Tackling child poverty - progress report 2023-2024: annex A - measurement framework

Child poverty measurement framework with the latest data on the drivers of child poverty. The indicators in the child poverty measurement framework are intended to monitor these drivers of poverty.

Driver: Income from Social Security or Benefits in Kind

Indicator 22: Reach of benefits

Estimated proportion of households with children in Scotland who are eligible for Universal Credit.

Source: Scottish Government analysis using UKMOD, based on Family Resources Survey 2019-20 and 2021-22

How this indicator relates to the child poverty targets:

- Relative poverty √

- Absolute poverty √

- Low income + material deprivation √

- Persistent poverty √

The indicator estimates the proportion of children who are eligible for Universal Credit. The calculation is done using a microsimulation model. This indicator requires careful interpretation, as a fall could be a result of positive change, such as households with children having more income from work. It could also, however, be the result of a negative influence such as eligibility becoming tighter, for example if benefit amounts are frozen.

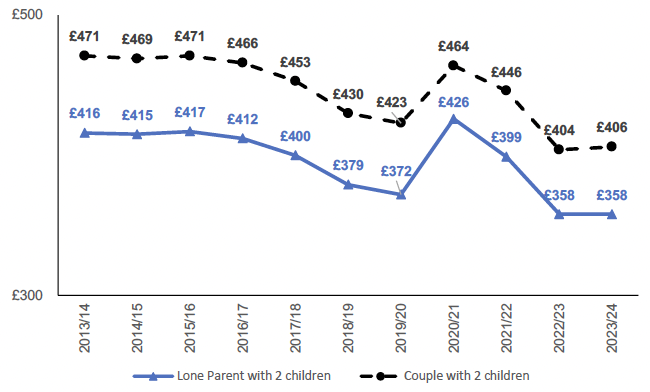

Indicator 23: Value of out-of-work benefits

Real terms value (£/per week in 2023-24 prices) of reserved social security entitlement (Universal Credit including housing element) for out-of-work lone parent/couple households with two children, living in Stirling.

Source: DWP, OBR

How this indicator relates to the child poverty targets:

- Relative poverty √

- Absolute poverty √

- Low income + material deprivation √

- Persistent poverty √

Social security payments have a direct impact on poverty by providing or supplementing household income.

Notes on the calculation of this indicator

The real terms value (£/per month in 2023-24 prices) of UC is calculated using the CPI inflation rate for each financial year. No taxes or legacy benefits are included in the calculations, and the childcare element of UC is excluded as take-up can vary. Household is assumed to use their full Local Housing Allowance. A weighted average was used to incorporate any relevant policy changes that occurred in-year into the UC income calculation.

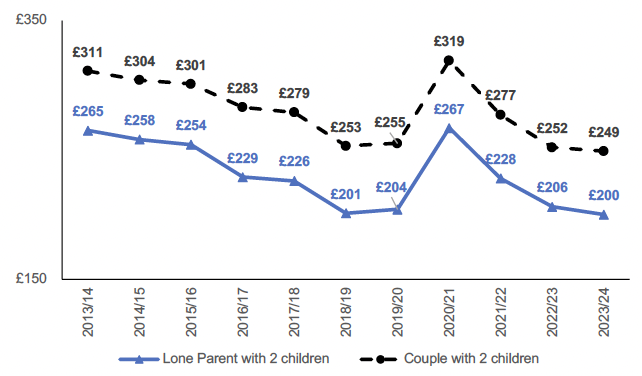

Indicator 24: Value of in-work benefits

Real terms value (£/per week in 2023-24 prices) of reserved social security entitlement (Universal Credit including the housing element) for a lone parent working full-time / couple with one working full-time and one not in paid employment, on minimum wage, with two children, living in Stirling.

Source: DWP, OBR, ONS

How this indicator relates to the child poverty targets:

- Relative poverty √

- Absolute poverty √

- Low income + material deprivation √

- Persistent poverty √

Social security payments have a direct impact on poverty by providing or supplementing household income.

