UK Employer Skills Survey 2022 – Scotland Report

Publication of Scotland results from the UK Employer Skills Survey 2022.

Training and workforce development

This chapter explores the training landscape in Scotland in 2022, covering how many employers had funded or arranged training and for how many staff. It goes on to discuss the types of training which employers had provided before discussing barriers to providing training. Lastly, this chapter briefly summarises employers’ investment in training (i.e., training spend).

Incidence of training and workforce development

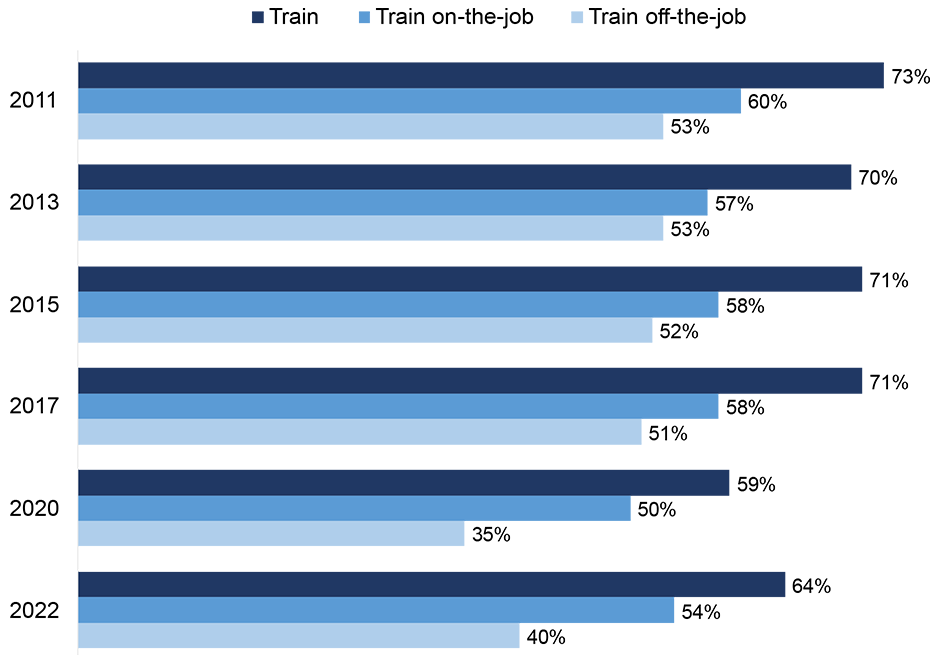

Overall, 64% of employers in Scotland had arranged or funded training for staff in the 12 months preceding the survey.

This was higher than in 2020 (59%), but still lower than the seven in ten employers that reported providing training between 2011 and 2017, as shown in Figure 20.

More than half (54%) of employers had provided on-the-job training, and two-fifths (40%) had provided off-the-job training to staff in the last 12 months. The proportion of employers providing on-the-job and off-the-job training both increased by a similar level, from 50% in 2020 to 54% in 2022, and 35% in 2020 to 40% in 2022 respectively. Figure 20 shows the change in training provision over time.

Around two-thirds of employers provided training to their staff in the last 12 months

Base: All establishments in Scotland (2011: 2,487; 2013: 6,014; 2015: 6,035; 2017: 6,017; 2020: 3,497; 2022: 5,207).

The proportion of employers providing training to their staff over the last 12 months increased with establishment size, ranging from 47% of employers with 2 to 4 staff, to almost all (96%) of those with 250 or more staff.

