the local authority, which should also provide the young person with, or pay for, accommodation. The local authority is allowed to take account of other income the young person has. More generally, the local authority has a responsibility towards care experienced young people who were looked after by that local authority on or after their 16th birthday. This can be advice, guidance and/or assistance and can include financial help. The responsibility lasts up to when the young person is 26.

Awareness of support offered by local authorities to care experienced young people varied. There were care experienced students who talked about receiving the Leaving Care Grant which they used to buy white goods for their accommodation while they were studying. However, care experienced students were not always aware of this support as soon as they could benefit from it and some only became aware of support once they were no longer eligible for it. Students said awareness of support was determined by the Social Worker they had. If they did not know about a certain type of support, or did not inform the young person of this support, it was possible to lose out on support even if the student was entitled to it.

"There is - through the local authority - a leaving-care grant to help with white goods and things like that which is again something that I got to this year without knowing has been available to me since I was 16. So it was nice to find out about in the end and that does help in terms of the living independently. (Care experienced student focus group)"

"I'm actually quite shocked because I've never heard of that [Leaving Care Grant]. It was never reported to me by social work, by any residential workers. I didn't even know that existed. I'm wondering how long you're actually entitled to that for because I feel like social workers - it should be mandatory for them to disclose that information to people leaving care, especially people that have minimum support and not great financial standing. So I'm really shocked about that. (Care experienced student focus group)"

While this additional support was appreciated, there were students who felt it did not fully cover the additional expenses care experienced students faced.

Applying for additional governmental support

Students who participated in an interview or focus group highlighted that a barrier to receiving additional support was knowing that support was available and that they were eligible to receive it. As highlighted above, there were students who only found out about support available to them because they disclosed that they were disabled, care experienced, estranged, a carer or a parent, either when they started their course or when they experienced financial difficulty. However, not all students felt comfortable disclosing this information; disabled, care experienced and estranged students stated that they felt embarrassed or uncomfortable doing so. As a result, there were students who were unaware of the support on offer to them because they had not disclosed this information.

"When I was younger, I hated attaching the label 'care experienced' to myself. I had very negative views of that and I was embarrassed to ever say. So I think unless you're willing to accept that part of yourself really young, you're really no' ever gonnae be aware of these supports. I think in terms of local authority support, more needs to be done to make it - no' something that you need to ask for or apply for; it's something that's a given to every care experienced young person. (Care experienced student focus group)"

"Sometimes I don't tick the box because I'm like - it's a weird shame thing even though I know I shouldn't be ashamed of it. For me personally, it's embarrassing. Just for me. I don't know if anyone else feels that way. (Estranged student focus group)"

Even when students became aware of support available to them, some still faced challenges access these sources of support because they were required to provide evidence of their eligibility or describe personal details as part of the application.

"You don't really want to go into all your disabilities and all your past and whatnot. Whenever the university asks me do I have a disability, I just say no, even though I may have some. It's just that I don't really want to go into it. I suppose it stems from ignorance that support and funding is available for these sorts of things, for me anyway. (Estranged student focus group)"

5.5.5. Qualitative findings on scholarships

In the qualitative research, eight undergraduate and postgraduate university students were in receipt of a scholarship of some sort. This included UKRI fees and living costs student stipends, university's Access Scholarships which provided living cost bursaries, and fees only scholarships provided by both universities and independent funders.

Scholarships applications

Students' experiences of applying for scholarships varied. Some had made an application for a specific scholarship (to their university or independent funding body) while others said they received their scholarships automatically as a result of the information their university received via their University and Colleges Admissions Service (UCAS) application.

Most students who were in receipt of a scholarship were postgraduates. Some received merit-based scholarships, while others received them on their basis of their student characteristics, such as their care experienced status. However, some students who received a scholarship were unsure who paid their scholarship or on what basis they received it. This was particularly the case for those who received an 'automatic' scholarship.

"I believe it was merit based, I think. They actually didn't give a reason. I actually hadn't even applied for a scholarship. I just ticked a box that was like, 'Enter me into any potential scholarship'. So I got awarded that one. I'm not sure if it was due to my performance previously. I really don't know, but I was just happy to have some fees knocked off. (Full-time postgraduate (Masters) student)"

By contrast, other students had a much clearer understanding of the scholarships on offer at particular universities and this had informed their choice of institution. An undergraduate applied to their chosen university on the basis of the scholarships available there to students from lower income households.

