Understanding the Cost of Living Crisis in Scotland

This report draws together analysis from a wide range of sources to provide a summary overview of evidence on the cost of living crisis and its impact on Scotland. It includes evidence from Scotland and the UK as well as from other European countries.

4. The impacts of the cost of living crisis on businesses and the delivery of public and third sector services

The cost of living crisis has had wide ranging impacts on business, the public and third sector. In introducing the 2022 Emergency Budget in September 2022 the Deputy First Minister stated: “the crisis is not just a cost of living crisis, as some characterise it. The costs of doing business, of third sector support and of public services are all rising as well. Indeed, in all my experience, now and during my previous tenure as finance secretary, there has never been a time of greater pressure on the public finances”[55].

4.1 Impact of the cost of living crisis on businesses

The sharp increase in energy and materials prices presented significant challenges for businesses, following on almost directly from the Covid-19 pandemic. Businesses responded to increased costs in a number of ways - by adjusting their prices, absorbing costs through reduced profits, and / or seeking to improve efficiency or reduce other operational costs.

Initial challenges related to maintaining business viability in the face of rapidly increasing energy costs. This was particularly the case for those businesses that use energy more intensively.

Chapter 5 of this report discusses energy support policy responses introduced by the UK and Scottish Government with the Energy Bill Relief Scheme and Energy Bills Discount Schemes providing support to businesses.

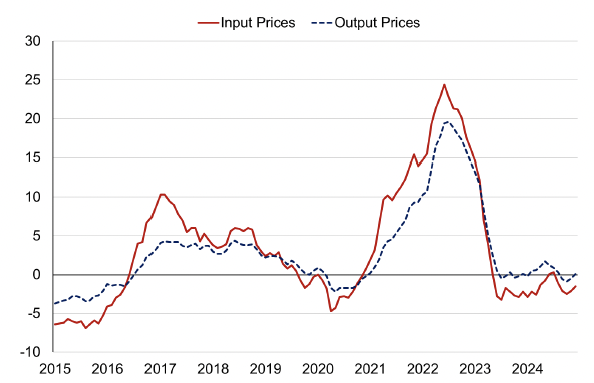

Figure 7 below shows how producers’ input costs rose rapidly in 2022 hitting a peak of 24.1% in June 2022. The latest figures show that producer input prices fell by 1.5% in the year to December 2024.

Source: ONS[56]

Small businesses were particularly affected by increases in gas and electricity costs. Research by Cornwall Insight in 2024 found that small businesses are on average paying over £5,000 extra a year on energy bills than before energy crisis in 2021.[57] They also forecast that small industrial businesses are predicted to be paying £550,000 annually for electricity per year in 2026/2027. This marks a 57% increase compared to pre-crisis costs[58].

4.2 The current economic picture

The latest Scottish business survey data indicate that cost challenges for businesses have evolved, but remain challenging. RBS Growth Tracker data for December 2024 indicate input and output cost pressures for businesses remain with recent pressures driven by staffing costs, supplier prices, and material costs.[59]

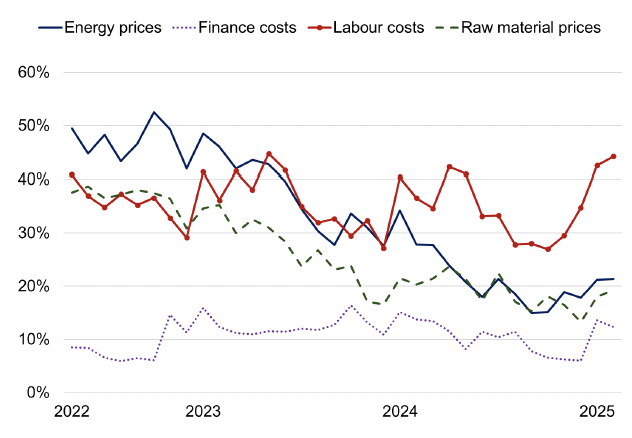

These factors have also been identified in the Business Insights and Conditions Survey ( BICS) data for January 2025, showing a recent rise in the share of businesses considering price increases because of labour costs (42.5%), energy prices (21.2%), raw material costs (18%) and the cost of finance (13.6%). However, 39.3% of businesses responded that they did not plan to increase prices, the lowest figure since May 2024 (see figure 8 below).