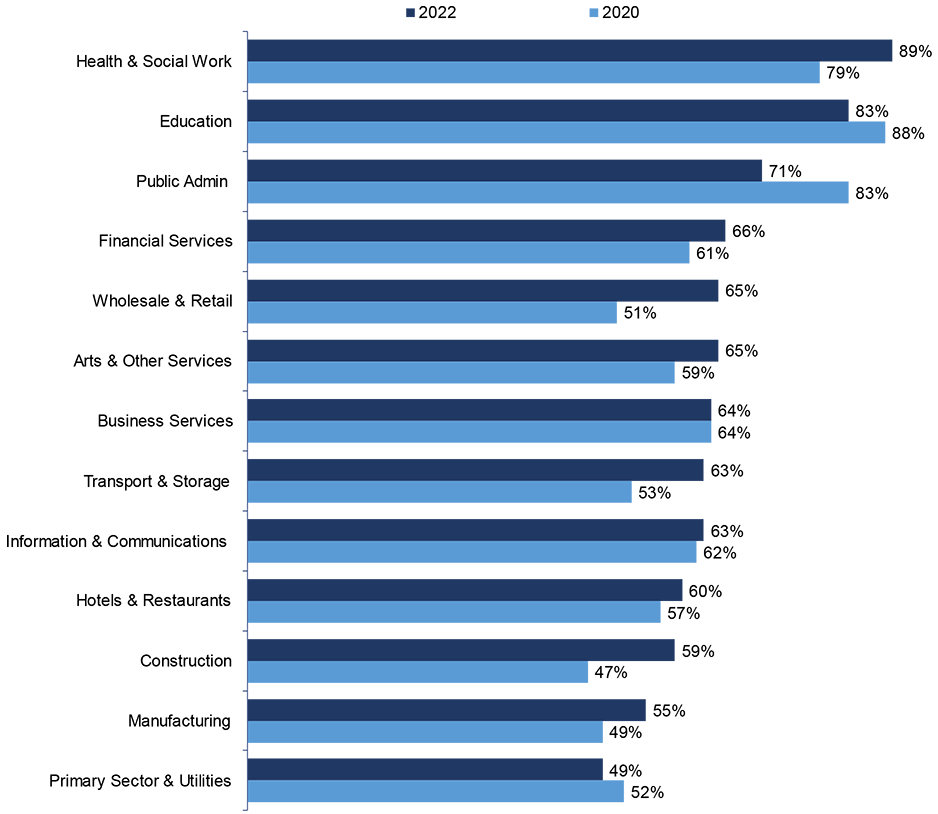

As shown in Figure 21, training incidence also varied by sector. Establishments in the Health and Social Work sector were most likely to provide training (89%), followed by Education (83%). Conversely, fewer than half (49%) of Primary Sector and Utilities establishments provided training to their staff in the previous 12 months; this was the only sector where a minority of employers had provided training to their staff.

Though there was a general increase in the prevalence of training, a few sectors experienced particularly large increases compared to 2020 including Wholesale and Retail (from 51% to 65%) and Construction (from 47% to 59%).

By ROA region, employers in Lanarkshire were most likely to provide training (69%), followed by Glasgow, and Edinburgh and Lothians (68% for both). Employers in Dumfries and Galloway were least likely to have provided training (57%).

Further data on the prevalence of training, with corresponding 2020 results, can be found in Tables 72 to 74 of the Background Tables.

Employers in the Health and Social work and Education sectors were most likely to have provided training to their staff in the last 12 months

Base: All establishments in Scotland. (2022: 5,207; sector base sizes range from 55 for Public Administration to 1,109 for Wholesale and Retail. 2020: 3,497; sector base sizes range from 54 for Financial Services to 692 for Wholesale and Retail.)

Scottish employers had provided 10 million training days over the last 12 months, equating to 6.7 days per annum per person trained (‘per trainee’) and 3.9 days per employee.

The number of training days per trainee decreased with establishment size, from 9.2 days per trainee among employers with 2 to 4 staff, to 5.9 days per trainee among employers with 100 or more staff. Training days per trainee were highest in the Primary Sector and Utilities establishments (13.1) followed by Financial Services (10.3), and lowest in Education (4.1) and Public Administration (4.4).

The proportion of staff trained

Across the Scottish workforce, 59% of employees had received training in the previous 12 months.

The proportion of staff trained was higher than seen in 2020 (55%), but lower than pre-pandemic levels (62% in 2017 and 2015, and 65% in 2013).

Staff among establishments with 50 to 99 employees were most likely to receive training (67%) and those with 2 to 4 employees least likely (38%). Increases were seen in the proportion of staff trained across most size bands, though had not increased among establishments with 100 or more employees (58% compared to 61% in 2020; note this is not a statistically significant decrease).