Notes on the calculation of this indicator

The real terms value (£/per month in 2023-24 prices) of UC is calculated using the CPI inflation rate for each financial year. No taxes or legacy benefits are included in the calculations, and the childcare element of UC is excluded as take-up can vary. Household is assumed to use their full Local Housing Allowance. A weighted average was used to incorporate any relevant policy changes that occurred in-year into the UC income calculation. The ONS estimate of full-time hours, and the minimum wage from the UK Government were used to provide an earnings figure for the purpose of calculating the UC benefit reduction resulting from in work activity.

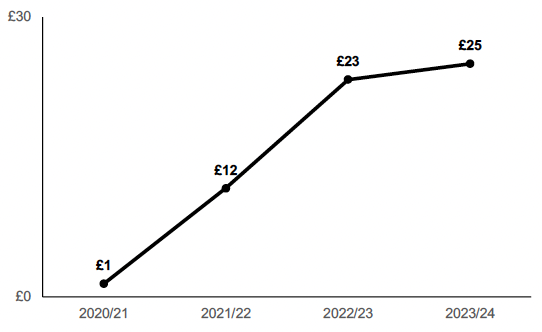

Indicator 25: Value of Scottish Child Payment

Real terms value (£/per week in 2023-24 prices) of devolved social security entitlement (Scottish Child Payment) per child.

Source: Social Security Scotland, OBR

How this indicator relates to the child poverty targets:

- Relative poverty √

- Absolute poverty √

- Low income + material deprivation √

- Persistent poverty √

Social security payments have a direct impact on poverty by providing or supplementing household income.

Notes on the calculation of this indicator

The real value of Scottish Child Payment is estimated (£/per month in 2023-24 prices) using the CPI inflation rate for each financial year. A weighted average is used to incorporate any relevant policy changes such as increase in the financial value of payments that occurred in-year into the real value SCP calculation.

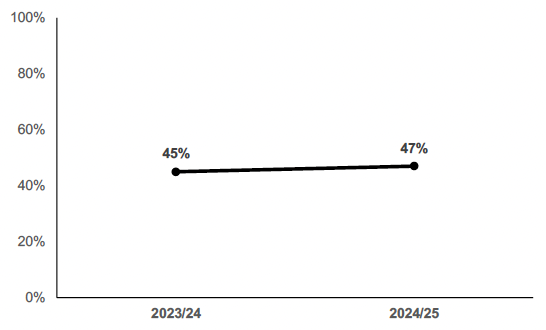

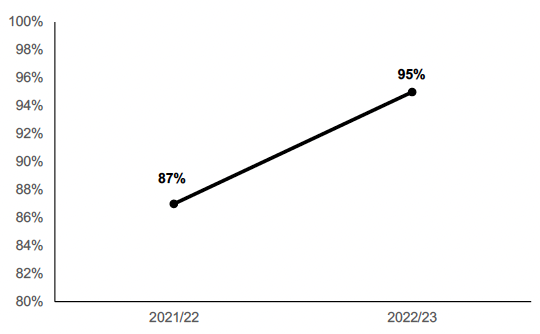

Indicator 26: Benefit take-up: Scottish Child Payment

Estimated take-up (percentage of those entitled to benefit who receive it) of Scottish Child Payment.

Source: Social Security Scotland

How this indicator relates to the child poverty targets:

- Relative poverty √

- Absolute poverty √

- Low income + material deprivation √

- Persistent poverty √

Social security payments have a direct impact on poverty by providing or supplementing household income.

Notes on the calculation of this indicator

The take-up rates shown in this indicator only pertain to children under 6; they do not take into account the extension of the payment to those aged 6-15 that occurred in November 2022. Future updates to this indicator will aim to incorporate take-up rates for all children.

Contact

Email: TCPU@gov.scot

There is a problem

Thanks for your feedback