"I was aware that - this is another reason why I applied to [University] is because it has such a large range of the scholarships available, and so I applied because I had that opportunity to gain a scholarship, to have that sort of financial help. So, I learned about it through the University website and the application process, I emailed and corresponded with the University at different points in time, just to understand a bit more about it. I filled out an application form which was really easy as well. I think when these things are intimidating, it would definitely put people off of applying. But the University made it quite seamless, I would say. (Part-time HNC/HND student)"

Among postgraduate students enrolled on PhD courses, differing experiences and perspectives were expressed with regard to the availability of UKRI PhD studentships. Two students who received them said it was a straightforward process and that the scholarships were easy to apply for and access. However, other PhD students noted that this did not reflect their experience, that there were fewer studentships available in specific fields, and highlighted the high levels of competition involved in accessing studentships. Some called for additional funding to be made available to those studying in the arts and humanities.

More broadly, students who did not receive a scholarship spoke of their awareness of scholarships and the various criteria attached to them. They referred to a range of other scholarships available through individual universities and, in some cases, the very specific criteria attached to them, such as geography- or subject-based conditions. The 'fierce' competition attached to these was enough for one student to decide not to apply for scholarships offered through their university. Others relayed the difficulty they experienced in finding appropriate scholarships that they would be eligible for. This was particularly the case for postgraduate and part-time undergraduate or postgraduate students who noted they were ineligible for some of the additional supports offered through their universities. Additionally, some postgraduate and undergraduate students highlighted the fact that they did not meet the specific criteria attached to some scholarships.

"I had a look around. I didn't think I was eligible for any of it. The scholarships that I saw for the area I was doing the Masters in appeared to be - and rightly so - directed towards international and Commonwealth students. If there were any for someone in my situation, I didn't see them. (Part-time postgraduate (Masters) estranged student)"

Impact of scholarships

Among those students in the study who were successfully awarded a scholarship, several positive impacts were identified. The consensus was that there was a reduction in stress associated with worrying about money as a result of receiving scholarship funding. This was also the case for students who did not receive cash directly due to the scholarship paying for their tuition fees or accommodation costs, as it was reported that having these elements paid reduced the financial burden and anxiety. Having a scholarship meant students faced less of a financial struggle and reduced the need for longer hours in paid work. Whilst it did not remove the need for students to access additional funding such as student loans, it nonetheless eased the plight of students.

"I think obviously if I didn't have it, I would have had to get a job, because I wouldn't be able to keep up with the finances and stuff like that. (Full-time postgraduate (Masters) estranged student)"

"It's definitely a huge relief financially. It means that I can focus more on studying rather than earning, I'd say, which is a huge, huge impact. It makes you feel less dreadful about what the next meal is gonnae be or how you're gonnae survive in the next year or so. So, yes, it's definitely good to be able to say that's done and dusted and you don't need to worry about it anymore. (Part-time HNC/HND student)"

An undergraduate student in receipt of an income-based access bursary spoke of the challenges associated with attending university for students from low income backgrounds and the stigma associated with receiving a scholarship. However, the stigma had been reduced through the provision of opportunities to meet others who had been awarded a scholarship.

"There's a lot of stigma, I think, attached to scholarships - well, at least I felt like there was. The University does make an effort, though, to make students feel like it's an asset and not something to be ashamed of. So, when I first joined they had a meet-up and so everyone who had received a scholarship from my course met up together and you realised, wow! I'm not the only person in this situation; there is a huge host of us, which was incredibly helpful. (Part-time HNC/HND student)"

Scholarships were also credited with having allowed students to leave home to study, and with providing students without parental financial support to have some form of a safety net. A care experienced student explained that they had placed their scholarship in a savings account, to be used as and when it was needed for any emergencies that might arise.

"I've not used any of it. I've just put it straight into my savings, which is good because it's a backbone which I didn't have. So if I fall behind rent one month, I can just dip into that. That's kind of like my mum and dad's money in there, which I use if need be but thankfully I've not had to yet. (Care experienced student focus group)"

PhD students receiving UKRI studentships highlighted the benefits of the living cost stipend on their accommodation options. Those living at home with their parents noted that it opened up the possibility of moving out to find their own place or enabled them to save up towards this.

"Yes, so I found because of the tax-free stipend I could afford to move out. The only reason I haven't is because everything is really expensive so it wouldn't be worth my while. This is only a temporary position. It's only three-and-a-half years so I'd rather wait until I had something that was more concrete. But I couldn't have done it in undergraduate. I couldn't have lived in my own - when I was an undergraduate. I couldn't afford to do that, absolutely not. (Postgraduate student focus group)"

The adequacy of UKRI stipends was also discussed by postgraduate students. While it was generally viewed as being adequate to suit students' needs, it should be noted that all of those who received it were younger students without families, and some lived at home with their parents and therefore had lower costs than more mature students with caring responsibilities. One of the UKRI postgraduate students did point out that the stipend is relatively low compared to other countries and that this can impact on students' abilities to manage their finances.