Employees in the Education sector were most likely to have received training over the last 12 months (72%), while the Manufacturing and Financial Services workforce were least likely (both 47%) as shown in Table 9. Despite an overall increase in the proportion of staff trained, this was not the case for all sectors. Employers in the Health and Social work in particular had trained fewer staff in the previous 12 months compared to 2020 (50% compared to 66%). The largest increases in the proportion of staff trained by sector were seen in the Information and Communications (50% compared to 31% in 2020), Primary Sector and Utilities (67% compared to 51% in 2020), Wholesale and Retail (61% compared to 45% in 2020) and Arts and Other Services (60% compared to 46% in 2020) sectors.

By ROA region, the greatest proportion of staff were trained by employers in Glasgow and Edinburgh and the Lothians (69% and 68% respectively). Many ROA regions saw an increase in the proportion of staff trained compared to 2020, with the largest seen in the Borders ROA region (60% up from 42%); the South of Scotland Enterprise Region (59% up from 42%); Dumfries and Galloway (59% up from 43%) and the Highlands and Islands ROA region (59% up from 47%). In comparison, the biggest reduction in the proportion of staff trained was in Ayrshire, from 55% in 2020 to 27% in 2022.

Further data on the proportion of staff trained, with corresponding 2020 results, can be found in Tables 76 to 78 of the Background Tables.

Proportionally, employers in the Education sector trained the most staff in the last 12 months. In volume terms, Business Services employers trained the highest number of staff.

| Number of employees trained | % of staff trained | |

|---|---|---|

| Scotland | 1.4m | 59 |

| Primary Sector and Utilities | 81,400 | 67 |

| Manufacturing | 81,900 | 47 |

| Construction | 79,600 | 57 |

| Wholesale and Retail | 207,100 | 61 |

| Hotels and Restaurants | 135,900 | 67 |

| Transport and Storage | 52,500 | 50 |

| Information and Communications | 20,500 | 50 |

| Financial Services | 12,700 | 47 |

| Business Services | 239,600 | 60 |

| Public Administration | 103,600 | 62 |

| Education | 153,700 | 72 |

| Health and Social Work | 209,600 | 50 |

| Arts and Other Services | 65,000 | 60 |

Base: All establishments in Scotland (5,207). Percentages are based on all employment rather than all establishments; figures therefore show the proportion of all staff within each subgroup trained over the last 12 months.

As shown in Figure 22, staff in Caring, Leisure and Other Services occupations were by far the most likely to have received training in the previous 12 months (91%); and saw the largest increase, up from 66% in 2017 (occupational breakdowns were not covered in Scottish ESS 2020). Managers were least likely to have received training (47%).

The largest decrease in the proportion of staff receiving training occurred among staff in Skilled Trades occupations (50% in 2022 compared to 70% in 2017). Professional occupations and Administrative and Secretarial occupations were also less likely to have received training than in 2017 (59% in 2022 compared to 68% in 2017, and 50% in 2022 compared to 57% in 2017 respectively).

Staff in Caring, Leisure and Other Services occupations were most likely to have received training in the last 12 months

Base: All establishments in Scotland (2017: 6,017; occupational base sizes range from 740 for Machine Operatives Occupations to 3,198 for Managers. 2022: 5,207 occupational base sizes range from 123 for Caring, Leisure and Other Services Occupations to 655 for Managers).