Source: Scottish Government analysis of ONS BICS data

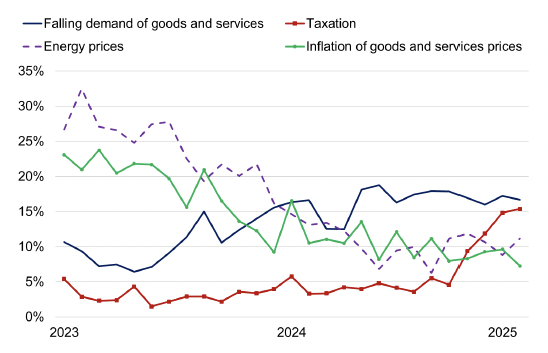

Overall, at the start of 2025, BICS data indicates that falling demand for goods and services was the leading cause for concern among businesses for January, cited by 17.2% of businesses, up slightly from December and in line with data from the middle of 2024. Taxation is the second most commonly cited concern for businesses in January, with the proportion of businesses flagging this issue rising from 11.9% in December to 14.8% in January, and has been on an upward trend since October.

Concerns around some other issues, related to the cost of living remain lower than in recent years, with energy prices being cited by 8.8% of businesses (down from 14.6% in January 2024), and inflation also becoming less of a concern, falling to 9.6% from 16.6% January 2024. Figure 9, below illustrates how business concerns have changed from the beginning of 2023.

Source: SG analysis of ONS BICS data

4.3 Impact of the cost of living crisis on public services

The cost of living crisis has raised significant challenges for public services. These are described below in relation to demand for services and the cost of delivering them.

4.3.1 Demand for services

The cost of living crisis has led to increased demand for some public services. This is perhaps most evident in relation to health and social care services, as well as informal and formal care and support.

There is evidence from a wide variety of sources including the Scottish Government’s YouGov survey and the Understanding Scotland survey[60] that the cost of living crisis is affecting the wellbeing of people living in Scotland. The latest YouGov findings (December 2024) show, just under one third of respondents (31%) believe their physical health has been negatively affected by the crisis and 43% believe their mental health has been negatively affected.

Ofgem has highlighted the health harms associated with households who self-ration their energy when they cannot afford to heat their homes, with pre-payment meter consumers more likely to self-disconnect.[61] [62] Restricting energy consumption, especially over winter periods can elevate the risk of health harms as a result of living in a cold, damp home,[63] with some groups like children and elderly people being particularly negatively affected.[64]

There have also been increased demands in relation to policing, in 2023 Police Scotland’s Chief Constable spoke about the impact of the cost of living crisis on ‘driving vulnerability’ and ‘pressure on other services’ when discussing policing budgets for 2024-25. The Chief Constable said:

“Although I welcome the important uplift in our budget, a changing, ageing population; a cost-of-living crisis driving vulnerability and pressure on other services; civil unrest; new laws and increasingly complex investigations all contribute to growing community need and increasing contacts to policing from the public”.[65]

4.3.2 Cost of Delivering Services

High inflation during the cost of living crisis had the effect of quickly eroding the value of resource and capital budgets. This led to the Scottish Government publishing an emergency budget review in September 2022, when the Finance Minister estimated the Scottish Budget ‘was worth around £1.7 billion less than it was worth in December 2021’[66].

Public sector pay makes up over half of the Scottish Government’s resource budget [67]. The cost of living crisis led the Scottish Government to introduce public sector pay offers that were significantly higher than the 2-3% set out in the Public Sector Pay Policy. The Emergency Budget Review in September 2022 set out the intention to make enhanced pay offers to public sector workers worth over an additional £700m. These larger public sector pay increases have significantly added to the cost of delivering public services in Scotland.

Capital funding is around 10 per cent of the Scottish Budget and covers investment in infrastructure such as roads and hospitals, and schools. Inflation has had the effect of eroding the value of capital budgets with significant cost increases on the common materials used on construction projects. In December 2023 the Scottish Fiscal Commission forecast that capital funding is forecast to fall over the next five years by 12 per cent in nominal terms. After accounting for inflation, capital funding is predicted to fall by 20 per cent by 2028 -29. These pressures continue to persist, and whilst there has been a recovery in resource funding, capital funding remains lower in real terms than in 2021-22.

4.4 Impact of the cost of living crisis on the third sector

The Third Sector covers every policy area of the Scottish Government. It is composed of charities, community groups, social enterprises, community interest companies and a variety of organisational forms constituting over 46,500 organisations (more than 24,000 of which are registered charities[68]) and employs 136,000 paid staff. Many are voluntary organisations ranging from grassroots community groups, arts and cultural organisations and sports clubs to large social care and housing providers[69].

The main areas where these organisations are active are: health and social care; culture and arts; sport; equality and rights; community development and the environment. The sector plays a vital role in supporting communities at a local level. It delivers essential services, helps to improve people's wellbeing and contributes to economic growth. The sector is of particular importance in tackling poverty through relational and person-centred approaches though is a key delivery partner across most policies[70].

