Tackling child poverty delivery plan 2018-2022: annex 2

Further technical information annexed within the tackling child poverty delivery plan 2018-2022.

What are the drivers of child poverty?

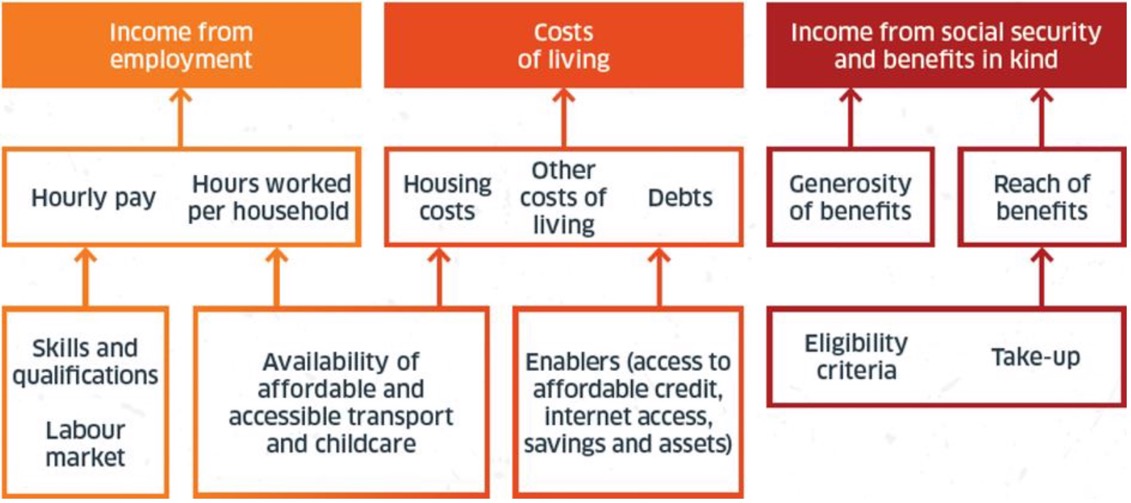

The direct drivers of poverty fall into 3 main categories – income from employment, costs of living, and income from social security. These are summarised in Figure 1 and discussed in more detail below.

Figure 1 – Summary of direct drivers of child poverty

Figure 2 summarises which of these drivers influence which of the targets. Income from employment, income from social security and housing costs influence all four targets. Other costs of living influence the combined low income and material deprivation target.

Figure 2 – Summary of poverty drivers and which targets they influence

We now look at each of these drivers in turn.

Income from employment

Being in employment remains the most sustainable route out of poverty, but it is not a guarantee against poverty. The vast majority of children in poverty live in a household where at least one adult is in paid employment. The number of children in relative poverty where at least one adult is in full time paid employment exceeds the number of children in relative poverty in families where no one is in paid employment, as shown in Chart 1.

Chart 1: Relative child poverty by economic status 2013/14 – 2015/16

There are many children who live in poverty where one adult works full-time, but the second adult either works part-time or is not in paid employment. In households where all adults are in full-time paid employment, although the child poverty risk is much lower (less than 10% for relative poverty), it still exists. This highlights the importance of hourly pay in addition to hours worked per household.

Individuals with higher qualification levels and skills are much more likely to be in employment, and have better employment prospects and higher earnings. However, the number and type of jobs available in the labour market also has an impact on people’s income, through the employment opportunities they have access to.

Education and skills policies that will benefit today’s children, such as the efforts to close the attainment gap, should lead to an improvement in work prospects for older children who may become parents before 2030, and the next generation of parents and children beyond [2] . However, we must be clear here that in order to meet the targets, it is the skills and qualifications of parents (and people who may become parents by 2030) that are our primary focus.

In order for skills and training to be able to impact on income, suitable jobs need to be available in locations that are accessible to those who want them. Labour market conditions and ensuring a spread of good quality jobs is therefore of paramount importance for tackling poverty.