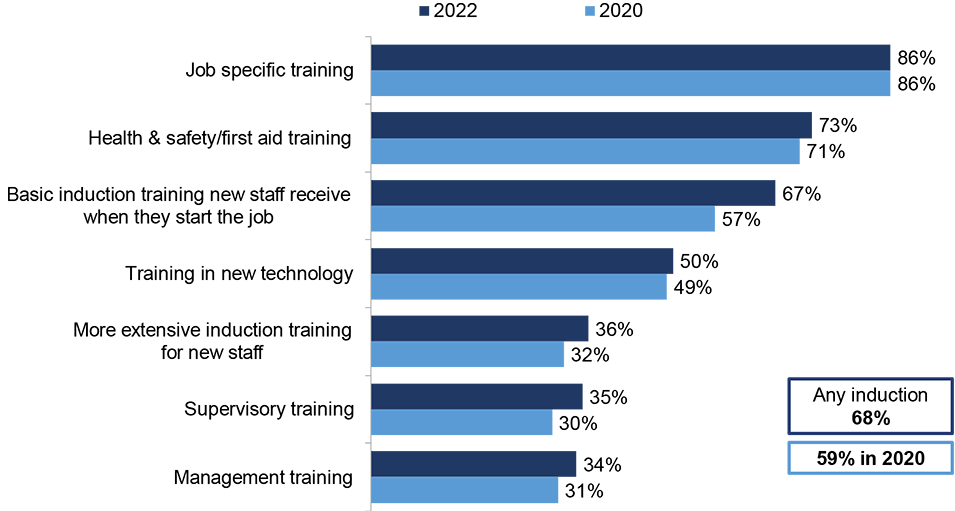

Type of training provided

Employers who provided training to staff in the last 12 months were most likely to have provided job specific training (86%) and health and safety or first aid training (73%); these were also the most common forms of training offered in 2020 (86% and 71% respectively).

Over two-thirds of training employers (68%) reported providing any form of induction training; an increase on 2020 when the figure was 59%. There was a particularly large increase in basic induction training (67% compared to 57% in 2020). This likely reflects the higher recruitment levels seen this wave, whereby 52% of employers had recruited anyone in the past 12 months compared to only 38% in 2020.

The most common type of training provided by employers was job specific training

Base: All establishments that train in Scotland (2022: 3,822; 2020: 2,396).

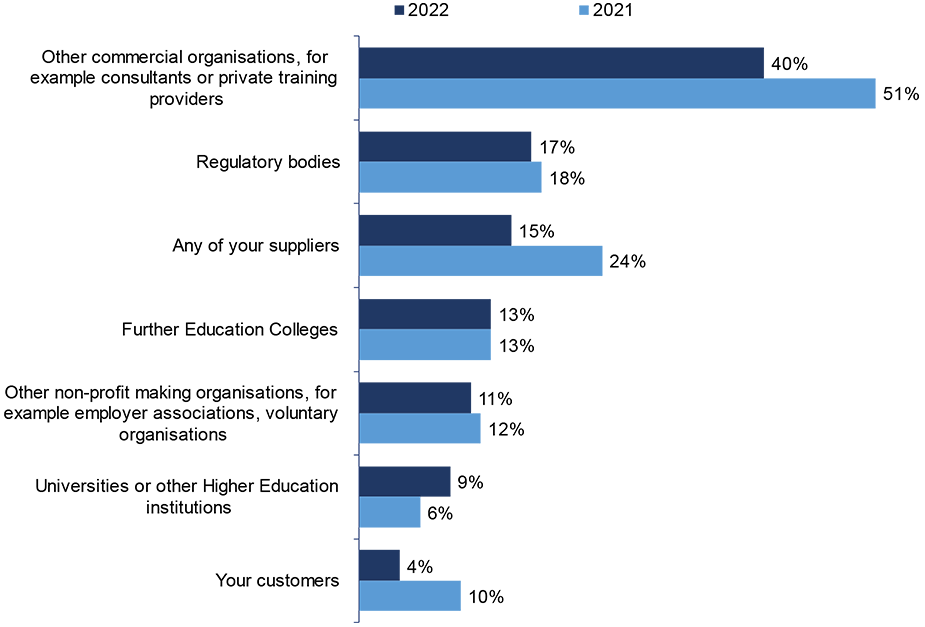

Overall, 54% of employers that had trained employees in the previous 12 months had arranged or funded external training for their staff, equivalent to around a third (35%) of all employers.

The most common source of external training used by training employers was commercial organisations (40%), a reduction from 51% using this source in 2021. Training employers were also less likely to report using any of their suppliers as a source for training (15% compared to 24% in 2021) as shown in Figure 24.

Training employers were most likely to use other commercial organisations as their source for external training

Base: All establishments providing training in Scotland (2022 (Module B): 996; 2021: 817).

Just over four in ten (42%) training employers had provided training to a nationally recognised qualification in the past 12 months, lower than the 46% figure seen in 2020. In 2022, this equated to 27% of all employers and a total of 217,000 staff. This was most commonly to SCQF Level 7 (12% of training employers had trained staff to a qualification of this level).

Overall, 15% of staff receiving training had worked towards a nationally recognised qualification, equating to 9% of the Scottish workforce in total. These results were similar to 2020 (17% and 9% respectively).

Two-thirds (66%) of training employers had provided online training or e-learning in the previous 12 months, the same proportion as in 2020. Around a third (30%) of employers providing online training or e-learning reported that this was a replacement for training that would otherwise have been provided face-to-face had it not been for the pandemic, while 68% reported that it was training they would have undertaken online anyway.