There are more than 24,000 charities in Scotland, (including community groups, religious charities, schools, universities, grant giving charities and major care providers) run by approximately 160,000 charity trustees, on an almost entirely voluntary basis[71].

4.4.1 Increased demand for services

The third (voluntary) sector has seen increased demand for services[72]. Trend data from the Scottish Third Sector Tracker survey indicates that third sector organisations’ ability to meet this increased demand has been relatively stable since the survey began in 2021. However, in the spring 2024 wave, the proportion of organisations reporting that they were able to meet ‘only some’ or ‘none’ of this demand rose to 23% the highest level reported since the survey began[73]. This figure decreased to 14% in the latest wave of the survey (autumn 2024)[74]. The most recent wave of the survey, also highlighted that while 66% of organisations reported that all, or nearly all, of this demand was for their core services, 24% reported that some of the demand related to services that sat outside their core remit. Significant needs or issues that organisations reported they had observed in the individuals and communities they work with included poor mental health and wellbeing (60% of respondents); financial hardship and vulnerability (57% of respondents); and poor physical health and wellbeing (36% of respondents)[75]

Increased demand for food banks is one example of where the cost of living crisis has led to higher levels of demand for services provided by the third sector. Trussell data for Scotland show significant increases in need over the last few years, with 2023/34 statistics similar to the record levels of 2022/23 in terms of the numbers of emergency food parcels distributed in Scotland (262,400). Trussell link this to the ‘soaring cost of living for people across Scotland’ and the fact that people’s incomes (especially from social security) have failed to keep up with these costs.[76] They are also seeing changes in the types of people they are helping, as the quote from their report below illustrates:

“We're certainly seeing a change in those that are coming through the door... As well as demand rising, I've seen the needs of people becoming more complex and the deprivation seems much more apparent.” Elaine, Food bank Manager at East Lothian Foodbank, in the Trussell network.

4.4.2 Reduced levels of volunteering and donations

The sustainability of third sector services has been affected by reductions in volunteering. Volunteer numbers fell during the pandemic (continuing a gradual downward trend since 2010) and haven’t since recovered (although it is unclear whether this is connected to the cost of living). This fall in volunteering has increased demand on public sources of formal support. A recent report on social capital and community wellbeing in Scotland outlines how volunteering in Scotland has been decreasing over recent years[77]. The latest data from the Scottish Household Survey shows that the proportion of people taking part in formal volunteering, has decreased from 26% in 2019 to 18% in 2022[78].

The Scottish third sector tracker shows that volunteer shortages is one of the top issues faced by third sector organisations. Recruitment of volunteers has been more challenging than retention, with 62% of organisations reporting a moderate-significant challenge when attempting to recruit volunteers, compared to 38% who reported retention of volunteers as a moderate moderate-significant challenge.[79]

There is also some evidence that there has been a decrease in food and financial donations to food banks over the course of the cost of living crisis which has coincided with a period of increased demand for food banks.[80][81]

4.4.3 Pressure on third sector budgets

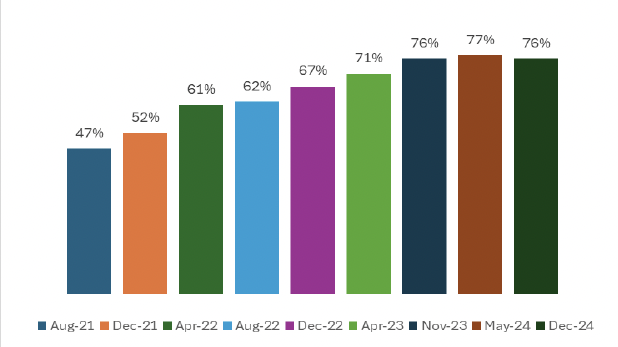

The Scottish third sector tracker shows that organisations’ top two most frequently reported challenges were: rising costs and inflation (49%) and difficulty fundraising (42%). The proportion of third sector organisations reporting financial challenges in their top three challenges has risen steadily. In December 2024, 76% of organisations included at least one financial challenge in their top three challenges, compared with 47% in August 2021 (see figure 10 below). However, the latest third sector tracker report states that “Despite these pressures, many organisations continue to meet the growing demand for their services by adapting services; collaborating with other organisations; and applying for additional funding and fundraising. However, the sector’s reliance on limited financial reserves and the unsustainable use of those reserves raises concerns about long-term sustainability.”[82]

Source: SCVO (2024)

Contact

Email: Tom.Lamplugh@gov.scot

There is a problem

Thanks for your feedback