"Focussing on the Research Council for a second, the stipends, they are really - I'm doing okay - but they are really not enough for the average PhD student, particularly touching upon other research bodies. […] it's really not enough especially when you compare it to other countries like Norway for example, how they treat their PhD students effectively like employees. So, you get holiday pay, you get leave, benefits. Sure, you get that here, but not to the extent of what a Norwegian does. If you look at the rates of pay, it's just absolutely night and day so what will happen is effectively you're either going to get your research talent going abroad, or the people that choose to stay here, they're gonnae really slug away with financial difficulties. It's really just gonnae start impacting research work at this point. (Postgraduate student focus group)"

5.6. Discretionary funding

5.6.1. Introduction

FE, HN/undergraduate and postgraduate students experiencing financial hardship can apply for additional support, known as discretionary funding, through their college or university. Institutions receive these funds from the Scottish Government and it is up to institutions to decide how they are administered. They can be used to assist students with a wide range of costs including accommodation, travel, childcare, utility bills. Students must provide their institution's funding or support team with evidence of their income and expenditure, often in the form of bank statements, and the reason for their application. As the discretionary fund is limited for each institution, students may not receive the full support they have applied for, but students may appeal the outcome of their discretionary fund application and can apply to the fund multiple times. Other forms of support may be offered if an application is refused, for example financial advice or guidance.

5.6.2. FE students

Around one in ten (9%) FE students had received income from discretionary funding; 10% of females and 6% of males had done so. In terms of age, 13% of those aged 25 and older received discretionary funding, compared with 6% of FE students aged 16 to 19. The median amount of total discretionary funding received by FE students was £1,000.

Applications for discretionary funding

Although most FE students (83%) had not applied for discretionary funding from their college this academic year, around one-sixth (17%) of FE students had. Almost a fifth (19%) of FE students whose parents did not have experience of HE applied for discretionary funding, compared with 12% of those whose parents had experience of HE.

Asked what the outcome of their application for discretionary funding was, 29% of FE students said they received the money they needed, 28% received money but not as much as they needed, and 43% did not receive any money.

Awareness of discretionary funding

When asked how they knew that discretionary funds were available, the majority of FE students reported that they heard about it from their college, either through student support communications (62%) or from a member of staff at their college (28%). Around one in ten said they heard about it from a friend, family member or colleague (13%) or from the Student Information Scotland website (10%).

Experience of the application process

Among FE students who applied for discretionary funding, two-thirds (68%) said it was 'very easy' or 'somewhat easy' to apply for, while 21% said it was 'somewhat difficult' or 'very difficult' to do so.

Reasons for not applying for discretionary funding

The majority of FE students (83%) said they had not applied for discretionary funding. Students were then asked their reasons for not applying and were presented with 14 answer options to choose from, and asked to select all that applied. The most commonly chosen answer option, reported by 29%, was that they were not aware that discretionary funding was available. A quarter of FE students (25%), who had not applied, said they did not need discretionary funds (18% for FE students from the 20% most deprived areas compared with 29% for those from the 80% least deprived areas). Table 5.2 shows the six most commonly chosen answer options.

Response |

Total (%) |

|---|---|

I was not aware that hardship/discretionary funding was available |

29 |

I don't need discretionary/hardship funds |

25 |

I did not think I would be eligible for this support |

19 |

I do not know – I haven't really thought about it |

16 |

I did not think my application would be successful |

16 |

I am not eligible for this support |

14 |

Unweighted base |

298 |

5.6.3. HN/undergraduate students

Around 1 in 10 HN/undergraduate students (9%) had applied for discretionary funding from their college or university for the academic year 2023 to 2024, with 1 in 20 (5%) receiving income from discretionary funding. While 2% of those aged 16 to 19 received discretionary funding, this was 8% among those aged 25 and over. Almost one in ten (9%) of HN/undergraduate students from the 20% most deprived areas received discretionary funding, compared with 4% of those from the 80% least deprived areas. While just 1% of those living with their parents received discretionary funding, 7% of those living independently (renting or with a mortgage) did so. The median amount of discretionary funding received by HN/undergraduate students was £700.

Applications for discretionary funding

HN/undergraduate students who were more likely to report they had applied for hardship or discretionary funding from their college or university were:

- Students aged 25 and over (14% compared with 3% of those aged 16 to 19)

- Students whose parents had no experience of HE (11%, compared with 7% of those whose parents had HE experience)

- Students from the 20% most deprived areas (14%, compared with 7% of those from the 80% least deprived areas)