Further data on the types of training arranged and funded by employers, with corresponding 2020 results, can be found in Table 80 of the Background Tables.

Barriers and limits on training

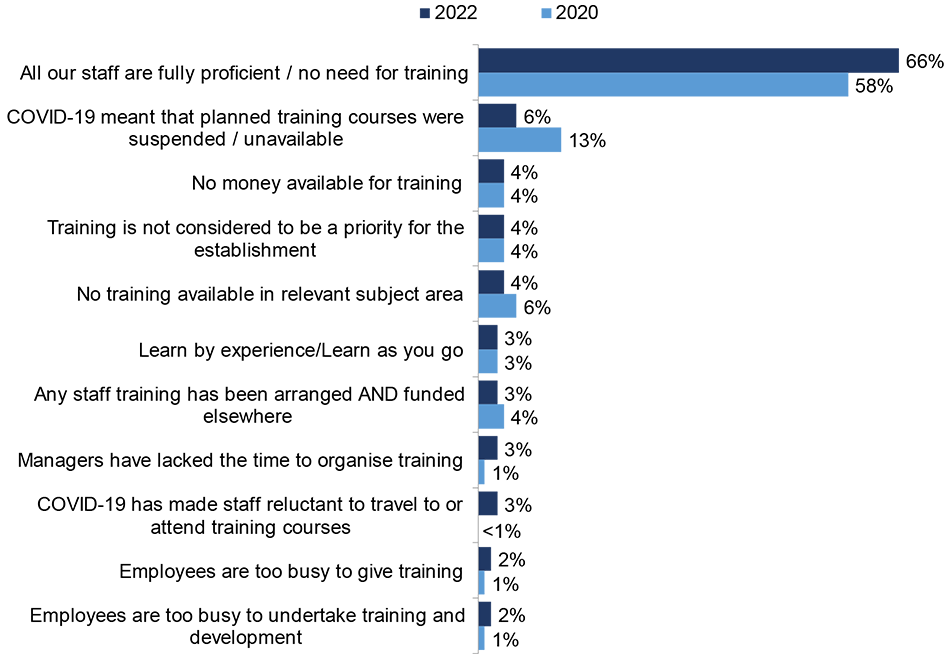

The most common reason for not providing training was that employees were already all fully proficient and had no need for further training (66%).

The proportion of employers reporting that all of their staff were proficient was higher than 2020 (66% compared to 58%). Employers were less likely to report reasons relating to COVID-19 compared to 2020 (8% compared to 22%).

Other reasons for not providing training included no money being available, training not being a priority for the establishment and no training being available in the relevant subject area (4% for all). The full list of reasons is shown in Figure 25.

Employers that did not train were most likely to report that the reason for not providing training was because all staff were fully proficient

Base: All establishments not providing training to staff in Scotland (excluding don’t know responses) (2022: 1,316; 2020: 1,068). Chart shows reasons mentioned by at least 2% of respondents in 2022.

Establishments in the Borders region were significantly more likely than the majority of other ROA regions to report that all of their staff were fully proficient (82% compared to 66% on average).

Overall, 46% of training establishments reported that they would have preferred to provide more training than they had done in the previous 12 months. Close to half of these establishments (47%) reported that this was because they could not spare staff time, while over a third (36%) reported a lack of funds for training. Only 17% reported COVID-19 related reasons for not being able to provide more training, a decrease from 65% in 2020.

Notably, establishments in the Highlands and Islands, and Borders ROA regions were more likely to report difficulty finding training providers who can deliver training where or when they want (16% and 15% respectively, compared to 6% overall).