Costs of living

The ‘cost of living’ generally refers to the prices of goods and services considered essential to day-to-day life. The Joseph Rowntree Foundation’s Minimum Income Standard ( MIS) [3] includes the following categories of essentials: housing; household goods and services; transport; food and drink; clothing; personal goods and services; social and cultural participation; and childcare. Price increases have a particular impact on low income households as they spend a higher proportion of income on goods and services.

Poorer households in Scotland spend a higher proportion of their income on housing. In 2015/16, the lowest income households spent, on average, 48% of their income on housing, more than five times that for middle income households (9%), and 16 times more than the highest income households (3%). In 2015/16, an extra 170,000 people were below the poverty threshold once housing costs were taken into account. Low income households renting privately spend an especially high proportion of their income on housing [4] .

High and rising energy prices can mean that households on lower incomes experience difficulties in paying their bills – resulting either in debts to energy companies, or households living in under-heated homes.

Childcare can be a significant cost for households with children. And a lack of affordable and flexible childcare can limit opportunities for paid employment. Other costs arising from children’s attendance at school – including the cost of school uniforms, transport costs, eating at school, learning resources, school trips, events and clubs - place pressure on family budgets, and can also lead to unequal access to opportunities, or stigma.

Transport enables people to travel further to find a good deal (for example, to shop in a large supermarket as opposed to a more expensive local convenience store), as well as access to jobs and essential services. People with low incomes do not travel as far or as frequently as those with high incomes, and rely more on walking and buses [5] . Low income households are much less likely to have access to at least one car than high income households [6] . Along with affordability, other aspects of public transport, such as limited frequency and timetable constraints, can make it difficult for people without access to a car to co-ordinate work, childcare and other activities.

The ‘poverty premium’ is a term used to describe a situation in which people in poverty pay more than those with higher incomes for equivalent goods and services, including:

- more expensive utility tariffs due to being on a payment method with higher charges (e.g. Pre-Payment Meters) or being on a suboptimal tariff

- additional charges for transaction method (e.g. not paying by direct debit)

- expensive credit (low income is often associated with poor credit ratings)

- higher insurance (those in poorer areas often face higher insurance premiums).

Enabling products are goods and services that improve access in other markets. These include: a current bank account, which increases credit options and allows payment by direct debit and standing order; and access to the internet, which allows opportunities to find lower-cost financial products and services, online banking, price comparison sites and online deals. Internet access and digital literacy also increase people’s chances of accessing jobs and social welfare systems.

There is a relationship between wealth and poverty. Savings can provide income, from interest earned, and therefore reduce the risk of income poverty. They can also allow people to buy goods and services, without eating into their disposable income, and therefore reduce their risk of material deprivation. Savings and affordable borrowing can cushion the impact of a loss of income, and avoid financial difficulty turning in to problem debt. Debt repayments reduce the amount of disposable income people have to spend on goods and services, and therefore increase their risk of material deprivation.

Income from social security and benefits in kind

Social security payments have a direct impact on poverty by providing or supplementing household income. The system is designed to help particular groups such as those who are out of work or on low incomes, sick and disabled people, families with children and older people, as well as people in certain circumstances, for example, new mothers or bereaved people.

The impact of social security on a particular household will depend on its characteristics and the benefits it is eligible for, whether they claim all of these benefits, the rate benefits are withdrawn at when a person in a household enters employment or increases hours and earnings, and benefit conditionality and sanctions. Delays to new claims, late payment or overpayments resulting from complexities in benefits administration can lead to financial crises for families. There are also important interactions between the social security system, the tax system and childcare support.

Benefits in kind are transfers to households that are non-cash but have a monetary value. Some of these benefits in kind count towards the definition of income used by DWP so will count towards all targets [7] , but all will have a positive impact on material deprivation.

Contact

There is a problem

Thanks for your feedback