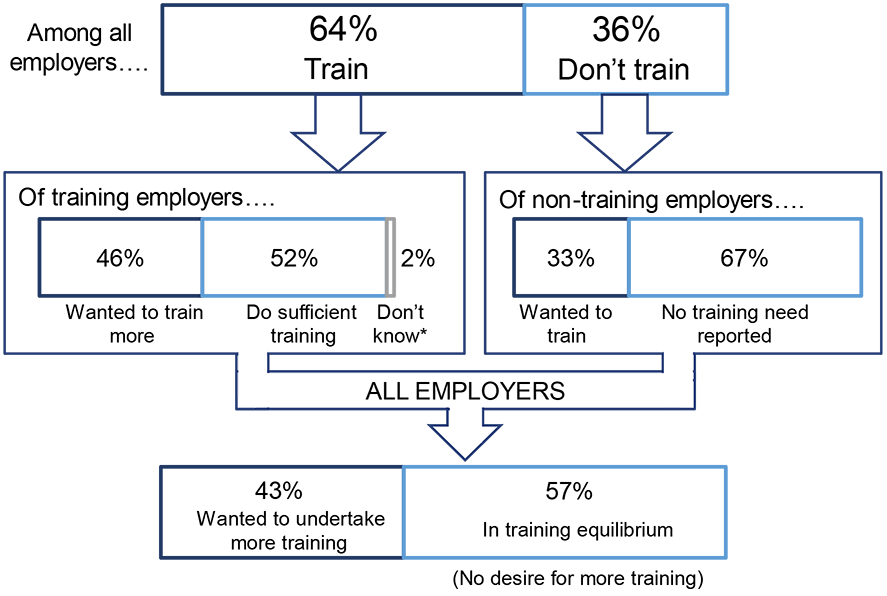

If an employer had provided all of the training that they wished to (including those who provided no training out of choice) they are said to be in “training equilibrium” (see Appendix A – Glossary). Overall, 57% of employers were in training equilibrium for the year preceding the survey, while 43% wanted to undertake more training than they did as shown in Figure 26. In 2020, 55% of employers were in equilibrium while 45% wanted to undertake more training.

While the majority of employers were in training equilibrium (no desire for more training), a sizeable proportion reported wanting to undertake more training

Base: All establishments in Scotland (5,207); training employers in Scotland (3,822); non-training employers in Scotland (1,385). *Training employers who responded “don’t know” to whether they wanted to provide more training have been classed as being “not in training equilibrium”.

Employer investment in training

This section is based on the follow-up ‘Investment in Training’ survey which was conducted with employers that had indicated they provide training during the main Employer Skills Survey. In total, 1,546 Scottish employers took part in the Investment in Training survey. This section summarises overall training expenditure and how this has changed over time, alongside spend per trainee and employee.

As shown in Table 10, overall training expenditure in Scotland has decreased since 2017, when inflation is taken into account, from £4.8 billion to £4.1 billion. The overall spend per trainee and per employee has also reduced by around £300 respectively.

The largest decreases in training spend were seen in establishments with 2-4 employees, decreasing from £812 million to £330 million in 2022, which reduced the average spend per employee to £1,660 from £4,070 in 2017.

Further information on employer investment in training, including the split between on-the-job and off-the-job training costs and investment, and how spend on individual components is broken down, can be found in the full UK technical report (available on the Department for Education's website).

Total training expenditure, spend per trainee and spend per employee in 2022 was lower than in 2017

| Year | 2017 | 2022 | ||||

|---|---|---|---|---|---|---|

| Group | Total | Per trainee | Per employee | Total | Per trainee | Per employee |

| Unit | £ | £ | £ | £ | £ | £ |

| Total | 4.8bn | 3.2k | 2.0k | 4.1bn | 2.9k | 1.7k |

| Size | Total | Per trainee | Per employee | Total | Per trainee | Per employee |

| Unit | £ | £ | £ | £ | £ | £ |

| 2 to 4 | 812m | 9.3k | 4.1k | 330m | 4.3k | 1.7k |

| 5 to 24 | 1.5bn | 4.3k | 2.5k | 1.5bn | 4.2k | 2.5k |

| 25 to 49 | 692m | 3.5k | 2.3k | 674m | 3.4k | 2.3k |

| 50 to 99 | 659m | 3.5k | 2.3k | 489m | 2.5k | 1.7k |

| 100 or more | 1.2bn | 1.7k | 1.1k | 1.2bn | 1.9k | 1.1k |

Base: All establishments in Scotland completing the Investment in Training survey (2017: 1,407; 2022: 1,546). NB: Figures over 1 billion (bn) are rounded to the nearest 100 million, figures under 1 billion are rounded to the nearest million (m). Figures reported in thousands (k) are rounded to the nearest hundred.

Contact

Email: FHEstatistics@gov.scot

There is a problem

Thanks for your feedback